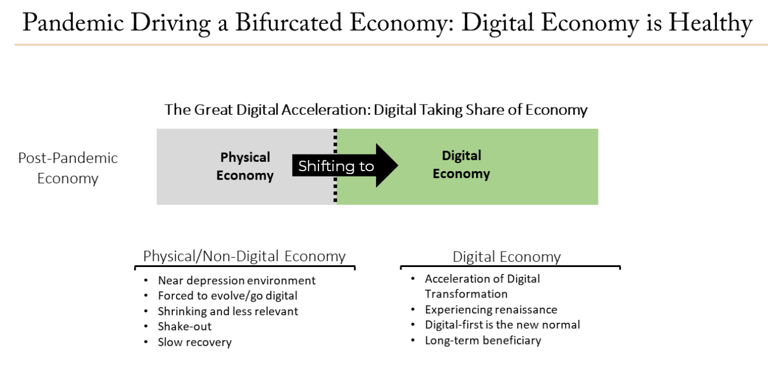

While the economy is on a road to recovery, we believe there is a seismic shift taking place as a result of the pandemic. We believe the pandemic is creating a “bifurcated economy,” widening the gap between the physical-based economy and the digital economy (see illustration below).

In the physical economy (think retailers and small, local businesses), the environment is a near depression, with many businesses at risk of shrinking or going out of business and others in a slow recovery. By contrast, the digital economy is in many ways undergoing a real renaissance, with acceleration for certain digital businesses as a “digital-first” mindset becomes the new normal.

The Evolutionary Tree portfolios were naturally positioned to benefit from this unforeseen pandemic and the outcome of a bifurcating economy, as we were already leaning into the digital economy.

Remember that even before the COVID-19 crisis, there was an evolutionary shift toward various digital innovations, such as e-commerce, cloud computing and software-as-a-service (SaaS), mobile apps, and digital media and advertising. These were major components of the Beagle Leading Innovators portfolio, and our clients benefited accordingly. Let’s dive deeper into this topic.

Accelerating Adoption of Innovation “Solutions” and Certain Evolutionary Shifts

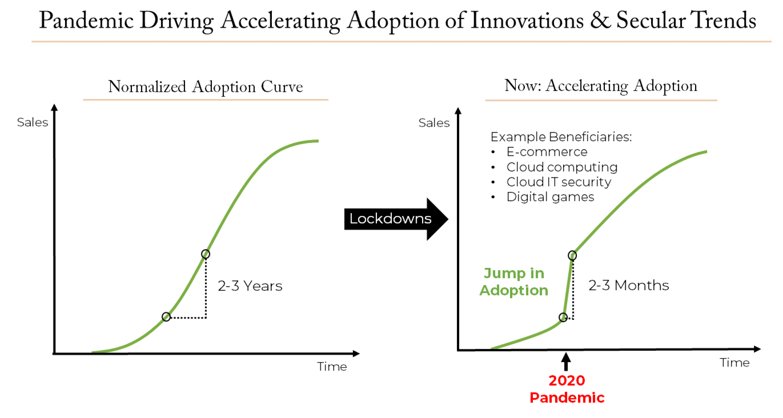

Recessions often drive consumers and businesses to adopt innovations that offer cost reduction, convenience, or a better way of performing an activity. These innovations are often viewed as the “solutions” for the pressures they face. In short, tough times often accelerate the future. Innovation-focused portfolios allow clients to potentially benefit from these dynamics.

We see these dynamics during the current pandemic in accelerated adoption of e-commerce, cloud computing, cloud-based IT security, and digital games, among others. For these innovative digital products and services, the pandemic lockdown has accelerated adoption that might take 2-3 years and compressed it into 2-3 months for certain offerings (see illustration below). For example, e-commerce globally has been growing about 20% in recent years, but data for May and June show that e-commerce sales are growing 70-80% year over year as consumers are wholesale shifting to e-commerce and shunning stores. We have seen similar data for adoption of streaming video, which has grown about 50% recently, as well as digital gaming apps.

Likewise, businesses and larger enterprises are accelerating “digital transformation” projects, especially as a majority of employees have been forced to work from home, accessing cloud-based applications and collaboration platforms. This, in turn, has accelerated the shift to cloud-based IT security for ensuring robust endpoint and network security.

Survey data from Twilio, conducted in June with over 2,500 respondents, provide evidence for this acceleration. This global survey showed that 97% of enterprise decision makers believe that the COVID-19 pandemic accelerated their digital transformation efforts, including shifting to cloud-based applications and digital collaboration and communication platforms. Our research indicates that this change in behavior is likely permanent. Consumers and businesses are not going back to antiquated ways of doing things. The future was accelerated and is here to stay.