A new secular trend is emerging in the current economic environment: Companies that have built leading platforms—defined as technology-based offerings that can be extended into adjacent areas and new applications—are thriving in an economy that is so focused on cost efficiencies. This is driven by users increasingly consolidating their spend on fewer platform offerings that are unified across multiple applications and moving away from point solutions, which can be costly to manage.

Platform Leaders Benefiting from Consolidation, Driven by Cost Focus and User Preference for Broad Platforms

We are seeing more and more platform companies being developed in more industries, most notably in technology. Companies with platforms create an ecosystem of related technologies and products that work exceptionally well together. Think of Microsoft’s Office suite or the Apple ecosystem. Platforms offer potent competitive advantages to the platform owner because users tend to gravitate toward them over time. They do this because of the built-in efficiencies of working within one environment, where multiple applications work well together, versus toggling between different products. This is how Microsoft’s Office became a de facto monopoly and vanquished older point solution competitors like WordPerfect (word processing) and Lotus (spreadsheets).

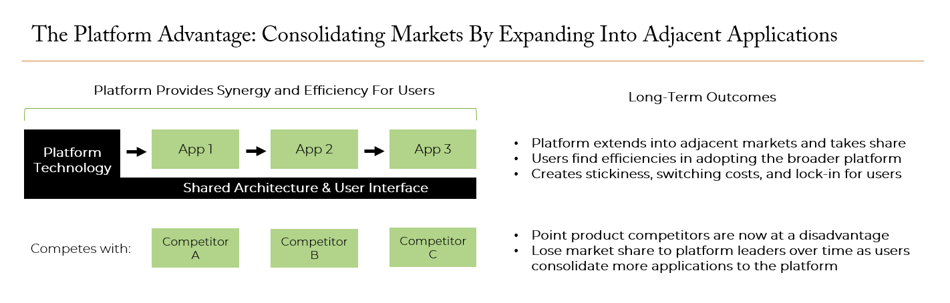

While most investors are familiar with the megacap tech platforms, there are a growing number of companies “below the surface” that offer similar platform capabilities. We touch on a few below, but let’s first illustrate why platforms have the potential to create competitive advantage over time. In the following graphic we show how a platform technology can launch multiple applications (“apps”) over time and how this compares with single point solution competitors that remain focused on just one app. Platforms are taking share from point solutions for several reasons: 1) They help reduce cost and complexity for customers, 2) They can simplify vendor relationships and contract management, and 3) There are fewer integrations that customers need to manage and maintain between tools. The bottom-line: Because platforms offer much greater utility and efficiency for users, the long-term outcome is that users tend to gravitate to the platforms, replacing the point solutions over time.

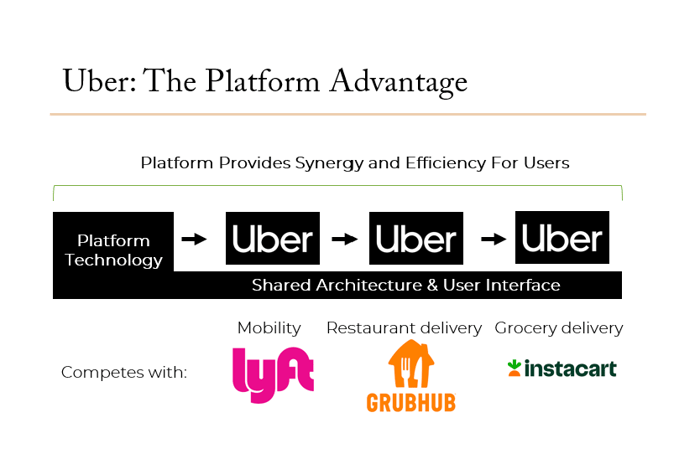

Uber is a great example of the power of the platform. The company has aggressively—and uniquely—expanded from its roots as an on-demand mobility app into adjacent markets (see chart). Notably, the company entered restaurant delivery with Uber Eats and is now a global leader in this market. More recently, Uber has entered into grocery delivery through partnerships and acquired Drizly to expand into alcohol delivery. Users see a lot of convenience in being able to access so many mobility and delivery services from one app they know and love—with one set of login credentials and payment information to manage, and with a membership and rewards program that works across the various product offerings.

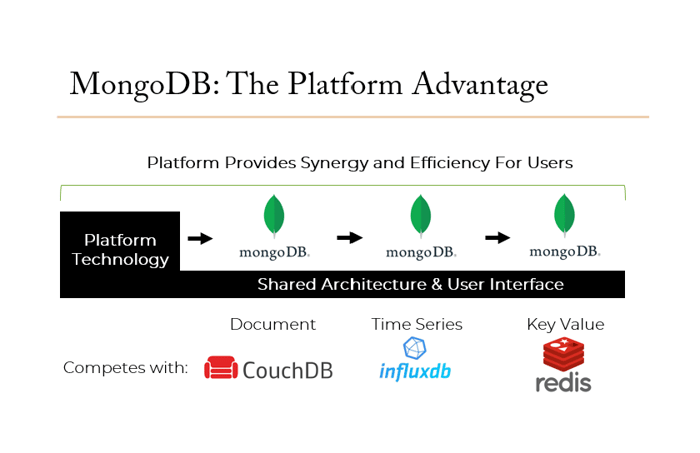

MongoDB is another emerging platform company that is a leader in modern database technology with its non-relational database platform. While MongoDB began its platform journey by focusing first on what is known as a document database, it has since entered into a series of specialized database segments by adding these functionalities to its MongoDB and Atlas platforms (including adding time series, key value, and, more recently, search capabilities). Users can now consolidate their various database needs onto one unified data platform, creating substantial cost efficiencies by not having to manage and pay for multiple discrete databases. As a result, MongoDB has been generally outgrowing these specialized database vendors and taking market share with its consolidated and multi-modal platform approach.

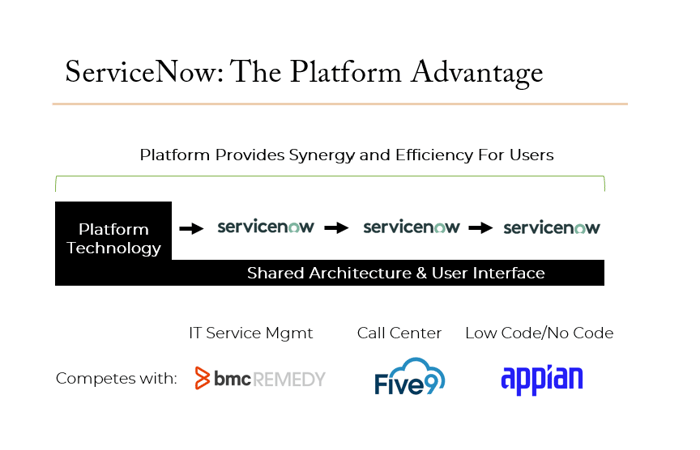

ServiceNow, a leader in enterprise cloud software, has also built a broad and unified platform that has enabled it to enter large adjacent markets and take market share from point-solution competitors (see chart below). While it got its start competing against on-premise IT service management companies like BMC Remedy, ServiceNow has subsequently expanded into customer service management and call centers, low and no-code solutions, and multiple other areas. In each case, the ServiceNow platform (which combines all these applications onto one common user interface and data architecture) has provided the company with a competitive advantage because users prefer standardizing on a platform over having to stitch together a series of discrete applications that are hard to integrate. In fact, on a total cost of ownership (TCO) basis, companies can often save money by replacing numerous point solutions and consolidating to a broad platform like ServiceNow.

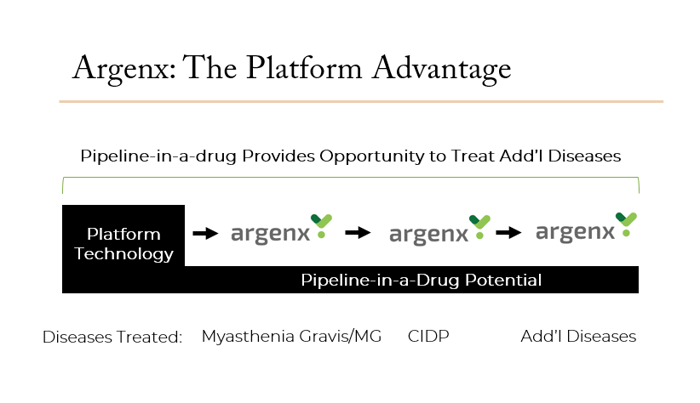

We see the power of platform technologies in other sectors as well, including in life sciences where certain technologies can provide a foundation to address multiple diseases using one core technology. For example, Argenx, a leading biotechnology company, developed a treatment called Vyvgart that is already FDA-approved for one disease indication, myasthenia gravis (MG), a rare autoimmune neuromuscular disease, and nearing blockbuster status as it closes in on $1 billion in sales. What makes Vyvgart special is that its mechanism of action (targeting the FcRn receptor with an anti-FcRn antibody) can actually be used to target a whole series of autoimmune diseases because this target is implicated in many different indications. In fact, the company is currently targeting 15 different disease indications across a number of clinical trials. This provides what investors call a “pipeline-in-a-drug” opportunity, and it is a good example of a platform-type technology.

Argenx has already reported positive Phase 3 results in other indications beyond MG, including in the biggest indication yet, chronic inflammatory demyelinating polyneuropathy (CIDP). Taken together, the current FDA-approved indication in MG and the potential in the newer indications may allow Vyvgart to scale into a multi-blockbuster product. We favor life science companies that have the potential to take a core technology platform and apply it to a series of new disease indications over time, providing potential for sustainable and profitable growth.

Innovation and Platforms May Allow Leaders to Power Through a Slow Global Economy

With the global economy continuing to face various headwinds, we continue to feel strongly that innovation may be the primary way many companies will be able to sustain growth over the coming years. The investment approach we employ, which leans into quality innovators that meet our criteria, tends to lead us toward competitively-advantaged platform-type companies. These platform leaders appear well positioned to sustain above-average growth in various economic environments.