In the current slow-growth environment – both in the U.S. and globally -- there is the potential for an economic recession. Inflation and higher interest rates are pressuring consumers and businesses alike. Despite the risk of a recession, recent indicators suggest the underlying economy, at least in the U.S., is perhaps healthier than most acknowledge: Unemployment remains very low by historic standards (below 4%) and both corporate and consumer balance sheets are relatively strong, certainly stronger than what we saw in 2008 and the Great Financial Crisis. Reflecting this, Mark Zandi, chief economist at Moody’s Analytics, dubbed the current unique environment a “slowcession.” As he put it, “There is no doubt the economy will struggle [in 2023] as the Fed works to rein in the high inflation.”

While we anticipate that the economy will continue to experience headwinds in the near term, this is precisely the type of environment in which investors go in search of pockets of growth. I believe their search naturally will bring them to areas of secular long-term growth (and away from cyclical industries). I also believe the quality innovative businesses Evolutionary Tree owns are generally well-positioned to continue sustaining growth, particularly given that their growth is less dependent on general economic growth and driven more by new products, services, and long-term shifts.

GROWTH OFFERS VALUE, ESPECIALLY IN QUALITY INNOVATORS

With growth stocks being so out of favor during 2022, I believe an unusual reversal has happened: Value stocks, in some cases, are now more expensive than growth stocks. Take a look at the tables below.

In the table on the left, we compare two large-cap growth bellwethers (Visa/Google) against two large-cap value stocks (Procter-Gamble/McDonald’s). As of 3/31/23 Visa was valued at a lower price/earnings multiple than McDonald’s, despite having higher operating margins and higher growth prospects—very similar dynamics exist between Google and Procter & Gamble.

In the table below, we compare two benchmarks in the small-cap space (S&P Small-Cap Growth Index vs S&P Small-Cap Value). Here we see that as of 3/31/23, small-cap growth stocks traded at a lower price-to-free-cash-flow multiple (P/FCF) than comparable small-cap value stocks. This is unusual and may indicate that growth offers greater value than value stocks.

The takeaway: During much of 2022 investors rotated away from growth stocks as interest rates rose. However, this process now has potentially overshot on the downside and may reverse over time. When inflation keeps easing and rates flatten out in the near term, or even fall, there is potential for growth stocks to come back into favor. Note: Since sharing this insight with our clients, this reversal is playing out with the small cap value index seeing compression relative to the growth index. While we cannot guarantee this will continue and we do not time the market, we believe, overall, the growth style still offers good value, especially in the context of a slowing economy.

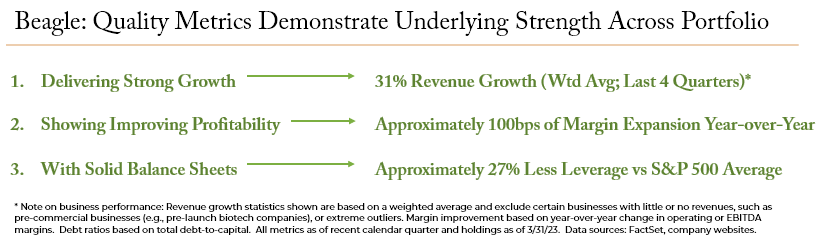

Over the long term, I believe that investment returns usually correlate with long-term growth in earnings power. As shown below, I draw confidence from the fact that the underlying growth of the businesses across the Beagle Leading Innovators portfolio is healthy and robust. On a weighted-average basis, the businesses in the portfolio delivered both strong growth (31% growth over the past four quarters) and improving profitability. They are also on strong financial footing, with typically strong cash positions and lower levels of debt than the average company—features that are critical for weathering a recessionary-like environment, where access to capital is difficult and expensive.

QUALITY INNOVATORS ARE WELL-POSITIONED TO SUSTAIN GROWTH

Markets have begun to separate companies into two buckets, sorting the wheat (quality companies) from the chaff (low-quality companies). Companies that demonstrate high-quality characteristics, including showing profitability or a clear path to profitability, along with strong balance sheets, are seeing renewed interest from investors. Evolutionary Tree’s eight investment criteria include these characteristics and are how we define quality—and they naturally lead us to quality innovators that launch important new products and services to sustain growth. We believe that, collectively, these businesses are delivering progress on innovation and well-positioned to sustain growth.