We live in the Age of Innovation. This era is built increasingly on intellectual capital as the value of ideas and concepts displaces the value of land (as seen in the age of agriculture) or even capital (in the industrial age). Others call our current era the Digital Age, but the result is the same: a growing array of innovations across all industries that increases the pace of change and the evolution of technologies, products and services, and industries.

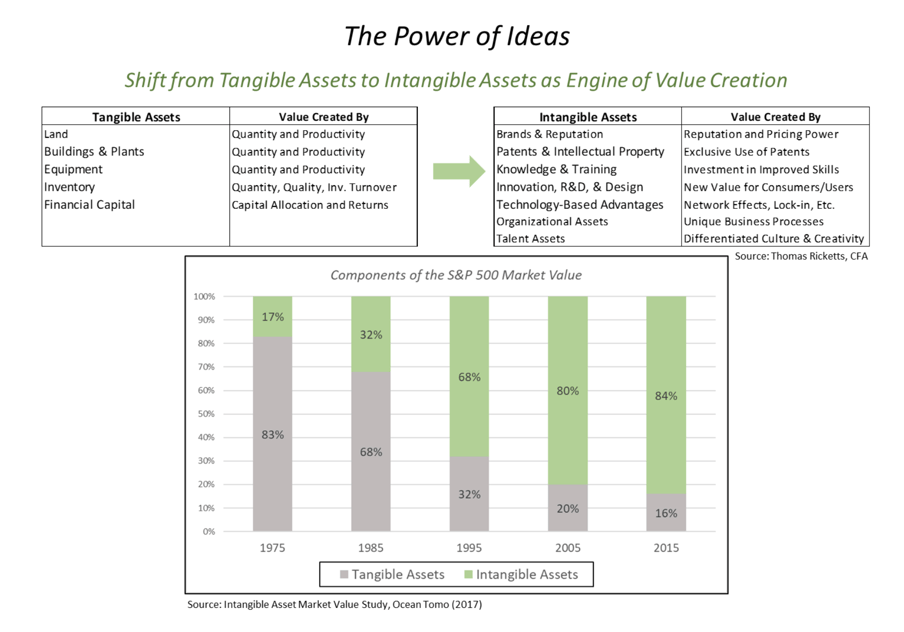

The most striking illustration of the shift from a tangibles-based economy to an intellectual capital or intangibles-based economy is shown by the shifting components of value in the S&P 500 index (see graphic below).1 As recently as 1975, tangible assets—those assets that include plant, equipment, inventory, and financial capital—made up 83% of the market value of the index and intangibles a mere 17%. With the rise of the digital age, the percentage of value represented by intangibles—those assets that include intellectual property, brands, innovation, and differentiated business processes—rose to 68% by 1995 and 84% by 2015.2 The intangible tail is now wagging the tangible dog. This shift from a tangibles-based economy to one dominated by intangibles reflects the power of ideas and the rise of the Age of Innovation.

The rise of intangibles naturally leads to the growing importance of creating new intellectual property (the domain of research and development), along with new marketing innovations. In a growing number of academic studies, data shows that R&D-intensive industries allow for greater persistence and profitability for market share leaders.3

The rise of intangibles naturally leads to the growing importance of creating new intellectual property (the domain of research and development), along with new marketing innovations. In a growing number of academic studies, data shows that R&D-intensive industries allow for greater persistence and profitability for market share leaders.3

The bottom line of these studies is that industries and companies with a higher level of research productivity, using innovation as the output, are correlated with strong growth and profitability. Furthermore, in industries where high levels of technology are embedded in the product or service offering, there is a tendency for the leading company to capture more of the economics. As a result, we are seeing increasing concentration across a growing number of industries.

A recent academic article entitled “The Fall of Labor Share and the Rise of Superstar Firms” describes how industries are increasingly “characterized by a ‘winner take most’ feature where a small number of firms gain a very large share of the market…markets have changed such that firms with superior quality, lower costs, or greater innovation reap disproportionate rewards relative to prior eras.”4

This is an excerpt of a white paper titled "Opportunity is Found on the Innovation Frontier". To read the white paper in its entirety, click here.