In today’s market environment—what has become a true bear market for growth and technology stocks—some investors believe software stocks remain overvalued. Hearing echoes of the dot-com era, they worry the current cloud era will meet a similar fate.

As an asset manager with more than 25 years of experience and a deep understanding of innovations that are driving the evolution of industries and the economy, my observations lead me to conclude otherwise: The cloud innovations of the 2020s are not following the same path as the dot-com companies of the 1990s. In my opinion, there are three key takeaways on this important topic:

- Relative to the dot-com era, the cloud era is built on more solid ground than investor perceptions expressed in the current market.

- The quality of current software businesses is healthy and on a strong path to profitability, a point that seems to be overlooked by investors who are anticipating a repeat of the dot-com bust.

- While valuations for software and other high-growth stocks were extended last year, the recent bear market has brought them down to more attractive levels.

Cloud era business models are built on solid ground, not sand

The cloud era is built on solid ground, while the underlying infrastructure of the dot-com era was primitive and immature with slow dial-up access and no real supporting infrastructure-as-a-service (such as AWS). As a result, dot-com era companies often had non-scalable business models and weak fundamentals—what I describe as “business models on a napkin.” Thus, valuations for these first-generation businesses were built on sand, and 99% of them went bust. By contrast, the current cloud era is built on significantly more robust and reliable infrastructure (broadband, 5G wireless, multiple scaled public clouds, electronic payments, logistics, etc). Cloud era companies therefore tend to have better business models that may sustain strong top-line growth and have a path to profitability as they scale up over time.

Leading cloud companies are, on average, scaling up, sustaining growth, and expanding profits

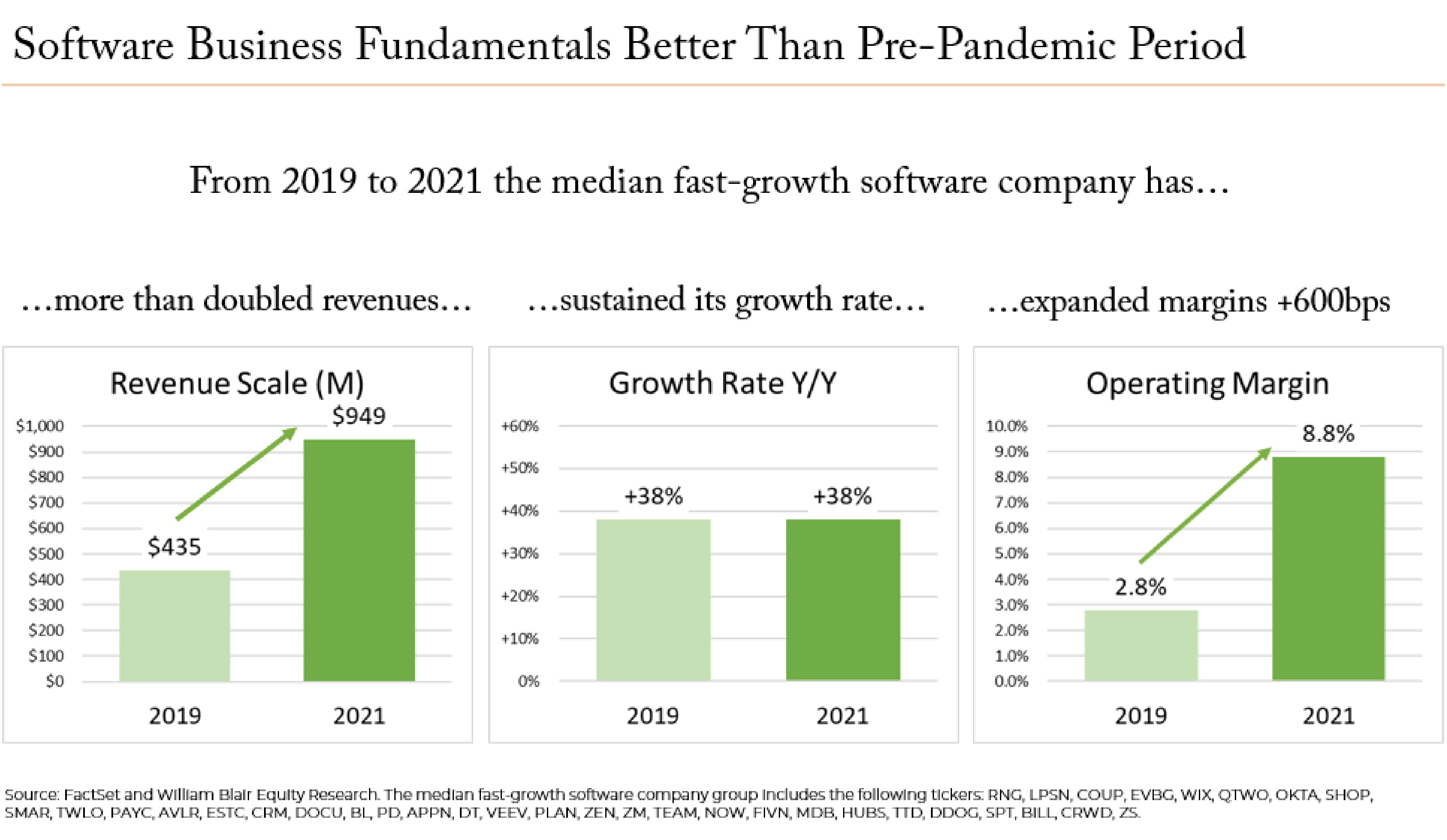

Want evidence? Recent data supports our thesis that cloud era companies have a clear path to profitability. Upon analyzing a basket of faster-growing software companies (shown in the chart below), William Blair Equity Research found that the underlying business fundamentals for these software companies was healthy. From 2019 (pre-pandemic) through 2021, the median fast-growth software company more than doubled its revenues (scaling up), maintained strong growth (sustainable growth), and expanded operating margins by 600 bps (demonstrating both profits and a path to expanding them). The sustainable and improving growth demonstrated by these companies during this challenging three-year period is, in our view, evidence that the cloud era is built on solid ground.

Software stocks may be on sale

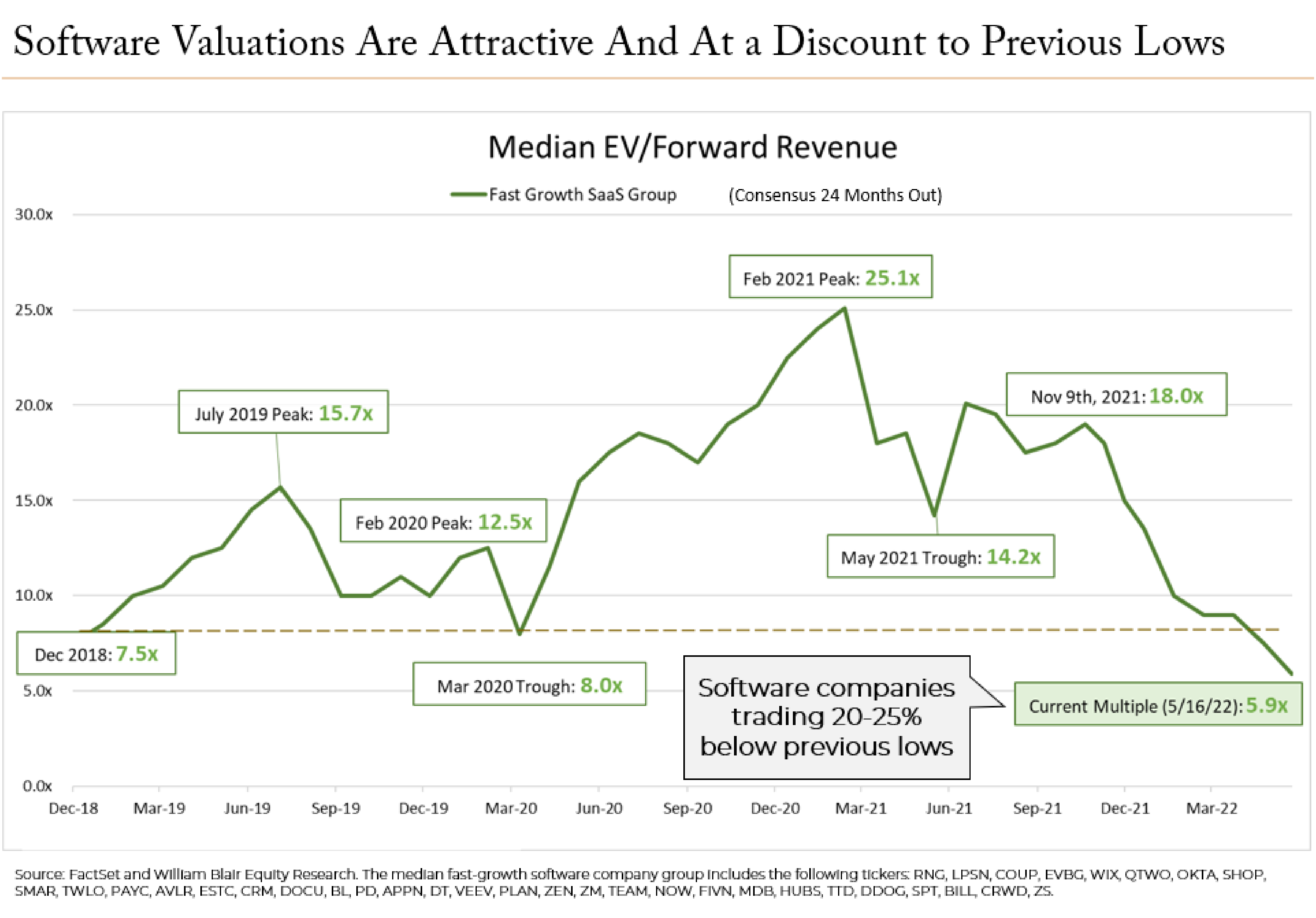

Following the dramatic pullback in software stocks over the past six to seven months, valuations have adjusted down to what we consider attractive levels. We base this on two points. First, the median EV/Forward-Revenue multiple, at around 6X, is now 20% to 25% below previous lows (see chart; relative to March 2020 COVID low and the December 2018 mini-bear market). This is despite the sustained growth in revenues and expanding margins shown previously.

There is also a strong case that software companies, particularly software-as-a-service/cloud companies, are on stronger footing post-pandemic, given that more businesses are now adopting a “cloud-first” approach to their applications and leaning into digital transformation. These software applications are also a primary way for companies to deal with the current staffing shortage, enabling them to improve productivity and gain efficiencies. Software and technologies are the solution.

Taken together—adopting a cloud-first approach, improving productivity, and driving cost efficiencies—these drivers provide a strong demand environment for software companies. With valuations at current levels, there appears to be a significant disconnect and opportunity as continued growth should draw investors back to the leading, quality software companies over time. Now represents a unique window of opportunity to embrace high-quality software companies at attractive valuations, in our opinion.