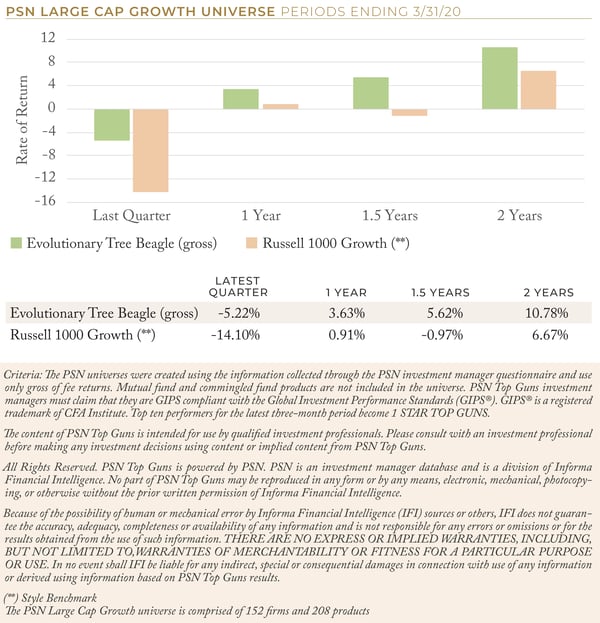

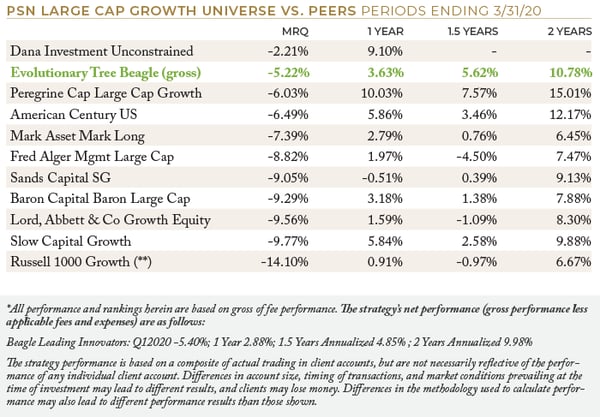

.png?width=114&name=PSN%20Top%20Guns%201%20Stars%201Q%202020%20(1).png) If you missed our recent press release, we are proud to have been awarded one of PSN’s Top Guns within the large cap growth manager universe for 1Q20. The Russell 1000 Growth Index fell -14.10% during the worst quarter for stocks since 1987. In comparison, our strategy was only down -5.22% (gross of fees), outperforming the Index by 8.88ppts.

If you missed our recent press release, we are proud to have been awarded one of PSN’s Top Guns within the large cap growth manager universe for 1Q20. The Russell 1000 Growth Index fell -14.10% during the worst quarter for stocks since 1987. In comparison, our strategy was only down -5.22% (gross of fees), outperforming the Index by 8.88ppts.

See important information below on gross and net performance.*

What drove the strong relative performance during the first quarter?

In a word: Innovation.

Evolutionary Tree is a specialist in innovation-focused, concentrated growth strategies. The firm believes that investing in leading innovators driving secular trends is the best way to add value for clients over the long term. In our experience, in times of crisis or recession, consumers and businesses often adopt certain innovations at a faster pace. Given the pandemic-driven stay-at-home and work-from-home dynamic, many secular trends and evolutionary shifts—such as the shift to e-commerce, video streaming, and cloud computing—have seen acceleration. The team at Evolutionary Tree believes that these behavioral changes will prove to be durable.

Recessions often drive consumers and businesses to adopt innovations that offer cost reduction, convenience, or a better way of performing an activity. In short, tough times accelerate the future. Innovation-focused portfolios allow clients to benefit from these dynamics.

In addition to offering growth opportunities, innovation-focused strategies can, at times, be lower risk than other investment strategies, especially when leading innovators benefit from structural shifts. The 2020 pandemic and bear market demonstrates that innovation-focused strategies may offer both offense and defense. Innovation-focused portfolios, such as Evolutionary Tree’s Beagle US Innovators strategy, have held up exceptionally well in the current environment. Additionally, the firm believes owning leading innovators will also allow clients to be well positioned when the economy finally re-opens.

If you are interested in reading our PSN Top Guns official press release, please click here.

![[Watch Webinar] Innovation Investing: Navigating Accelerating Change in an Evolving Economy (recorded May 5, 2020)](https://no-cache.hubspot.com/cta/default/4802837/a2aaf374-0acb-427d-b82c-f90a60543de2.png)