Last week, the Federal Reserve raised its benchmark short-term interest rate by three-quarters of a percentage point (75 basis points) – the largest rate increase in two decades and the third rate hike in under three months. These measures, which are widely anticipated to be followed by as many as four more rate hikes in 2022, are part of the Fed’s strategy to rein in record-high inflation. Several factors have driven inflation to its current elevated level, including pandemic-related supply constraints, Russia’s invasion of Ukraine, and a widespread labor shortage.

We believe the Fed’s rate increases will slow the economy and, as supply chains improve, gradually ease inflation over time. While signs of that happening should stabilize the markets, we recognize that investors are eager to understand whether the companies in our portfolio can manage inflation in the interim. Our short answer is “yes.”

We offer a more detailed explanation below, including a discussion of two important but distinct effects on the portfolio caused by higher inflation and interest rates: 1) the impact on the fundamentals of the underlying businesses, and 2) the impact on the valuations investors are willing to pay for future cash flows.

Potentially More Limited Impact on Business Fundamentals

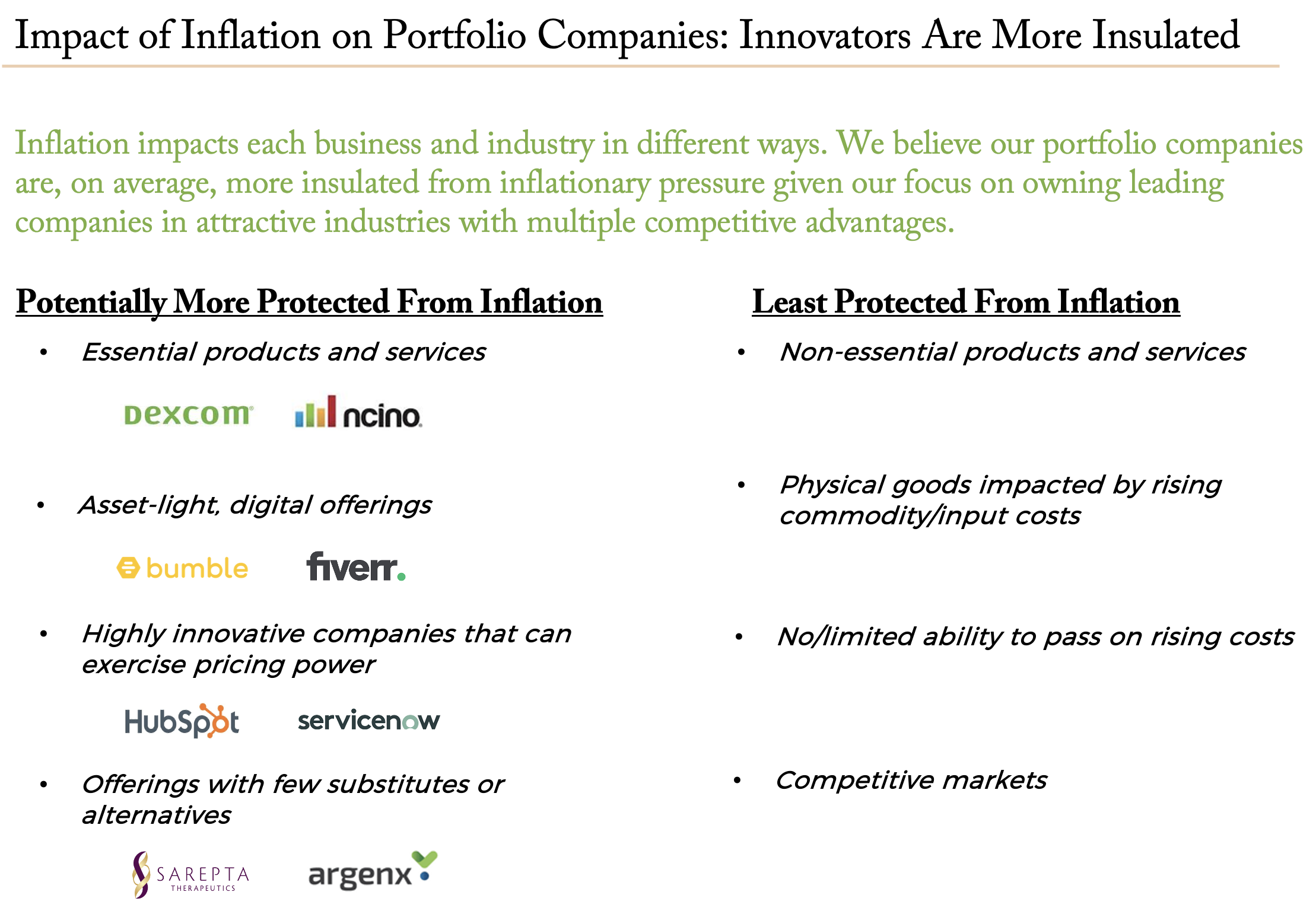

With regard to business fundamentals, we believe our portfolio companies are, on average, more insulated from inflationary pressure. In fact, the businesses we invest in are demonstrating strong fundamentals, with approximately 30% revenue growth and generally stable-to-improving operating margins on a weighted-average basis over the past quarter and calendar year. As leading innovators in attractive industries with multiple competitive advantages, many of these companies have pricing power and growth engines to sustain growth.

Specifically, the companies we own often demonstrate one or more of the following characteristics:

- They offer essential products and services

- They are asset-light digital offerings

- They are highly innovative and have pricing power

- They provide a product or service that cannot be easily substituted

As represented in the below table, businesses with these attributes are more likely to be protected from inflation than businesses that offer non-essential products or services; are directly impacted by rising commodity/input costs; have no or limited ability to pass rising costs on to customers; and/or operate in competitive markets. This table also includes a few examples of portfolio holdings that are relatively insulated from inflation. We use the term “relatively” because we acknowledge that all companies will experience some negative impact, be it from higher wages, increased input costs, and/or slower demand. However, we believe that highly innovative and differentiated companies—the type that we lean into in our portfolios—may be incrementally more insulated, especially if they have pricing power and can pass on higher costs to users.

Essential products and services — those that are mission-critical — are least likely to be eliminated if budgets get squeezed, while non-essential products and services are often the most impacted. Asset-light digital offerings, including many of our Internet and software businesses, are also less affected by rising commodity prices and input costs than companies that provide traditional products or durable goods. Additionally, highly innovative companies with unique and valuable products usually have pricing power and can pass some or all of the rising costs on to customers. For example, both HubSpot and ServiceNow, software-as-a-service leaders in marketing automation and service engagement platforms, respectively, are successfully moving their client base to higher-priced tiers as they add more features to their platform. Lastly, companies with products or services that are difficult to substitute or replace, such as life-saving biotech treatments like those offered by portfolio holdings Sarepta and Argenx, are more protected than companies in competitive markets where customers may shift to lower-cost alternatives.

Inflation and Rising Rates May Already Be Reflected in Valuations

The second impact referenced above is the effect on stock valuations — how much investors are willing to pay for future cash flows. As rates rise, so does the discount rate in financial models, which can reduce valuations. Since the Fed started signaling the need to increase interest rates in November 2021, the 10-Year Treasury rate has gone from 1.4% to 3.0%, an increase of 160 bps. In response, many innovative growth stocks are now down 30% to 70% from their highs. We think this suggests future interest rate hikes may already have been discounted by the market and may have even overshot on the downside relative to the fundamentals.

Historically, growth stocks tend to underperform once the Fed signals the need to increase rates. However, growth stocks can perform reasonably well during the period of rising rates. This is a classic example of the market discounting the news before the rate hikes take place. In the current environment, we think it’s likely that most of the pullback from rising rates may already be priced in by the market.

Poised for a Rebound

Given the dramatic, if not excessive, decline in prices and valuation relative to continued growth for portfolio companies, we believe there is a significant disconnect, which creates opportunity. We believe stocks of quality innovators may be poised for a substantial rebound over time. We believe the portfolio has potential to be a “coiled spring” that could experience a strong recovery as inflation and other current headwinds begin to dissipate over time. We acknowledge that this process may take time and that volatility may continue. While the timing of a rebound is unknown, we’re optimistic that patience will be rewarded.

Despite the recent pullback in technology and growth stocks, we remain confident in our innovation-focused investment approach. In particular, we believe our portfolio holdings continue to demonstrate strong underlying business fundamentals that support long-term potential for adding value.

Keep up to date with current market developments and insights and learn more about our innovation-focused strategy by subscribing to our blog.