Market volatility—the short-term gyrations of risk-on to risk-off and back—doesn’t have to be an investor’s focus. Investors can liberate themselves from the potentially paralyzing impact of day-to-day volatility by re-focusing on the true drivers of long-term investment returns.

What are those long-term drivers? At Evolutionary Tree, we talk a lot about the importance of innovation as a long-term driver of value creation. There is another major driver that complements innovation: the power of secular trends, or, as we call them, evolutionary shifts. These two engines—innovation and evolutionary shifts—are relatively unaffected by the ups and downs of the market. That is the secret to long-term wealth creation. We focus on this second engine—evolutionary shifts or secular trends—in this blog post.

The Power of Secular Trends and Evolutionary Shifts to Drive Long-term Wealth Creation

In my experience, the most successful investments have benefited from a combination of profound innovation coupled with a powerful long-term secular trend.

The concept of secular trends relates to structural changes that may play out over many years. Secular trends can apply to consumer trends (changes in consumer needs or behavior), industry trends (changes affecting the structure of industries), demographics (changes in the composition of populations), or technological trends (evolution of technologies underlying product or service offerings). There is usually a strong underlying evolutionary force—or shift taking place—that is driving these trends over time, which may increase their probability of continuing in place for a multi-year period. If they don’t, then they are fads. We search for durable secular trends.

Like most anything, trends also have a lifecycle and, as such, eventually play out and mature. So, it is important to know whether there is room for the secular trend to continue driving growth over the long term. For example, consumers adopting smartphones might sound like a secular trend, but it is actually a pretty mature one, since the number of smartphones hasn’t grown much over the past few years. By contrast, e-commerce is actually still very early in global adoption, with online sales comprising only about 15% of total retail sales in the US, and often less than 10% of retail sales in many emerging markets. We search for leading innovators benefiting from secular trends that we believe are earlier in their lifecycle.

The importance of secular trends for investors is even greater now than in years past. Why? In a global economy experiencing structurally slower growth—given the demographic and economic headwinds facing both developed and developing economies (namely, an aging workforce and high levels of debt)—secular growers may be the only types of businesses positioned to sustain growth in an above-average fashion.

When the global economy was growing more rapidly in the past, largely led by the rise of emerging markets and China opening up to the world, many industries benefited, including various industrial segments and even commodities. That appears to have ended. As a result, secular growth opportunities are now more important than ever. Secular growers—companies that benefit from secular trends in addition to creating innovative new products and services—benefit by having a steady source of above-average growth in demand, which can enable them to power through slower periods of economic growth.

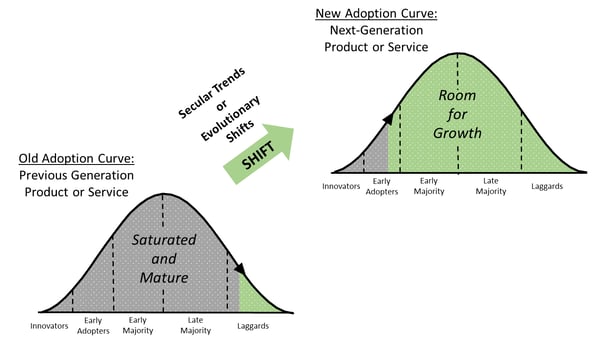

At our firm, we seek to dig deeper into these secular trends. In my experience, I have found that understanding the underlying drivers of secular trends is a powerful way to build visibility into the potential path of these trends. One framework we use at Evolutionary Tree Capital is to view secular trends through an evolutionary shift lens. It is useful to think about the root causes of a long-term secular trend, which is often built on consumers/users shifting away from some older way of doing things to a new, better way (see chart below). We describe this evolutionary process as shifting from an older generation (“old gen”) to the next generation of a product, service, or business model (“next-gen”). This will only happen, of course, if the next-gen offering has unique advantages over the old gen, offers new capabilities, and/or solves some of the pain points or problems of the prior generation.

Our team searches for important secular trends and shifts, and the leading innovators driving these into the future. Examples of important secular trends that we believe are investable include cloud computing and software-as-a-service (SaaS), the shift to e-commerce and e-marketplaces, and the rise of advanced biotechnologies, among others.

Broad market indexes and traditional growth managers can have some exposure to secular growers. However, we believe focused exposure, through a concentrated portfolio of leading innovators, best positions investors to potentially benefit from secular growers and, at the same time, avoid companies being disrupted by evolutionary shifts.

We end this blog with the comforting insight that the risk-off dynamic in the markets does not materially affect, over the long term, the underlying secular trends present in select areas of the economy. Temporary market pullbacks simply cannot stop innovation or powerful trends. In many cases, short-term crises or recessions may actually accelerate these trends, particularly if the next-gen product or service improves efficiency and lowers costs, such as the shift to cloud computing. We believe leaning into these select secular trends may not only be the best way to build wealth over the long term it may also reduce risk by avoiding the companies being hurt or disrupted.