At Evolutionary Tree a key part of our investment process is identifying what we believe are the most important secular trends, or as we call them, evolutionary shifts, happening across the economy. Companies benefiting from multi-year secular trends have a higher probability of sustaining growth over time and may grow at an above-average rate for longer than short-term focused investors might expect. Our investment team systematically tracks well over 100 secular trends and evolutionary shifts with the goal of understanding their effects on each industry, and, ultimately, to identify leading companies that we believe are the primary beneficiaries. By doing this, we help our clients navigate an evolving economy.

There’s not a more pervasive or important secular trend in the technology sector than the shift from on-premise software to cloud-based, software-as-a-service (SaaS). A decade ago, that wasn’t the case, as companies were still grappling with concerns over security (hosting company and customer data in Amazon data centers, for example, was a scary proposition at first) and cost. Fast forward to today and the narrative has changed, and the concerns of the past have actually proven out to be key benefits. Cloud providers like Amazon, which have thousands of customers and experienced security professionals and engineers, are better positioned to protect sensitive data than the customer could within their own data center. And, the cost of sharing infrastructure is cheaper and, as a result, we’ve seen many companies shift a growing proportion of their infrastructure to the cloud.

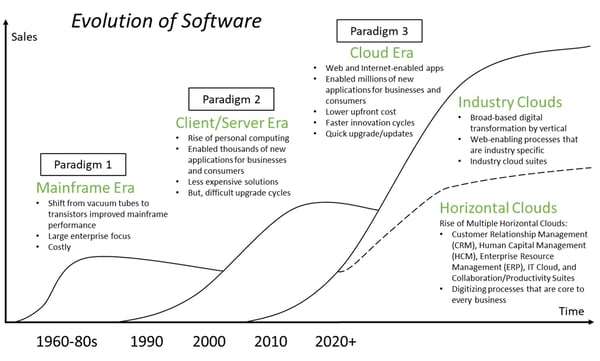

The diagram below illustrates the evolution of software as the industry moved through three different paradigms over the past 50+ years. We are clearly in the “cloud era” today. And, yet, we are only in the early innings of this shift from the client/server era to cloud computing.

Overall, cloud computing remains in the early innings. In fact, J.P. Morgan’s June 2020 CIO survey, which surveyed 130 CIOs, found that 59.3% of organizations currently spend less than 20% of their IT budget on the public cloud. However, when asked how their spend will change in 5 years, the distribution shifted dramatically with 40.7% of respondents expecting greater than 50% of their IT budget to be spent in the public cloud. Additionally, a 3Q19 Morgan Stanley CIO survey, which surveyed over one hundred CIOs in the US and Europe, found that cloud computing was the #1 investment priority for CIOs. The COVID-19 pandemic has only served to accelerate the trend towards SaaS, as companies have sped up their digitization timelines considerably.

In our thought piece on Software-as-a-Service (available below), we touch on what we believe is an underappreciated benefit of the SaaS business model, the ability to speed up innovation cycles by pushing software updates to customers at a more frequent pace. Innovation cycles in the software industry have been shortening from years to months and even as frequently as weekly. SaaS vendors can push out incremental new features almost immediately, and larger updates typically 2-4 times per year. As a result, software is shifting from a cost center to a business and revenue driver. SaaS providers are layering on new products, integrating big data, analytics, and artificial intelligence.

Companies making the switch to SaaS are finding that this model offers a competitive advantage because of its ability to speed up their own innovation cycle. The shift to SaaS is one of the most important secular trends in the technology sector, and one we believe will generate sustainable growth for leading SaaS companies over the next decade. There is still fuel in the tank for cloud computing.