In the Age of Innovation, we need to shift our thinking about where risk lies. Increasingly, the leading innovators are less risky as businesses (and investments) than non-innovators.

Traditionally, it was the defensive so-called “stable blue chips” that offered lower risk and solid returns. However, with the pervasive rise of digitization and related technology-enabled business models, industry after industry is undergoing massive change. Many describe it as disruption. We describe these secular trends as evolutionary shifts, which create opportunity (winners) and risk (losers) across the economy.

Many of the traditional blue chips, from IBM to Kraft Heinz, find themselves on the losing side of this evolutionary process. While this process is unlikely to cause any of these traditional blue chip companies to go out of business, they are nonetheless struggling to maintain volume growth and pricing power, and, in some cases, are even experiencing declining revenues. In our opinion, the new way to lower risk is to own the innovators.

Innovation-Focused Portfolios Enable You to Lean into the Future, Not on the Past

A study by McKinsey Global Institute supports this view. In its article, “Navigating a World of Disruption,” the article states that “companies that are digital leaders in their sectors have faster revenue growth and higher productivity than their less-digitized peers. They improve profit margins three times more rapidly than average and are often the fastest innovators and disruptors of their sectors.”

Leading innovators are also capturing more of the profits within their respective industries than in the past. According to McKinsey in the same report, the top decile of nearly 6,000 firms studied now captures 1.6 times more economic profit today compared to twenty years ago, while the bottom decile is seeing 1.5 times the level of economic losses. Top-performing companies—often the leading innovators embracing digital business models—are widening their economic moats and capturing more of the growth and profits.

Importantly, this new dynamic of increasing concentration of profits within industries plays to concentrated investment portfolios (that own fewer than 35 holdings) versus index funds, which cannot take advantage of focusing on the leading innovators. Index funds essentially own everything, which dilutes the impact of these innovators, ultimately saddling the indexes with many non-innovators.

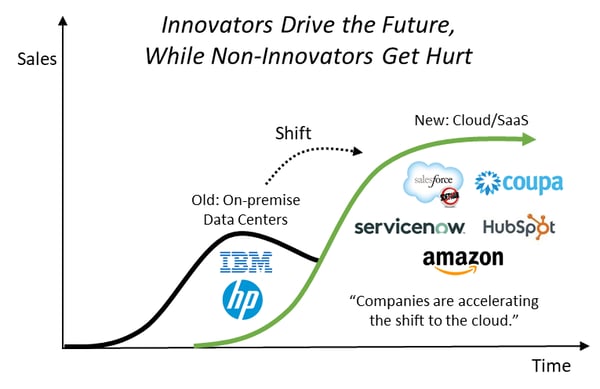

Shifting to the Next Generation Leads to Some Blue Chips Being Put in the Proverbial Wood-Chipper

Let’s review one important evolutionary shift and how this dynamic creates risk for traditional blue chips and opportunity for the innovators. This example is the shift from on-premise data centers toward cloud computing and software-as-a-service (SaaS) for enterprise customers. IBM was a leader in the traditional data center paradigm, selling servers, software, and services for corporations to build and manage their own IT infrastructure. But in the past five-plus years, there has been a marked acceleration in companies shifting their applications out of their data centers and into the cloud, benefiting such leaders as Amazon Web Services (for basic compute and storage), Salesforce.com (for Customer Relationship Management), ServiceNow (for IT Service Management), Coupa (for Business Spend Management), and HubSpot (for Marketing Automation), among other cloud companies.

Source: Evolutionary Tree Capital Management

While these cloud and SaaS companies have been growing their revenues 20-35% or more each year, IBM saw revenues decline 3-5% year-over-year in recent quarters. Traditionally, IBM was viewed as the “less risky” investment with its perceived stability and dividends, compared to emerging cloud/SaaS players, but this seems backward when viewed through the long-term evolutionary shift lens. IBM, in our opinion, is the riskier business and is clearly ceding both market share and relevance to the next generation of innovators. The combination of new innovations and evolutionary shifts leads to some blue chips being put in the proverbial wood chipper, so we refer to them as “blue chippers” to reflect this new reduced status and higher risk.

Focus on Innovators, Avoid Non-Innovators

The key message is that this theme—leading innovators driving evolutionary shifts and hurting traditional blue chips—is playing out across many, if not most, industries. Our investment strategy of focusing on businesses developing important innovations naturally positions client portfolios to lean into the leading innovators and avoid those companies ceding market share and being displaced (non-innovators). As long as innovators drive the future, non-innovators will get hurt and therefore, in our opinion, the leading innovators are lower risk.

![[Watch Webinar] Innovation Investing: Navigating Accelerating Change in an Evolving Economy (recorded May 5, 2020)](https://no-cache.hubspot.com/cta/default/4802837/a2aaf374-0acb-427d-b82c-f90a60543de2.png)