Whether it’s video streaming supplanting cable TV or e-commerce taking share from brick-and-mortar stores, most investors realize innovation is rapidly creating winners and losers across today’s economy. However, navigating this environment and keeping up with the pace of innovation can be extremely challenging. This issue of determining who the leading innovators are, as well as avoiding the companies being disrupted, is as critical as ever.

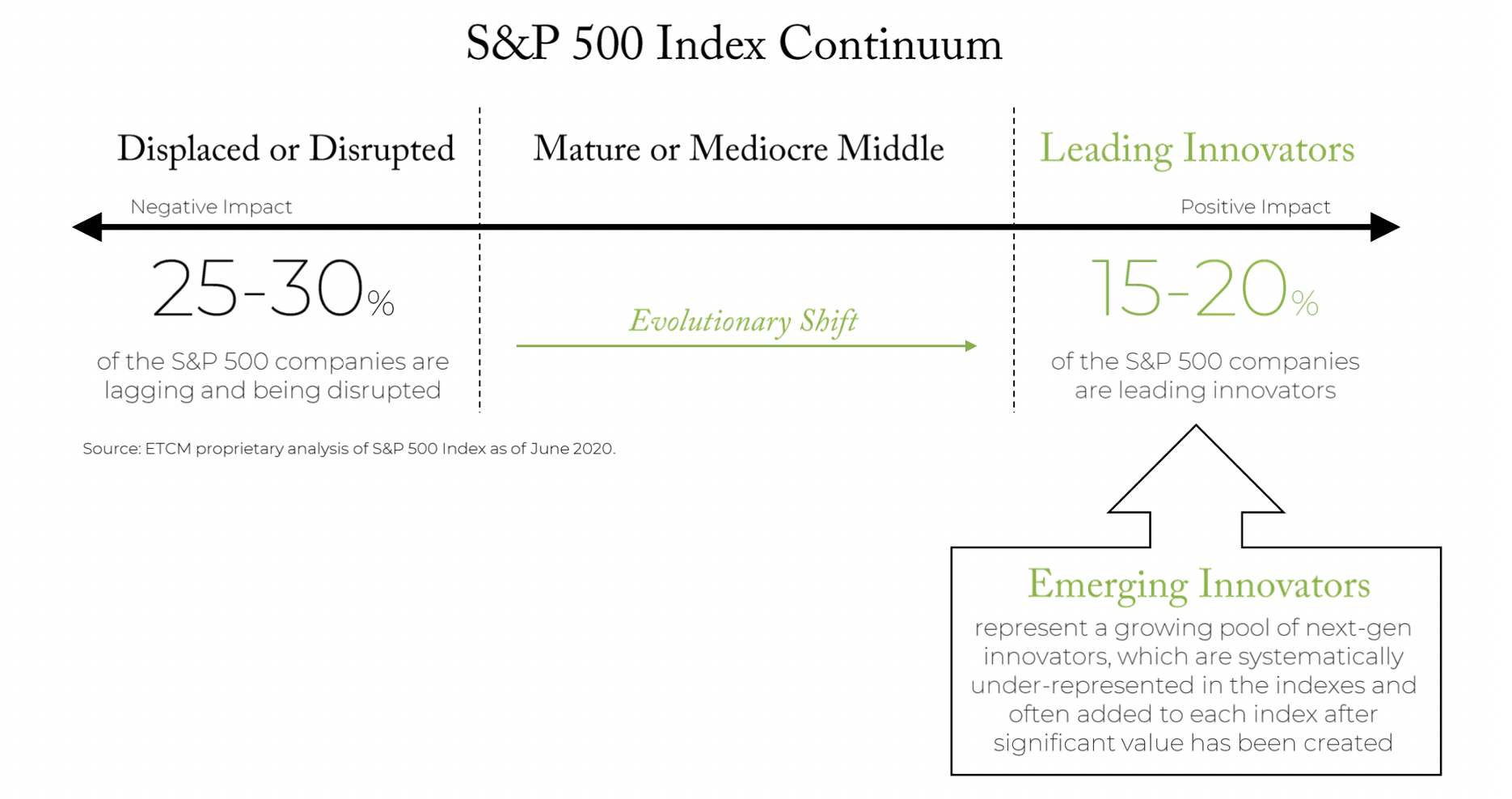

We performed an analysis of the S&P 500 Index and determined 25-30% of its constituents are being displaced by a relatively smaller group (just 15-20% of the Index companies) that is creating next-generation innovation and driving value creation. We call this group the Leading Innovators, as illustrated by the visual below.

The concepts of disruption and displacement aren’t new, but what many investors may not realize is that there currently exists a growing pool of next-generation innovators that are not adequately represented in the major indexes. For example, in order to be eligible for inclusion in the S&P 500, the index provider requires a company meet certain criteria, such as being profitable for four consecutive quarters. As a result, many companies which are early in capturing a massive opportunity and are investing heavily in their businesses—rather than optimizing for current profitability—are systematically not included in mainstream equity indexes. As illustrated in the lower-right corner of the graphic above, we call these under-represented companies Emerging Innovators.

Possibly the most powerful example of a company that consciously suppressed profitability year after year but created extreme long-term value is Amazon. The company aggressively reinvested its earnings back into its businesses and did an admirable job of steering capital from its well-established e-commerce business into even more profitable, fast-growing segments like Amazon Web Services (AWS). Today, AWS is the largest cloud services provider in the world.

There is a whole new crop of next-generation innovators across many industries that are bubbling up and taking share from well-established brands. Most feature tech-enabled business models which help maximize efficiency. These companies are generating considerable revenues yet are often initially unprofitable as they continue to invest heavily in R&D and scale their businesses, much like Amazon did years ago. Instead of trying to please shareholders on a quarterly basis, the best innovators are creating underlying value that will likely become apparent three, five or even ten years down the line. This dynamic plays to innovation-focused strategies with a quality, long-term approach.

While we are invested in a select number of companies with large weights in the benchmark, like Amazon, the majority of our portfolios consist of emerging innovators that are either not represented in the benchmark or have small, almost inconsequential, weights in the benchmark. Not only does this positioning fill what is essentially a gap in our clients’ exposures, but we believe it increases the probability for investment success over the next decade as innovations sustain future growth.

Further, since we developed our strategy to have flexibility around market capitalization, we have the ability to invest in innovative companies early in their S-curves and then stick with them as they grow. Today, this is especially important since Leading Innovators like those in the FAANGM group (Facebook, Apple, Amazon, Netflix, Google/Alphabet and Microsoft) have become massive index constituents and are closer to maturity and higher up on the S-curve. We believe that through our risk-managed approach, we are able to identify the next generation of FAANGM-type companies and provide clients with long-term value creation, especially compared to passive index-tracking strategies where emerging innovators are systematically underrepresented. Finding the next generation of leading innovators has never been more important for investors, which is why we specialize in strategies that embrace these emerging innovative businesses.

[Note: If identifying emerging innovators is of interest to you, please join our upcoming conference call on Tuesday, November 17th at 1pm ET to hear President, CIO and Portfolio Manager Thomas Ricketts, CFA discuss this concept in greater depth. Click below to register.]