We know it has been a volatile period in the markets over the past six and twelve months, particularly for growth and innovation-focused strategies. Given this backdrop, we provide an expanded blog post to discuss the drivers of the recent volatility and the reasons why we remain confident in our innovation-focused strategy. Despite the recent pullback in growth and innovation stocks, we believe the underlying portfolios are actually in great shape, with strong and healthy business fundamentals that we believe support long-term potential for adding value. There are five big-picture takeaways that we wish to share:

- Innovation remains important for investors and can add value over time. Innovation strategies, such as the Beagle Leading Innovators portfolio, have added value over the past few years, even when factoring in the difficult 2021 investment results. We believe innovation investing still has a strong rationale going forward. Innovation is not going to stop, and the secular trends it creates represent the future.

- We own quality innovative businesses that are sustaining robust growth. Progress with underlying innovation across portfolio companies has been robust, which is driving healthy business fundamentals and growth. We believe this growth, if sustained, is the engine of stronger investment results over time.

- Innovative businesses are well positioned to navigate through inflationary periods. We believe innovative and differentiated businesses can sustain growth and exercise pricing power to offset inflationary headwinds. Innovation may also provide the solution to the labor shortages that are driving inflation. For example, cloud computing enables improved efficiencies and higher productivity.

- Quality innovators are on sale now. As growth and innovation stocks have pulled back, we believe valuations have overcorrected to compelling levels, with strong return potential over the longer term. In short, the future is on sale right now, so we counsel staying fully invested or, for the intrepid and where appropriate, adding to accounts.

- The trends and evolutionary shifts we focus on are still very much intact and represent the future. While investors and traders have rotated into more mature cyclical industries, such as traditional retail, banks, and commodities, we believe they may re-embrace secular growth companies over time as cyclicals revert to slower growth. We are staying focused on multi-year evolutionary shifts that power growth over long periods of time.

Innovation Adds Value Over Time: Putting the Difficult 2021 Investment Results into Long-Term Perspective

While the Beagle Leading Innovators strategy experienced a period of underperformance relative to our benchmark during 2021, we believe this period needs to be put into context.

We are certainly frustrated that we were unable to add value for our clients this past year. To explain last year’s results, we believe it is important to evaluate the Beagle Leading Innovators strategy over two periods: since inception (from its launch in early 2018) and over the two-year period that includes the start of COVID (2020) and the period of the economy reopening (2021).

Let’s start with the longer-term track record, which demonstrates that focusing on innovation and quality innovators can add value for clients. As long-term investors, our time horizon is measured in years, and we counsel evaluating our investment strategies over rolling 3- and 5-year periods (we hit our 5-year track record in February of 2023). We believe this longer timeframe better captures our ability to add value for clients over various economic and market environments, including periods of underperformance. From its inception through December 31, 2021, the Beagle Leading Innovators strategy delivered a return of 29.01% (net of fees) on an annualized basis, offering nearly four percentage points of value-add over the 25.08% return of the Russell 1000 Growth Index.

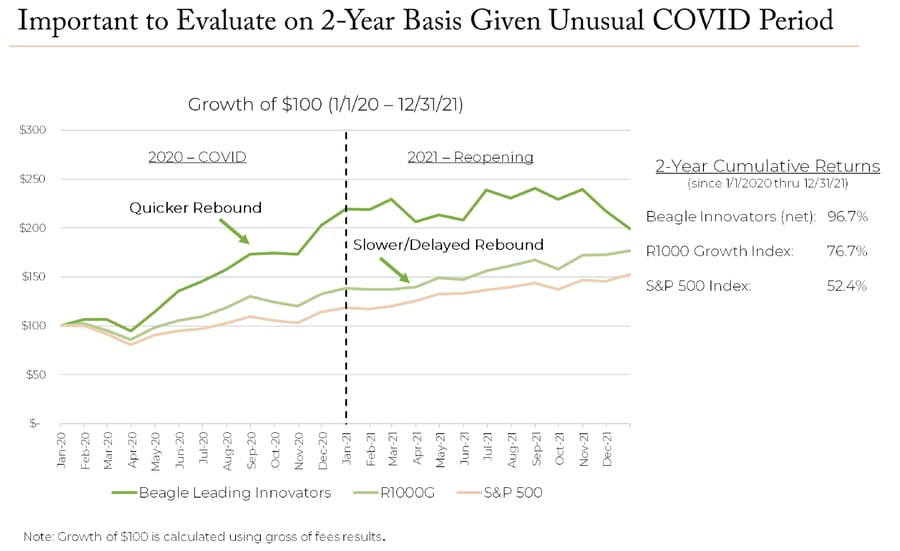

Now, let’s shift our focus to the two-year period that covers the highly unusual COVID period, which includes both the negative impacts of COVID to the economy and markets during the dark days of 2020 and the reopening of the economy during 2021. To put 2021’s investment results into perspective, we believe it is important to evaluate these results against this two-year period that includes the full COVID-to-reopening period.

The COVID-induced shutdown and subsequent reopening of the economy affected companies in different ways—boosting some companies in 2020 (such as digital-focused companies) and causing tougher comparisons and deceleration in 2021. For more traditional companies, such as retailers, industrial companies, and banks, the opposite was the case, with headwinds in 2020 and a cyclical rebound in 2021. Thus, regardless of what company one considers, it is important to evaluate specific investments and results over this two-year period to make fair comparisons between differing styles and industries. To see this graphically, please refer to the chart below, which shows how the Beagle Leading Innovators strategy performed relative to both the Russell 1000 Growth Index and the S&P 500 Index during this timeframe.

We would like to highlight a couple of key takeaways from this two-year period. First, despite underperforming in 2021, the Beagle Leading Innovators portfolio outperformed both the Russell 1000 Growth and S&P 500 Indexes over this period: the Beagle Leading Innovators portfolio’s cumulative return was 96.7% (net of fees) versus a return of 76.7% for the Russell 1000 Growth and 52.4% for the S&P 500. In this two-year context, the Beagle Leading Innovators portfolio added 20 percentage points more than the Russell 1000 Growth and over 44 percentage points more versus the S&P 500. Second, we believe an important dynamic to understand is that the Beagle Leading Innovators strategy experienced a quicker rebound during 2020, whereas the benchmarks rebounded over two years. This resulted in a strong year for the Beagle Leading Innovators strategy (2020), followed by a pause and eventually a pullback year (2021).

We Own Quality Innovative Businesses That Are Sustaining Robust Growth

The underlying businesses held in the Beagle Leading Innovators portfolio, in aggregate, have continued to deliver robust growth, which we don’t think is reflected in 2021’s investment results. These companies delivered 53% revenue growth during 2020 on a weighted-average basis, according to our calculations, and are estimated to report approximately 45-50% revenue growth for 2021. This robust underlying growth, coupled with improving profitability, is what gives us confidence in the ability of the companies we own to add value for clients over the long term. Though they may deviate over shorter periods, stocks tend to follow the underlying growth of businesses over time.

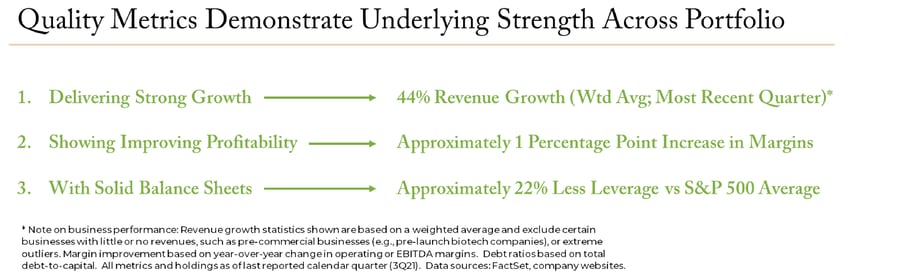

While we use our eight investment criteria to define quality innovators, we monitor three quality metrics, which demonstrate the underlying strength across the portfolio. The portfolio companies, in aggregate, are: 1) delivering strong growth, 2) showing improving profitability, and 3) building strong balance sheets. Even with some companies facing difficult comparisons as a result of the prior year’s boost from COVID, recent quarterly earnings reports have shown that portfolio companies delivered weighted-average revenue growth of approximately 44% year over year, with broad-based growth across the portfolio. Furthermore, they are doing this with generally improving profitability, in aggregate, with almost a full percentage point increase in margins year over year. Lastly, these portfolio companies have built strong balance sheets, typically with less debt and higher relative cash than their competitors. On a weighted-average basis, the total debt-to-capital ratio of companies held in the portfolio typically is 22% less than that of the average S&P 500 company—plus, our companies generally have healthy levels of cash on the balance sheet. Solid balance sheets allow leading companies to invest in their innovation pipelines, fund internal growth, and weather any storms in the economy.

Perspective on How Innovation Stocks are Affected by Near-Term Market/Economic Headwinds, Such as Inflation

We have seen investors in the near term rotating away from companies that benefited from COVID into industries that may benefit from the reopening of the economy, notably cyclical industries. As it turns out, investors seem to be penalizing digital and tech-enabled businesses (and their stocks) the most in this environment, partly due to the concept that these companies may face tougher comparisons following the boost they received during the pandemic. This rotation away from technology and innovation-based companies has been a headwind during 2021 and into early 2022.

The Beagle Leading Innovators strategy tends to lean into the digital-based business models, which served the portfolio well before and during the lockdown period in 2020 and early 2021. However, from an investment-return point of view, this turned into a short-term headwind later in 2021. Despite this, we believe the shift to digital-based business models will continue even as the economy reopens. Many of the behaviors shaped during the pandemic, such as a growing reliance on e-commerce and cloud computing, are becoming permanent. We are not reverting back to less-efficient ways of doing things. As such, we continue to maintain ownership of quality innovative businesses, including digital innovators.

In addition, the equity markets are currently hyper-focused on near-term inflation and any risk that this may push interest rates higher, which is perceived as negative for equities in general and growth stocks in particular. Interest rates have been too low for too long, and we believe it’s a healthy dynamic for rates to move to more normalized levels. While we acknowledge that inflation is running hot in the near term (with the reopening and supply chain issues), we believe the impact on the companies held in the portfolio will be limited. This belief is driven by the fact that the businesses we currently own have differentiated products or services and competitive advantages, which typically result in pricing power. We are confident that, armed with pricing power, these businesses can pass on any increase in component or input costs to the consumer, limiting the impact on margins.

It’s also worth noting that, while inflation may remain elevated in the intermediate-term period (as supply chains catch up), the impact on interest rates has been fairly modest to date. For example, consider that, despite a yield for the 10-Year Treasury Note of approximately 2.00%, which is up from pandemic-era lows of around 0.50%, the current yield continues to be at the low end of the range over the past 10 years, where it has typically ranged from 1.5-3.0%. During this historical period, growth stocks did well. This suggests that the current interest rate environment is still conducive to growth stocks over the long term. With that said, we recognize interest rates could trend higher, but we believe there is still room for expansion while allowing growth stocks to deliver attractive returns over the long term.

With portfolio companies continuing to sustain above-average growth, in aggregate, and now at depressed valuations, we believe the portfolio can navigate through this period of inflation and add value over time. Innovative businesses typically can create their own weather and sustain growth by launching new products and services. The most innovative businesses also can show pricing power to largely protect margins. In our view, innovative businesses are in a stronger position to manage through inflation compared to less-innovative businesses or industries, which are at greater risk for margin compression.

Quality Innovators Are On Sale Now

The combination of the pullback in the stock prices of many of the portfolio companies during 2021 (and through mid-February 2022), coupled with the strong growth delivered by the underlying businesses of these companies over the past year, lead us to believe that valuations—stock prices relative to their underlying fundamentals—have declined to very attractive levels. The stocks of many of our holdings are now trading below their pre-COVID valuations despite emerging from COVID in stronger competitive positions. We believe this is especially the case for quality companies that meet our stringent set of eight investment criteria, as these criteria guide us to companies that generally are leading innovators in attractive secular growth industries, with multiple competitive advantages, unique cultures, and solid balance sheets. In short, we believe quality innovators are on sale.

Our research suggests there is a significant disconnect between the strength and quality of the companies we own in the portfolio and their current stock valuations. While we cannot predict when this disconnect will close—which could lead to improved investment results—we remain confident that the collection of businesses we own can continue to sustain growth over the long term. We believe staying invested in this portfolio will reward investors over time.

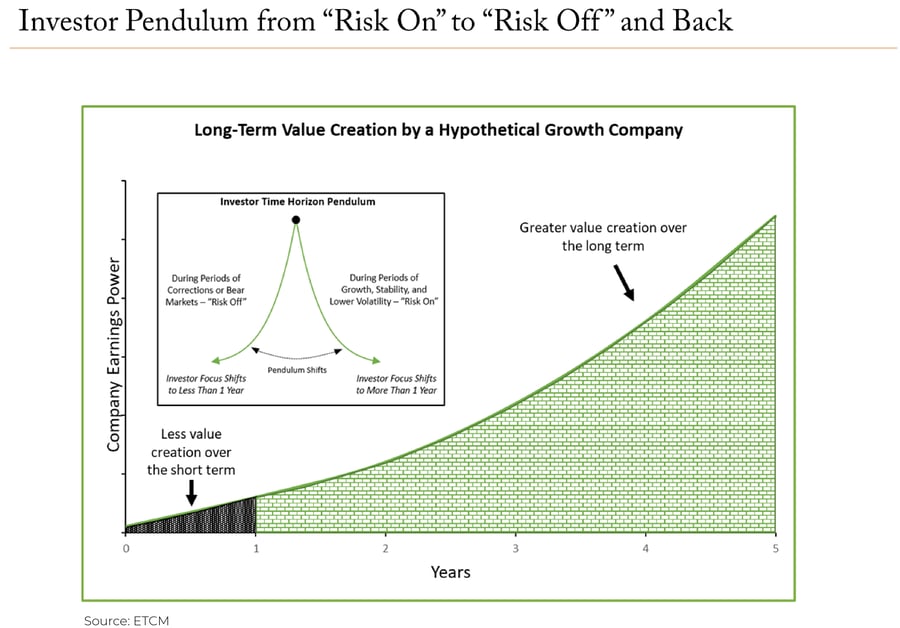

Our observation is that the current challenging market environment, driven by near-term macro concerns and geopolitical events, has caused investors to substantially narrow their investment time horizon. We saw a similar dynamic in the fourth quarter of 2018 when a mini-bear market for growth stocks rattled investors. In our client letter at that time, we discussed the concept of the investor time horizon pendulum, a dynamic we believe applies to the current environment. As we shared in that letter:

This investor pendulum shifts back and forth from a hyper-short-term mindset (focusing on events/drivers less than one year) during periods of corrections to a somewhat longer-term mindset (comfort in looking out more than one year) during periods of market stability and economic growth. This shifting investor mindset has profound implications for how growth companies are valued, leading to volatility in the short term as the pendulum swings during the market cycle (see inset illustration in the chart below). The reason this happens is that most of the value creation for growth companies occurs in years two through five and beyond (the green section in the larger chart below).

When markets are stable, investors look further out in time; but when markets enter a correction or a bear market, investor time horizons shrink down to one year or less, and this future value (which still has good potential, and thus value) is ignored temporarily. This can lead to growth stocks pulling back more than so-called stable stocks (like utilities), leading to short-term volatility. If you sell during the downdraft, you may be succumbing to emotion that can put you at risk. As markets stabilize, investors gain more comfort looking further out, and the pendulum swings toward a longer-term mindset, boosting growth stocks. Our view is to stay focused on the long-term value creation of leading innovators.

The Trends and Evolutionary Shifts We Focus On Are Still Very Much Intact and Represent the Future

In addition to focusing on the power of innovation in driving sustainable growth, we also focus on owning companies that benefit from multi-year trends. We call these evolutionary shifts, and they represent a fundamental shift from an old way of doing things to a new, often better, way (e.g., shift from physical retail stores to e-commerce). We believe these evolutionary shifts and trends provide another powerful engine to sustain growth for the companies in our portfolio.

While investors have temporarily rotated into more traditional industries, such as industrials, banks, retailers, and commodities, the underlying secular trends represented in the portfolio are still intact. For example, in industry after industry, we are seeing companies embrace “digital transformation,” where they are updating business processes to become more digital and automated. This process is still in the early stages within the U.S. and globally, with recent estimates showing that only about 20% of IT infrastructure has shifted to cloud computing and software-as-a-service. In some industries, such as traditional banking, the journey to the cloud has really just started. What this means, in our opinion, is that there are many years, even decades, of growth left, driven by the evolutionary shift to cloud computing. We see similar dynamics with many other multi-year trends in the portfolio and believe there is plenty of room for growth with these important evolutionary shifts. We aim to own the leading innovators driving these shifts. Recent growth demonstrates the continued health of these secular trends.

What Gives Us Confidence in the Portfolio: We Own Quality Innovators

Despite recent volatility, we remain focused on the long-term growth prospects of the leading innovative businesses held in the portfolio. We believe owning quality innovators—companies pioneering long-term trends with highly innovative products or services, competitive advantages, and strong balance sheets—provides a strong foundation for confidence in the long-term potential of the portfolio.

We believe recent robust growth validates our view that a stronger economic recovery is positive for secular growers as well as cyclical industries. Now that cyclicals have seen much of their rebound, investors are likely to re-embrace secular growers. Recent events—such as higher inflation, omicron, and geopolitical events—have led to a temporary risk-off environment and volatility, but investors will re-embrace quality innovators as they continue delivering strong growth over time. We counsel patience and focusing on the underlying growth of the businesses, which provides a foundation for improving investment results over time.

We believe quality innovators are capable of driving the most value creation when investors stick with them over many years—including riding through periods of volatility—as their innovations gain adoption over time. Innovation is not going to stop, and important secular trends represent the future.

To learn more about Evolutionary Tree’s innovation-focused investment strategy, click here.