We believe an important shift is happening across the growth stock and technology sector landscape, one that is causing investors to re-evaluate and re-embrace the stocks of highly innovative companies, more broadly. The shift? Quality innovative businesses are now pivoting from a “growth-at-all-costs” approach toward one that emphasizes “efficient growth,” an approach that balances strong top-line growth with a focus on also expanding margins and driving profitable growth. We think this pivot is an important and healthy dynamic, and one that is also contributing to improved results for the growth and innovation style.

Until recently, many growth companies, especially tech companies, were focused on simply driving the fastest revenue growth possible, delaying margin expansion while they invested across each business to drive the top-line. For businesses that have inherently strong unit economics, such as many enterprise cloud software companies, this top-line focus made sense, at least for a period of time. However, the markets have spoken, and are now forcing discipline on management teams to pivot to efficient growth by rewarding those companies that demonstrate an ability to drive operating leverage and expand operating margins—in turn, driving profits with only moderate impact on revenue growth. And, for those companies that may be at an earlier stage in their development, the market discipline is now forcing an accelerated path to profitability.

Quality Innovators with Competitive Advantages May Be Best Positioned to Pivot to Efficient Growth

We believe this new discipline around efficient and profitable growth is a very positive dynamic, especially for quality innovators that may be in the best position to deliver on it. It is not easy for fast-growing companies to make this pivot and many less-competitive and lower-quality businesses will find it hard or impossible to do so. Only companies with truly differentiated offerings and strong competitive advantages or moats will be able to make this pivot. In short, the pivot to efficient growth will lead to a separation of companies into two buckets: those able to achieve this balanced growth (quality innovators) and those unable to do so and end up falling behind their competitors (low-quality companies). We define quality innovators using our eight investment criteria, which include the following characteristics: Three of our investment criteria provide support for a company making the pivot to efficient growth. First, our focus on industries with an attractive industry structure (Criterion #3), typically oligopolies, duopolies, or de facto monopolies, confers a less-competitive environment. This should allow all the players to make the pivot, a dynamic we are seeing in the enterprise and cloud software space. Second, by focusing on companies that have built multiple layers of competitive advantage (Criterion #5), we tend to own companies that have solid market share positions and pricing power, both conducive to profitable and efficient growth. And third, we focus on companies that we believe have strong business models and financial positions (Criterion #6)—defined as inherently attractive unit economics on a long-term basis with strong balance sheets. We believe this last criterion is one that will be most impactful, as a strong balance sheet should allow a quality innovative business to be efficient while still largely investing in the business. Access to funding and capital is critical, so weaker competitors may find it difficult to access capital and fund their growth now. Lastly, if a business has strong inherent unit economics, they are likely to be revealed in this environment. We believe we are starting to see this play out with many portfolio holdings.

Three of our investment criteria provide support for a company making the pivot to efficient growth. First, our focus on industries with an attractive industry structure (Criterion #3), typically oligopolies, duopolies, or de facto monopolies, confers a less-competitive environment. This should allow all the players to make the pivot, a dynamic we are seeing in the enterprise and cloud software space. Second, by focusing on companies that have built multiple layers of competitive advantage (Criterion #5), we tend to own companies that have solid market share positions and pricing power, both conducive to profitable and efficient growth. And third, we focus on companies that we believe have strong business models and financial positions (Criterion #6)—defined as inherently attractive unit economics on a long-term basis with strong balance sheets. We believe this last criterion is one that will be most impactful, as a strong balance sheet should allow a quality innovative business to be efficient while still largely investing in the business. Access to funding and capital is critical, so weaker competitors may find it difficult to access capital and fund their growth now. Lastly, if a business has strong inherent unit economics, they are likely to be revealed in this environment. We believe we are starting to see this play out with many portfolio holdings.

Digging in more specifically, the pivot to efficient growth is having the effect of encouraging management teams to create new initiatives to find efficiencies across their businesses. We are seeing the application of this discipline in a more careful approach to staffing, through a slowing in hiring or even selective reductions in force. There is also a greater focus on zero-based budgeting where every expense line item is scrutinized. This shift to efficiency often happens during recessions, one of the silver linings of periods of slowing or contraction in the economy. These periods force companies of all sizes to, as they say, cut the fat and, if they have strong industry-leading positions, retain the muscle—allowing quality innovative businesses to drive a profit push while not sacrificing above-average growth and leadership. By contrast, for weaker competitors this process may force a cutting of both fat and muscle, leaving them further behind the leaders. This is why we believe this period may allow the leading innovators to emerge stronger once the economy strengthens. We believe our eight investment criteria—which emphasize leadership, competitive advantage, strong business models, and robust balance sheets—increase the odds we own companies that can benefit from this pivot to efficient growth.

New “Profit Push” is Enabling Leading Companies to Power Through an Earnings Recession

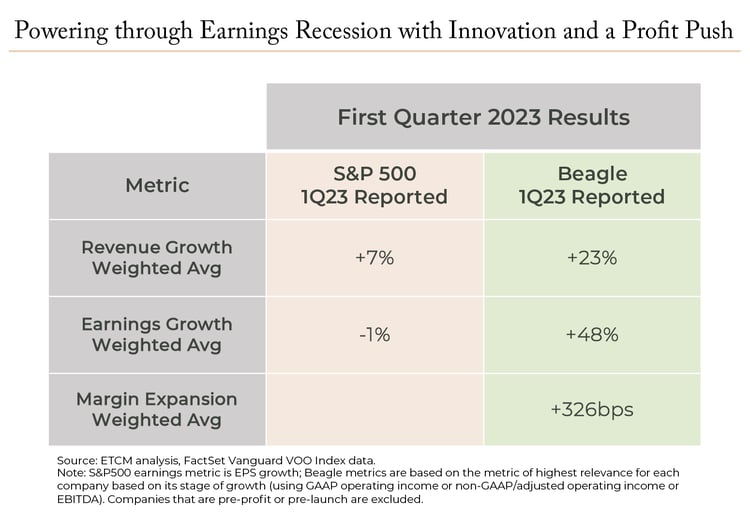

While the current economy, at least in the US, does not quite qualify as a recession (despite it feeling that way), the markets are experiencing an earnings recession, which is defined as declines in earnings for the average company, typically for at least two quarters. The S&P 500 index demonstrates this dynamic, with a 1% decline in earnings in the most recent quarter (see chart below), likely followed by another quarter of decline in earnings, before it may see an improving trend in the second half (based on current Street estimates).

One of the interesting ramifications of the new pivot to efficient growth is that many leading growth companies now have a lever to power through this earnings recession and deliver positive growth despite headwinds. Said another way, this “profit push,” as we put it, adds another growth driver to sustain growth. Truly innovative, leading companies now have two engines to drive growth, mostly independent of the economy: 1) innovation (new products and services), and 2) profit push (new initiatives for driving efficiencies and margins).

We see evidence for the power of this profit push in the recent first quarter earnings season, where holdings in the Beagle Innovators portfolio delivered 23% revenue growth year-over-year (yoy) and 48% profit growth, boosted by a 326 basis-point expansion in operating or EBITDA margins. This compares with the average company, as represented by the S&P 500, which saw revenues grow 7% yoy but profit drop 1% as margins contracted.

Quality Innovators Have Two Engines for Sustaining Growth: Innovation and the Profit Push

In a stagnant US and global economy—experiencing slow growth amidst various macro and geopolitical headwinds—innovation-driven growth may be the primary driver of growth and value creation in the economy. With well-capitalized leading innovators able to continue investing in innovation—but with a newfound focus on expanding margins (efficient growth)—they now have two engines to sustain growth: innovation and margin expansion. We believe this focus on efficient growth and the profit push is still in the early innings.