Over my 25-year investment career investing in sustainable growth companies, experience has taught me that the core driver—the root cause—of value creation across the economy is innovation.

While most investors acknowledge the importance of innovation in a general sense, it is, in my opinion, more profound than most appreciate for a few key reasons:

- Innovation is what creates new market-leading products, services, and business models, which are the engine for sustainable revenue and earnings growth. This, in turn, drives long-term stock price appreciation. Additionally, innovation enables companies to differentiate from competitors, enhance pricing power, improve profitability, and create new legs of growth.

- When zooming out over longer periods of time it also becomes more clear that a series of innovations over time is what drives the evolution—and structural change and disruption—of industries. Innovation is the force behind the tectonic shifts that drive “accelerating change” across an evolving economy.

- Importantly, from an investor point of view, I believe that the equity markets misprice innovation and the leading innovators driving them forward. Why? Markets are more efficient over shorter time periods, discounting products or services contributing to growth in the next year or two. However, the market seems to systematically underappreciate innovations contributing to growth in the out-years, typically in years 3-5 and beyond. Investors who take a true long-term perspective and identify these out-year innovations have an informational advantage and can add significant value.

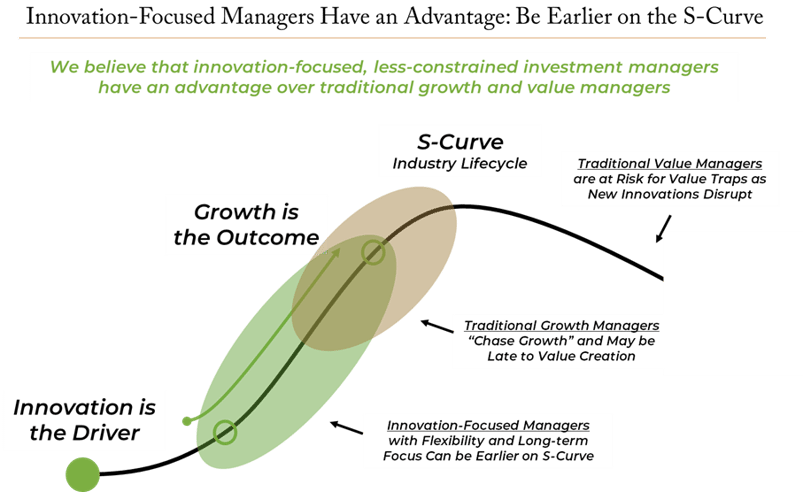

Most investors are aware of the concept of the “S-curve” or industry lifecycle curve, and intuitively know that much of the value creation happens on the growth part of the curve.

But, the question I pose to you is: what drives the growth?

It is, of course, innovation, if not a series of innovations that sustain this growth up the S-curve over many years. So, while “growth” can add value, it is really just an outcome, while innovation is the driver. This viewpoint of shifting the lens from a growth focus to an innovation focus has important implications when evaluating the various investment styles.

Innovation-focused managers have a fundamental advantage versus traditional growth and value managers when it comes to capturing the value creation from innovations on the S-curve. How? Traditional growth managers are often “chasing growth”, which may mean they are finding growth businesses years later in the process, what I refer to as buying “up the S-curve”. In short, they are late. Traditional value managers are increasingly at risk for “value traps” as new innovations are disrupting more and more industries across the economy, especially with digital transformation.

By contrast, innovation-focused investment managers—those focusing on identifying important innovations—may be able to identify leading innovators earlier. I call this “being earlier on the S-curve”. As we all know, investors don’t get paid on past growth, only future growth. Innovation-focused managers—and the innovation investing style—may be better positioned to identify future growers earlier than traditional growth and value managers. Specialists in innovation investing focus on this sweetspot of the S-curve.

In May 2020, we hosted a webinar with the CFA Institute of Columbus, Innovation Investing: Navigating Accelerating Change in an Evolving Economy. Please watch an excerpt of this webinar (3 min) which covers the “S-curve” concept, below:

Interested in viewing the full-length (55 min) presentation?

Click below.

![[Watch Webinar] Innovation Investing: Navigating Accelerating Change in an Evolving Economy (recorded May 5, 2020)](https://no-cache.hubspot.com/cta/default/4802837/a2aaf374-0acb-427d-b82c-f90a60543de2.png)