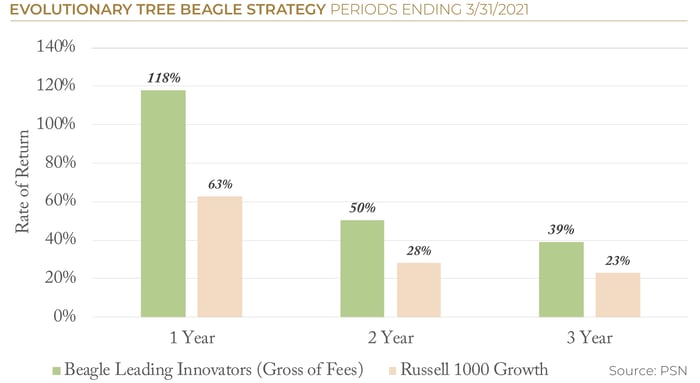

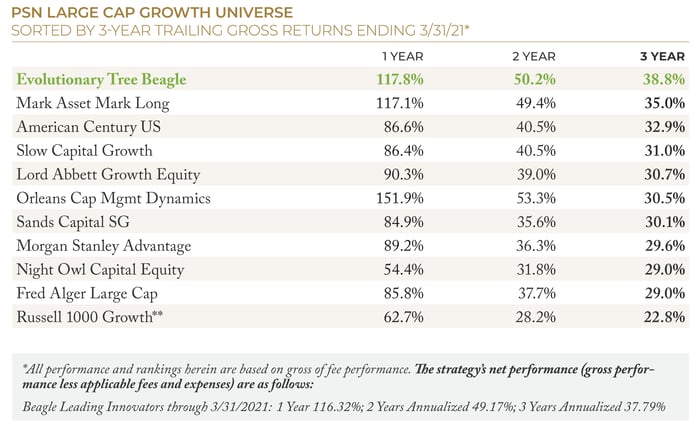

We are very proud to report that our flagship innovation-focused portfolio, Beagle Leading Innovators, recently hit its three-year anniversary as of 3/31/21 and is the top-performing strategy in the PSN Large Cap Growth Universe over the trailing three-year period. *See important information below about gross and net performance.

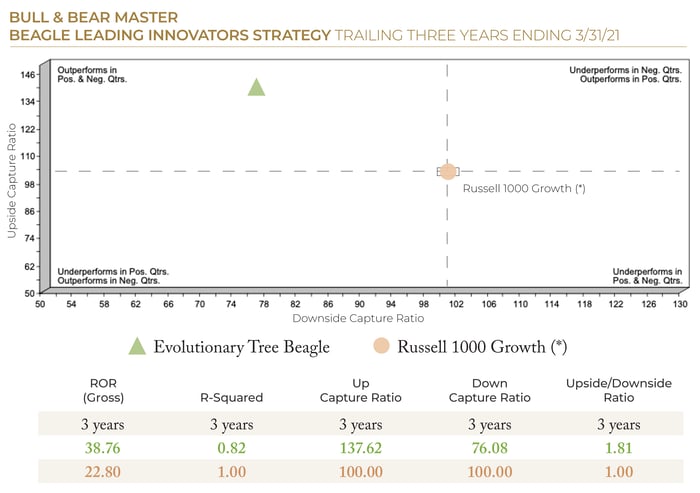

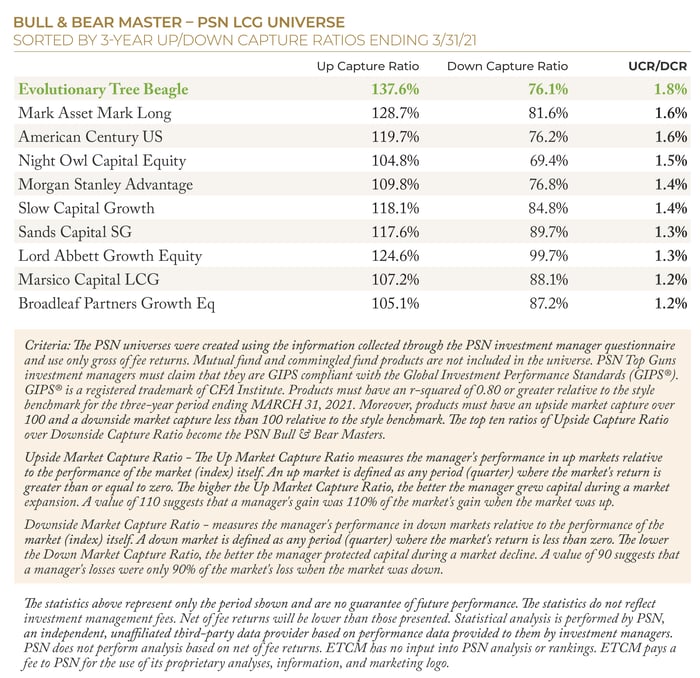

Beyond the strong absolute and relative performance, we are especially proud of the Beagle Leading Innovators’ risk-adjusted returns. The strategy ranked #1 in PSN’s Bull & Bear Master report for the three-year period, capturing 137.6% of the Russell 1000 Growth Index’s upside and just 76.1% of its downside.

We believe these results validate the resiliency of our innovation-focused investment approach. This is especially true given the significance of the market events that occurred during the three-year period ending 3/31/21, including two bear markets, a pandemic, an economic recession, a U.S./China trade war, and a transition in presidential administrations. Despite these headwinds, strength in our holdings’ underlying business fundamentals—driven by innovation and secular trends—successfully translated into investment results that rebounded faster than the overall market over this time period. Further, investors tended to gravitate back to these high-quality, long-term secular growers after each market selloff. We believe this track record demonstrates that quality innovators and our unique approach have the potential to provide both offense and defense.

Small/Mid Cap and Global Strategies Also Win PSN Top Guns Awards

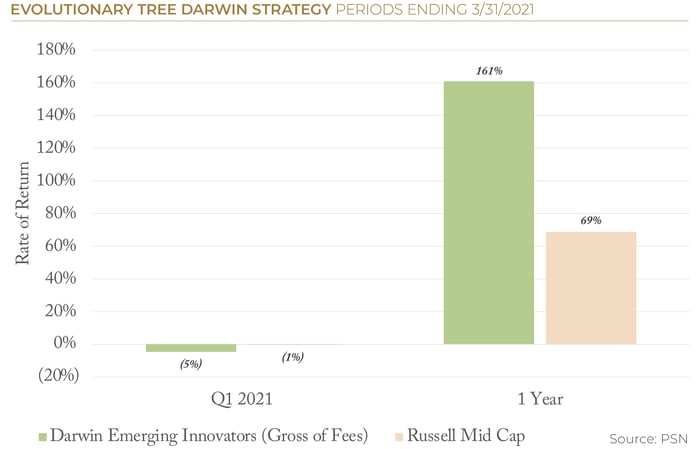

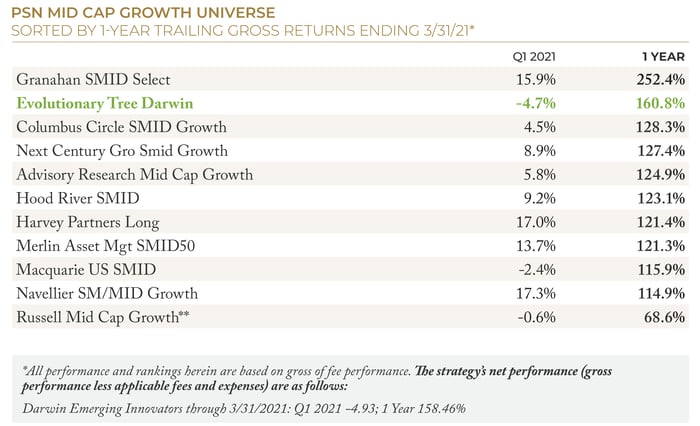

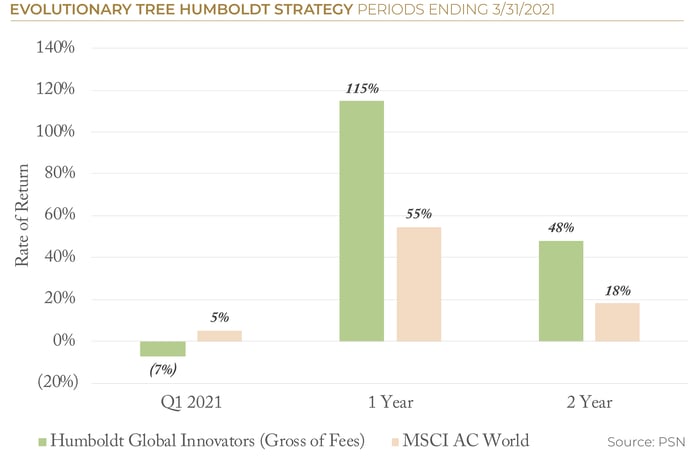

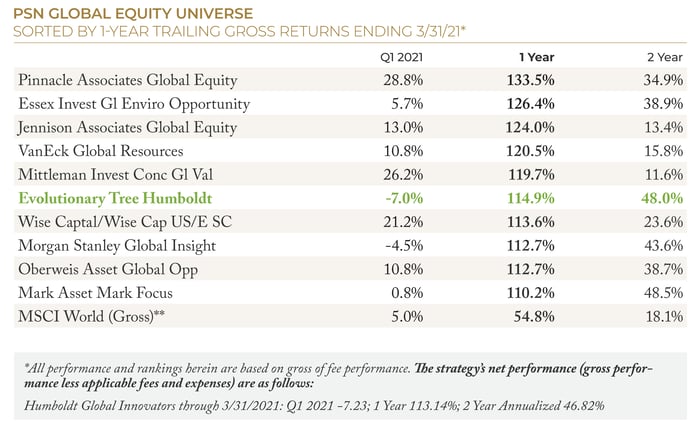

The Evolutionary Tree Darwin Emerging Innovators and Humboldt Global Innovators strategies also continue to deliver considerable value on both a relative and absolute basis for our clients. As innovation knows no boundaries, we strive to identify clusters of innovation regardless of size or location and these portfolios hold some of our best ideas across the market cap and geographic spectrums.

Darwin Emerging Innovators ranked #2 out of 142 products within the PSN Mid Cap Growth Universe over the trailing one-year period. We believe this demonstrates our team’s ability to identify emerging and mid-stage innovators earlier in their growth cycles - typically before they are recognized by traditional growth investors.

Analyzing innovation through a global lens is critical in today’s widely-connected and fast-changing global economy. Our Global Equity offering, Humboldt Global Innovators, ranked #6 out of 627 products within the PSN Global Equity Universe for the trailing one-year period ending 3/31/21. We believe Humboldt’s strong results highlight our ability to add value in global investing and the advantage of targeting innovation clusters to identify and own the most innovative businesses around the world.