Most investors know that the economy is experiencing accelerating change and intuitively understand that this change can create both opportunity and risk. But how does this change play out, and what drives this process? Most importantly for investors is the question: How can I harness this change for long-term value creation?

We have developed a unique model around our evolutionary lens approach that tracks the progression of change to its root cause and source: technology evolution and new innovations.

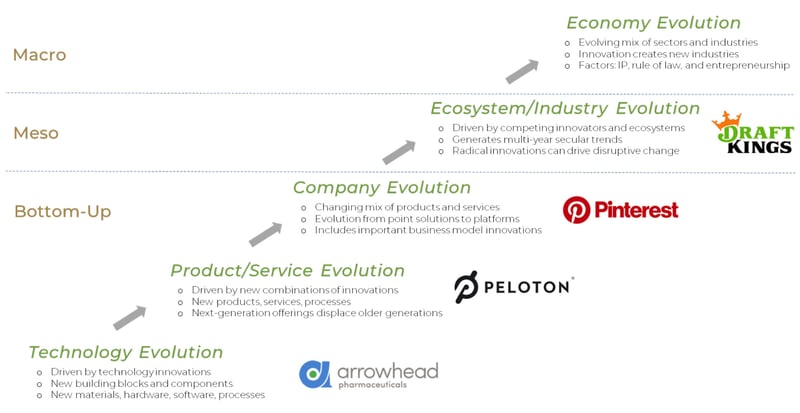

In the Age of Innovation, all roads lead back to a series of innovations that drive, first, Technology Evolution, shown in the lower left of the chart below. Think of technology innovations as new building blocks or components—often including new materials, hardware, software, or processes—that when combined in innovative new ways lead to next-generation products or services. This leads into the next level up, which is the evolution of product and service offerings, or Product/ Service Evolution. Innovative companies create next-generation offerings that, in turn, displace older-generation products or services.

Over time, leading innovators themselves evolve through Company Evolution. This company evolution may involve a changing mix of products, or a shift from being a “point solution” company (having only one product or service) to creating a full “suite” of offerings. The highest level of company evolution is becoming a “platform company,” where the company can extend into adjacent markets with a whole ecosystem of partners building on its platform.

As companies compete in the broader landscape, they drive Ecosystem/Industry Evolution. Competing innovations, over many years, create new industries as well as drive the structural evolution of existing industries. Eventually, these dynamics lead to Economy Evolution, as the mix of dominant industries changes over decades. Our mission is to help navigate this change and evolve portfolios over time so that they are positioned to systematically benefit from these types of evolutionary changes.

The Long-Term Power of Evolution: Driven by Bottom-Up Innovation

This blog is an excerpt from our thought piece The Power of Evolution to Create Long-Term Opportunity. To continue reading, please download the PDF below, where we discuss specific company examples to bring to life the power of evolution at different levels.