While many investors are currently focused on near-term macro headwinds, we believe innovation can still drive growth for leading innovators and remains critically important for long-term investors. Innovation is not going out of style or losing its importance.

We believe many of the macro headwinds are mostly discounted in current valuations for quality innovative businesses, and we share examples below on the disconnect between the strength of the underlying businesses owned in the portfolio and current valuations. Bear markets eventually end, and markets recover. History has shown that the eventual recovery can be quite powerful.

Our Main Viewpoints On Putting Current Macro Headwinds Into Perspective

- While inflation is high currently, it is likely at or near peak levels and will ease gradually over time, particularly as the global economy slows. Signs of easing inflation will start to stabilize the markets and, in particular, growth stocks. We may already be seeing signs of this dynamic. Time will tell.

- A slowing economy, driven by the ending of one-time pandemic subsidies and monetary policy tightening by the Fed, will begin to ease inflation. The recent pullback in commodity prices is already revealing this potential.

- Technology companies, particularly software companies, are a part of the solution to addressing the labor shortage issue, as companies look to drive cost efficiencies and worker productivity. Technology is a part of the solution, and quality tech stocks are attractively valued, in our opinion.

- A slower economy will hurt cyclical industries, which we avoid, while highlighting the value of secular growth industries and innovators, which can generally grow through difficult economic environments.

- Growth is the new value, and lower valuations may further entice investors to re-embrace growth and innovation over time. The timing of this process is unknown, particularly given the above-mentioned headwinds, but we believe patience will be rewarded.

The Market Is (Temporarily) Penalizing Faster-Growing Companies, Even Quality Innovators Delivering Growth

In the current market environment, investors are temporarily shunning fast-growing companies that are earlier in their profit cycles. We believe as investors eventually look beyond macro headwinds, particularly if inflation starts to ease (which we acknowledge may take some time), investors are likely to re-embrace these innovative, secular growth companies. We believe we own a collection of high-quality innovative companies—ones that meet our stringent criteria and have competitive advantages, strong management teams, and typically robust balance sheets. We actively avoid “hype” and “concept stocks” and believe the current market has thrown the proverbial babies out with the bathwater. If the businesses we invest in—which we believe are quality innovators—continue to deliver on their innovation pipelines and sustain growth, we believe this will provide the foundation for adding value over time.

In our view, there is a significant disconnect between the strength and quality of the companies we own in our client portfolios and their current stock valuations. To put some numbers to this disconnect, on a weighted-average basis, the holdings in the portfolio delivered 29% revenue growth in the most recent quarter, and generally showed improving operating margins, while the portfolio experienced a decline during the recent bear market period. Although we cannot predict when this disconnect will close—which could lead to improved investment results—we remain confident that the collection of businesses we own can continue to sustain above-average growth over the long term.

We see real value in leading innovative growth companies in this market environment. To demonstrate the potential magnitude of the disconnect between current valuations and the strength of underlying business fundamentals, we profile three examples. We start with a leading company in biotechnology, then shift to where we are seeing extreme value in e-commerce, and end with a software and cloud computing example.

Growth Is the New Value Example in the Biotechnology Space: Sarepta Therapeutics

During this bear market, we have also seen indiscriminate selling of biotech and medical technology stocks. While this was certainly true during the “risk off” market environment during the first half of the year, more recently, we have started to see investors re-embrace quality biotech leaders. This is being driven by a more accommodative FDA and positive clinical updates, along with acquisitions of biotech companies by big pharma. That said, we acknowledge that many small and unproven biotech companies recently went public, most of which we view as risky and low quality. We actively avoid these types of biotech companies.

However, the selling pressure across biotech for much of this year has negatively impacted even the quality biotechnology leaders—an example of throwing babies out with the bathwater. We are highly selective in our biotech investments, seeking to identify leading companies with validated platform technologies, multiple “shots on goal” with deep pipelines, products and/or partnerships that generate revenues, and robust balance sheets.

While these characteristics don’t eliminate risk from these businesses, they can substantially reduce it. Despite these potentially attractive features, in the current market environment, we are seeing even the “quality babies” being heavily discounted, such that many are trading at deep discounts to what we estimate to be fair value.

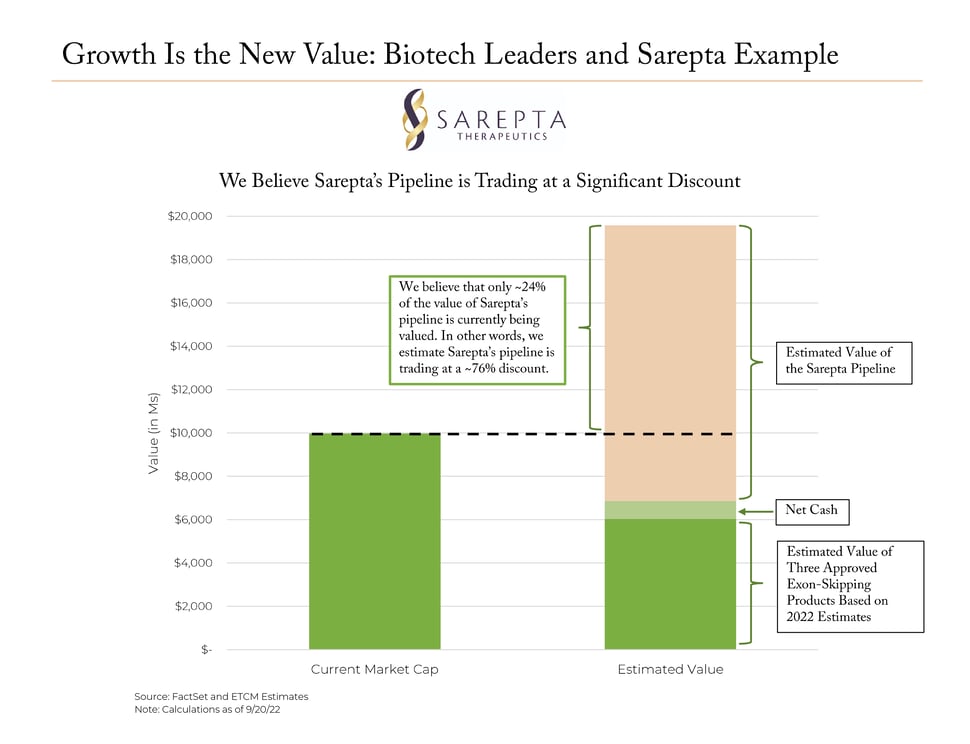

For example, we own Sarepta Therapeutics in client portfolios, which is a leader in advanced treatments for neuromuscular disease and a company that generates over $800 million in revenues on three FDA-approved drugs. The big surprise in our analysis: If we apply reasonable latent profit levels to their existing three approved drugs, we calculate that the value of these assets alone nearly equaled the market value of the company in June, which meant that an investor was getting Sarepta’s pipeline for almost free during the worst of the bear market.

While the stock of Sarepta has recovered a fair amount since then, we estimate the value of the pipeline is still trading at a significant discount. Our internal estimate—using a probability-of-success framework—indicates that Sarepta’s pipeline may be currently valued at over a 70% discount (see chart below).

To be clear, Sarepta’s pipeline carries risks (such as clinical trial risk, FDA approval risk, and commercialization risk), but we believe the current valuation does not adequately value Sarepta’s gene therapy and next-gen exon skipping pipeline programs. In fact, the company has a deep pipeline of seven major clinical-stage programs (and over 40 including pre-clinical programs), with at least two late-stage programs with blockbuster potential, including a promising gene therapy for Duchenne’s Muscular Dystrophy (DMD) that has shown strong efficacy and safety to date.

The main point is that Sarepta is but one example among a collection of high-quality innovative leaders in biotechnology and medical technology where we estimate the current valuation substantially discounts the value of each business and its pipeline. With investors hyper-focused on the near-term macro environment, they appear to be systematically undervaluing the potential of these innovation pipelines.

Growth Is the New Value Example in the E-commerce Space: Amazon

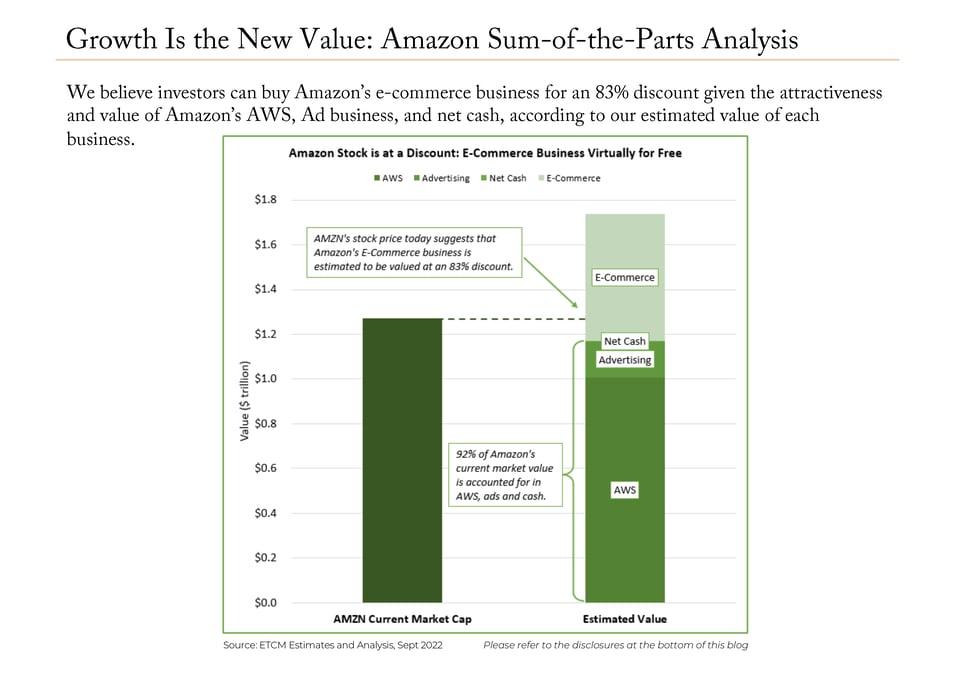

Undervalued situations are not the sole province of emerging innovators or small-to-mid cap companies. Even dominant and established innovators, such as Amazon, appear to be attractively valued in this bear market environment. While we acknowledge Amazon is seeing a deceleration in growth in its e-commerce business, the company is still experiencing 25–35% growth in its Amazon Web Services (AWS) business. We also believe its e-commerce business will return to growth later this year or next year and can deliver a level of profitability over time comparable to, or above, both Wal-Mart and Costco. Amazon’s third-party/3P and Prime membership components make this business compelling compared to traditional retailers.

When viewed through this longer-term lens and after putting pen to paper (or finger to keyboard) and conducting a sum-of-the-parts (SOTP) analysis on Amazon, we find something pretty surprising: We estimate that at the current valuation, investors can essentially buy Amazon stock and get its e-commerce business for an 80%+ discount, given the robust growth and value of its AWS and digital ads businesses (see chart below for our estimates). Said another way, Amazon’s stock, based on our estimates (and opinion), currently trades at a significant discount to its intrinsic value. While the market may take time to reflect the underlying value within Amazon, and the upcoming quarter may be rocky for Amazon’s e-commerce business given the recessionary-like environment, we believe Amazon can deliver above-average growth in future years.

Growth Is the New Value Example: Quality Software and Cloud Computing Leaders

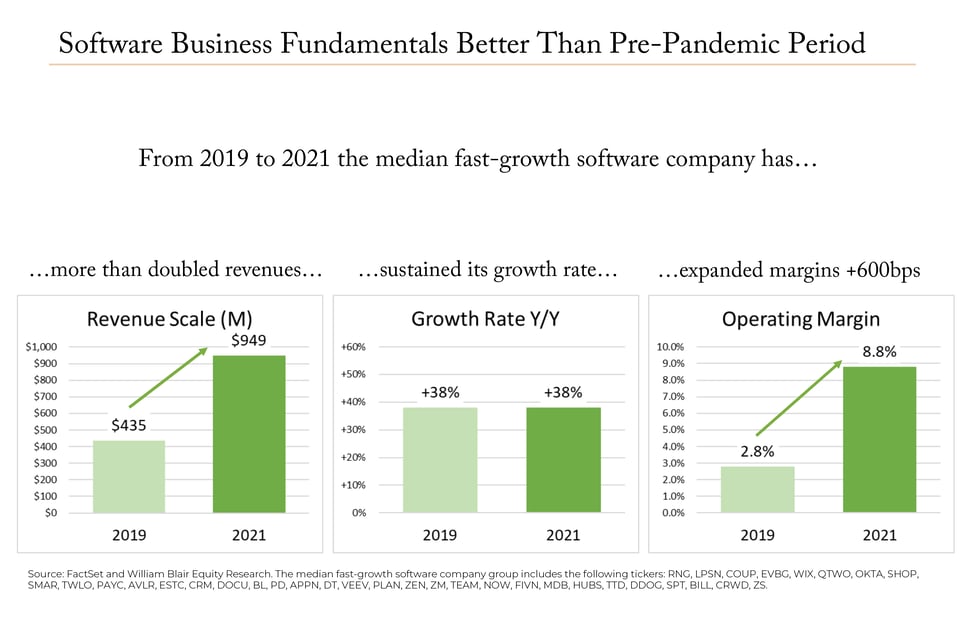

We believe leading cloud software companies are, on average, showing robust fundamentals by scaling up, sustaining growth, and expanding profits over time. Want evidence? Recent data supports our thesis that cloud-era companies are healthy and have a clear path to profitability.

Upon analyzing a basket of faster-growing software companies (shown in the chart below), William Blair Equity Research found that the underlying business fundamentals for these software companies were healthy. From 2019 (pre-pandemic) through 2021, the median fast-growth software company more than doubled its revenues (scaling up), maintained strong growth (sustainable growth), and expanded operating margins by 600 bps (demonstrating both profits and a path to expanding them). An analysis of our software holdings revealed a similar profile, with revenues more than doubling from 2019 to 2021, growth sustained with an average revenue growth rate of 40%+, and operating margins expanding over 1000bps. The sustainable and improving growth demonstrated by these companies during this challenging three-year period is, in our view, evidence that the cloud era is built on solid ground.

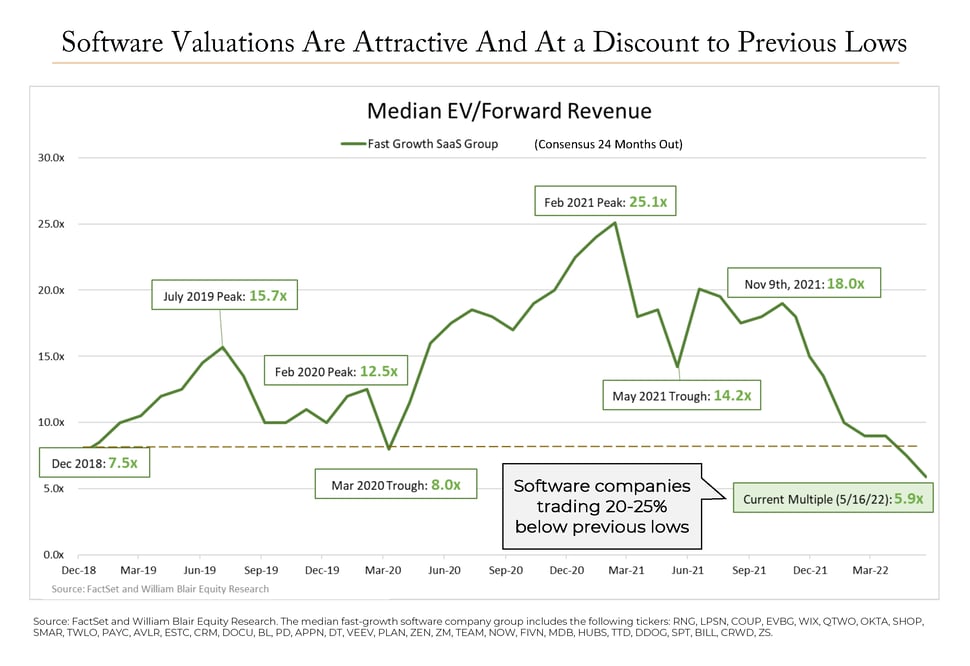

Not only are leading cloud software companies driving sustainable growth, but their stocks may also represent a good value opportunity, in our opinion. Following the dramatic pullback in software stocks over the past ten-plus months, valuations have adjusted down to what we consider quite attractive levels. We base this on two points. First, the median EV/Forward-Revenue multiple, at around 6X, is now 20% to 25% below previous lows (see chart below; relative to March 2020 COVID low and the December 2018 mini-bear market). This is despite the sustained growth in revenues and expanding margins shown previously. Acquisition deals for quality software companies over the past five years have typically been done at a range of 10-12X revenues, which would indicate that current valuations may be substantially discounted.

There is also a strong case that software companies, particularly software-as-a-service/cloud companies, are on even stronger footing post-pandemic, given that more businesses are now adopting a “cloud-first” approach to their applications and leaning into digital transformation. These software applications are also a primary way for companies to deal with the current staffing shortages, enabling businesses of all sizes to improve productivity and gain efficiencies. While software and enterprise IT budgets are not immune to recessions, we believe they may be less impacted than other industries and represent primary solutions in this inflationary environment.

Taken together—adopting a cloud-first approach, improving productivity, and driving cost efficiencies—these drivers provide a strong demand environment for software companies. With valuations at current levels, there appears to be a significant disconnect and opportunity, as continued growth may draw investors back to the leading, quality software companies over time.

Concluding Thoughts

Riding through bear markets is one of the toughest jobs for investors, and yet, it is essential for long-term wealth creation. In our opinion, no one can consistently time either the market or the economy.

With portfolio companies continuing to sustain above-average growth in aggregate, and now at what we view as extremely low valuations, we believe quality innovators can both power through a period of economic slowdown and get back to adding value as investments. Innovative businesses typically are capable of creating their own weather and sustaining growth by launching new products and services, and if they are truly innovative, they also tend to demonstrate pricing power to potentially offset the impact of inflation. We are going to be patient and ride through these macro storms, stay focused on our core long-term investment strategy, and continue ownership of quality innovative businesses.