Shifting Center of Gravity: Navigating the Next Phases of AI

February 12, 2026

While We Are Believers in AI, We Seek to Avoid Areas of Hype We are long-term AI bulls. We use AI tools internally and see the technology’s positive impact on our research process and across our portfolio companies. In coming decades, we believe AI will be a powerful driver of productivity and corporate profits, with benefits accruing to AI tech enablers and adopters alike. The benefits of AI will broaden out.

Cybersecurity: Resilient Growth and Clear AI Beneficiary

November 12, 2025

Cybersecurity is an important component of the Darwin, Humboldt, and Beagle portfolios. We often refer to these companies as "mayhem stocks," capable of playing both offense and defense. On offense, the sector is benefiting from secular growth drivers like cloud adoption, AI, and the trend toward tool consolidation, which is enabling durable growth. On defense, cybersecurity has proven to be among the most resilient categories of enterprise IT...

Navigating Tariffs by Leaning into Resilient Leading Businesses

June 11, 2025

The initial threat of US tariffs on trading partners has led to increased volatility, sparking a near-bear market and, with the recent “pause” in tariffs, a rebound of equal size. Given these dramatic events—which threw a damper on an otherwise healthy underlying economy—we thought it would be helpful to use this blog post to provide some perspective on these events and explain how we are navigating through them.

Identifying Next-Generation Leaders

March 20, 2025

Our firm is increasingly being recognized for our differentiated approach that enables identifying next-generation innovative businesses earlier in their lifecycles—and, at times, embracing these emerging leaders well ahead of traditional growth managers. We developed our eight investment criteria (see graphic below) to provide a disciplined framework for our team to identify and analyze next-generation leaders that can add value over time. The...

Macro 2.0: An Updated Approach to Global Investing Focused on Innovation Clusters

November 21, 2024

Every investor increasingly must navigate a world of structural headwinds, which requires new strategies to succeed. In the old approach to global equity investing, one could generally rely on a few engines of growth, like the rise of emerging markets (especially China), reasonably steady growth in global GDP, and positive demographic trends such as an emerging middle class. In a post-COVID and post-Ukraine invasion world, much has changed from...

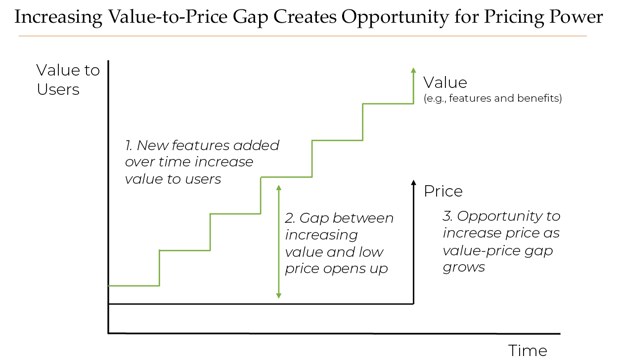

Innovators Are Flexing Pricing Power

May 16, 2024

We believe we are entering a period in which leading companies, with mission critical products and services, can finally flex pricing power. There are multiple reasons for this newfound power. First, we believe the shift from the Easy Money era to rational money is making a number of industries less competitive (as startups die off), allowing the industry leaders to emerge stronger and, in some cases, with improved pricing power. Second,...

Leading Platform Companies Are Thriving in Market Focused on Cost Efficiencies

December 13, 2023

A new secular trend is emerging in the current economic environment: Companies that have built leading platforms—defined as technology-based offerings that can be extended into adjacent areas and new applications—are thriving in an economy that is so focused on cost efficiencies. This is driven by users increasingly consolidating their spend on fewer platform offerings that are unified across multiple applications and moving away from point...

The Pivot to “Efficient Growth” is Driving a Profit Push for Quality Innovators

June 29, 2023

We believe an important shift is happening across the growth stock and technology sector landscape, one that is causing investors to re-evaluate and re-embrace the stocks of highly innovative companies, more broadly. The shift? Quality innovative businesses are now pivoting from a “growth-at-all-costs” approach toward one that emphasizes “efficient growth,” an approach that balances strong top-line growth with a focus on also expanding margins...

An Anti-Hype Investor Explains Why AI is Real and Going Mainstream

May 17, 2023

Every couple of decades, a game-changing technology emerges that triggers a wave of innovations. Known as “general purpose technologies” by economists, they represent a major new enabling technology that has wide application across many use cases, deliver profound impact, generate substantial value across the economy, and ultimately affect all industries. Artificial intelligence, known as AI, is one such technology. We sat down with Tom...

Finding Pockets of Growth in a Struggling Economy: Quality Innovation Can Power Through a “Slowcession”

April 27, 2023

In the current slow-growth environment – both in the U.S. and globally -- there is the potential for an economic recession. Inflation and higher interest rates are pressuring consumers and businesses alike. Despite the risk of a recession, recent indicators suggest the underlying economy, at least in the U.S., is perhaps healthier than most acknowledge: Unemployment remains very low by historic standards (below 4%) and both corporate and...