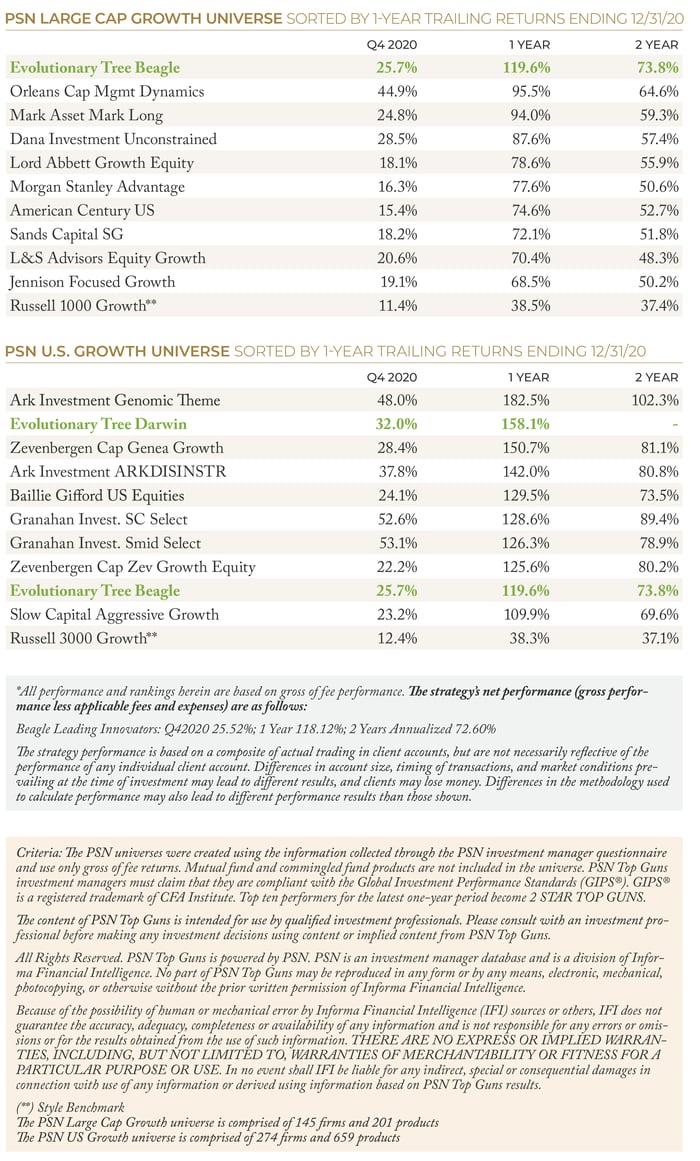

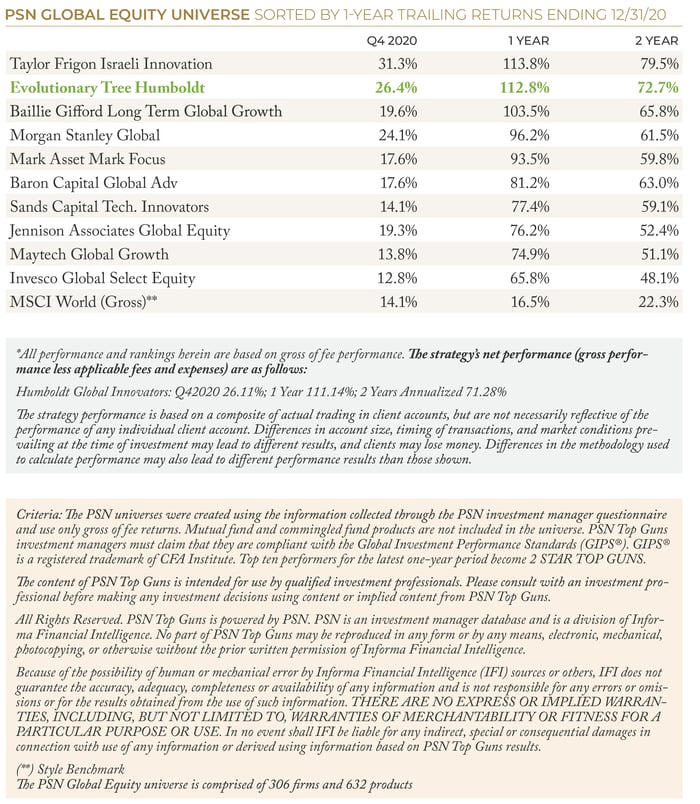

We are proud to report that our three innovation-focused portfolios, Beagle Leading Innovators, Humboldt Global Innovators and Darwin Emerging Innovators, continue to deliver considerable value on both a relative and absolute basis for our clients. All three strategies won PSN 2 Star (meaning trailing one-year) Top Guns awards for the period ending December 31, 2020, including multiple first place rankings.

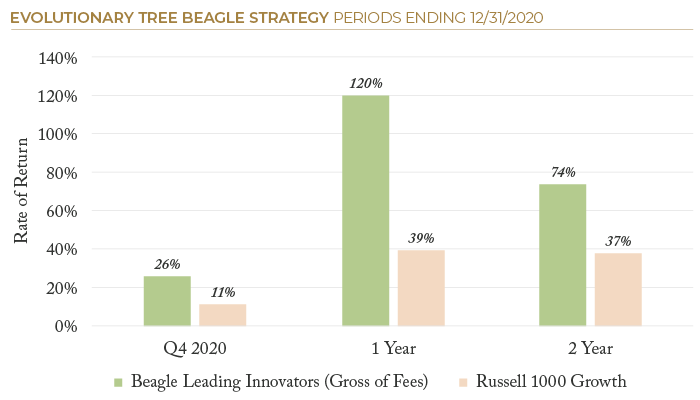

While the awards were for the one-year period, we also are proud to announce our flagship Beagle Leading Innovators strategy recently reached its three-year track record with similarly strong results.

Despite the exceptionally difficult investment environment in 2020, our strategies outperformed, with returns that were well above what one would normally expect in a given year. We believe that the theme of innovation was the primary reason for our strong performance; innovation is becoming the solution for many challenges across the economy.

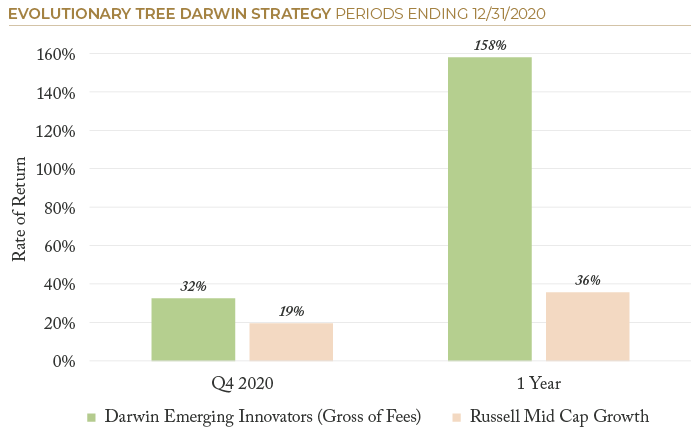

In addition to innovation being a solution to the pandemic itself, innovation-focused investment strategies were validated as a way to weather storms. Innovative businesses were shown in this crisis to be more resilient than traditional or less-innovative businesses. When the US economy (using GDP data) was shrinking during the first and second quarters, the businesses held in Evolutionary Tree client portfolios grew revenue, on average, over 30% year over year in each quarter. These innovative companies, in aggregate, experienced resiliency in their businesses despite the recessionary environment, with positive and even accelerating revenue growth throughout the year. *See important information below on gross and net performance.

One of the primary reasons we focus on innovation versus worrying about the economy or the markets is that leading innovators rely more on the power of innovation to sustain long-term growth than the state of the general economy. It turns out that this also means that during economic slowdowns, or even crises, this internal engine — innovation — allows portfolio holdings to drive forward and in many cases continue growing even during recessions. Crises also accelerate secular trends — essentially accelerating the future — and thus can benefit many of the companies we own which are leaders in these areas.

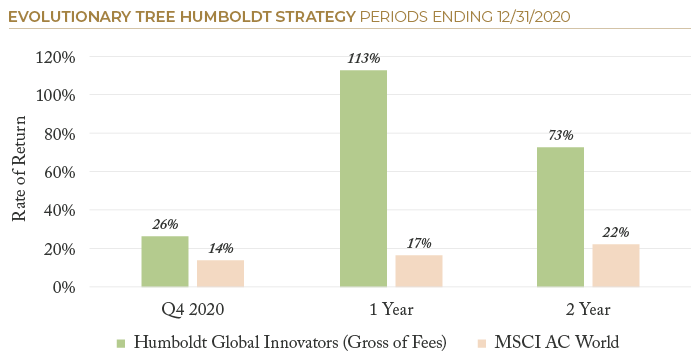

Our Global Equity offering, Humboldt Global Innovators, has seen similar success versus its benchmark and peers as the same trends discussed above also played out on the global stage. The strategy ranked #2 within the PSN Global Equity universe for the 2020 calendar year. Its strong results validate the strength of our global research capability, which we believe every equity manager must possess in this fast-changing world economy.

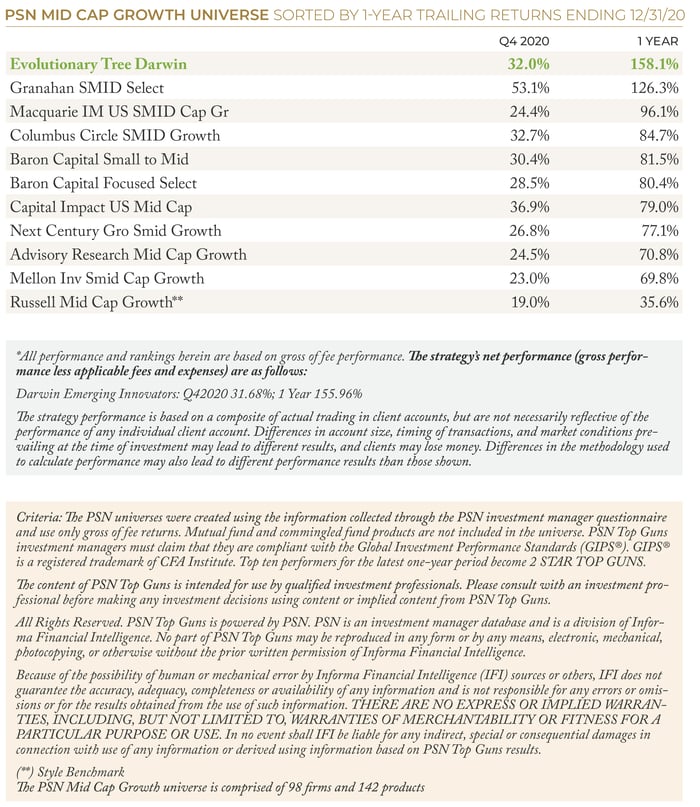

Lastly, our small-to-mid cap offering, Darwin Emerging Innovators, also took home PSN Top Gun honors, ranking #1 in the Mid Cap Growth universe and #2 in the entire U.S. Growth universe. We believe this validates our team’s ability to identify emerging innovators across the market cap spectrum.