The recent pullback in technology stocks has led some investors to surmise that growth at these companies has slowed dramatically or that many have experienced significant business issues. Worried about the impact of inflation on the economy and tech stock valuations, many investors have sold growth and tech stocks. Although we certainly acknowledge rising inflation, spurred on by a combination of reopening economies, labor shortages, and supply chain issues, we view technology as a solution in this challenging environment.

Opportunity in adversity

The investment ramifications for technology stocks during the current labor crisis are potentially profound. Specific technology companies, including those in enterprise software, are seeing sustained demand as companies of all sizes use technology platforms and solutions to make up for fewer workers by relying on improving productivity of existing workers. This is the role of technology, a role that is more (not less) relevant as today’s global economy experiences a shortage of workers. Furthermore, as companies feel pressure on their margins from rising input costs, they will search for ways to gain greater efficiencies.

The bottom line? Technologies, particularly business and enterprise software solutions, are a primary solution to inflationary pressures globally and will see sustained demand as a result.

With valuations now having undergone a major pullback, select quality innovators in the technology sector appear to offer compelling valuations. We believe there is a significant disconnect between the low valuations we see currently relative to the strong and sustained demand environment for these companies. In our opinion, that creates opportunities for long-term investors and potential for a strong rebound over time.

Strong demand suggests a stark disconnect

We see evidence of a disconnect between low valuations and strong demand within many of the technology companies we own in the portfolio. In fact, recent earnings results for a number of these companies indicate a robust demand environment, even in the face of a slower economy.

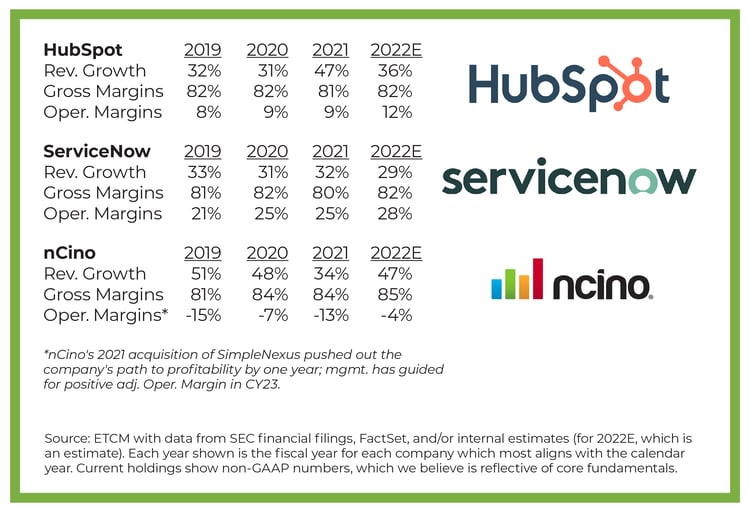

Consider, for example, three portfolio holdings: ServiceNow, HubSpot, and nCino. ServiceNow and HubSpot are software-as-a-service (SaaS) platforms that enable IT service management and marketing automation, respectively, while nCino is a cloud software company that holds a leadership position in the financial services technology industry with its core product, the nCino Bank Operating System. All three of these companies recently reported strong demand for their services and platforms, supporting our thesis that current valuations are low relative to the strong and sustained demand environment.

From ServiceNow’s 2Q22 earnings call and comments by CEO Bill McDermott:

ServiceNow's Q2 results once again beat expectations on the top line and the bottom line. Revenue growth was 29.5% at constant currency. Operating margin was 23%... Enterprise software is an all-weather industry. Some businesses out there are prioritizing enhanced productivity to lower cost. Others are evolving business models to stimulate growth. All of them know full well that digital technology is the only answer. That's why the demand environment of software is consistent and durable. Market research from IDC and several prestigious institutions on this call, I might add, have all affirmed the stability of technology budgets. We also see consolidation of enterprise software as buyers shift further away from experimentation with unsustainable solutions. So, when you think about the technology sector, there are niche vendors, legacy leaders and platforms. ServiceNow is a platform company with strong demand in a fast-changing world. And this is consistent with what we see from our customers. It's all about reprioritization. Customers are making significant investments with fewer platforms to drive faster ROI. As this process unfolds, while sales cycles can lengthen, deal sizes get bigger…And we at ServiceNow are on the right side of the great reprioritization.

From HubSpot’s 2Q22 earnings call and comments by CEO Yamini Rangan:

Q2 was a solid quarter for HubSpot with revenue growing 41% year over year in constant currency and total customers growing 25% year over year to more than 150,000 globally, with more than 60% using multiple HubSpot products… As I talk to our customers, it is clear that SMBs [small-medium businesses] need to do more with less as they navigate the current macroeconomic environment. They're looking for ways to consolidate their fragmented tech stack of point solutions, improve inefficiencies and get better visibility into their customers' journey. As a result, HubSpot's connected, easy-to-use platform is mission-critical for our customers.

From nCino’s 1Q23 earnings call and comments by CEO Pierre Naude:

Subscription revenues grew 55% or 29% organically…We continue to see strong demand for technology investments and digital transformation across the financial services sector…While we are aware of the various business headwinds across the globe, most banks are well capitalized today…In a rising interest rate environment, banks are typically more profitable and in an even better position to continue growing and investing…financial institutions are always looking for ways to become more efficient, to streamline their operations and to remain compliant, and nCino helps them achieve all three of these goals.

Strong underlying growth creates the foundation for stronger returns over time

While noteworthy, the revenue growth and demand dynamics enjoyed by HubSpot, ServiceNow, and nCino are not the exception. We are seeing similar strong demand trends in the majority of our technology-oriented companies, creating substantial opportunity in the face of lower valuations.

The robust underlying growth we’re seeing among our portfolio holdings, coupled with improving profitability, give us confidence in the ability of our holdings to add value for clients over the long term. History suggests that—although they may deviate over shorter periods—stock prices tend to follow the underlying growth of businesses over time.