We are often asked the question: How do you describe the advantage that investment boutiques have over larger asset managers, and how does innovation investing play to these advantages? Let’s briefly define boutiques first and contrast them with larger firms.

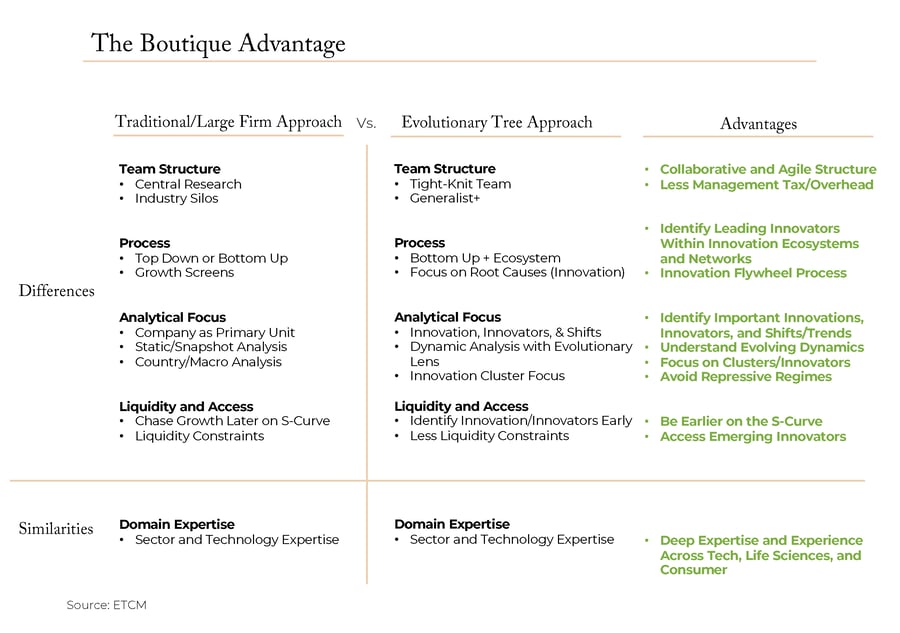

In our eyes, boutique investment managers are specialists and tend to focus on a single investment philosophy or approach. This has inherent advantages. They have smaller, tight knit investment teams, and usually work collaboratively together, which improves insight sharing and execution with investment actions. This structure contrasts with larger asset managers, which may have a large number of investment strategies using different investment philosophies (such as having value and growth under one roof). Larger firms also tend to utilize a “central research” structure with a pool of analysts feeding ideas into many different strategies, creating some distance between their work and that of the portfolio managers. This has inherent disadvantages. But, perhaps, the biggest difference is that larger firms tend to be run to maximize assets under management, whereas boutiques tend to be run to maximize returns for clients.

Taken together, boutiques tend to be specialized, tight knit, and client focused, while larger asset managers tend to be broad based, potentially bureaucratic, and highly asset-growth focused. In our opinion, the boutique approach—if built on an institutional-class foundation—can better serve clients over the long term.

But we believe there is more to the story.

Accelerating Change in the Age of Innovation Accentuates the Boutique Advantage

In today’s economy of accelerating change, maintaining a structure of nimbleness is more important than ever. Innovation cycles are speeding up—new products are being launched and are gaining adoption more rapidly than in the past—and putting more pressure on the hand-offs between research and portfolio management. Our belief is that, in order to keep up with structural changes happening across the economy and get ahead of the curve, an innovation focus is required. Emerging innovative businesses can bubble up from below and come on the scene quickly, so having a structure and process to catch this early is important. This new innovation-driven environment—what we like to call the Age of Innovation—is a prime reason we build innovation-focused strategies and are specialists in what we call innovation investing.

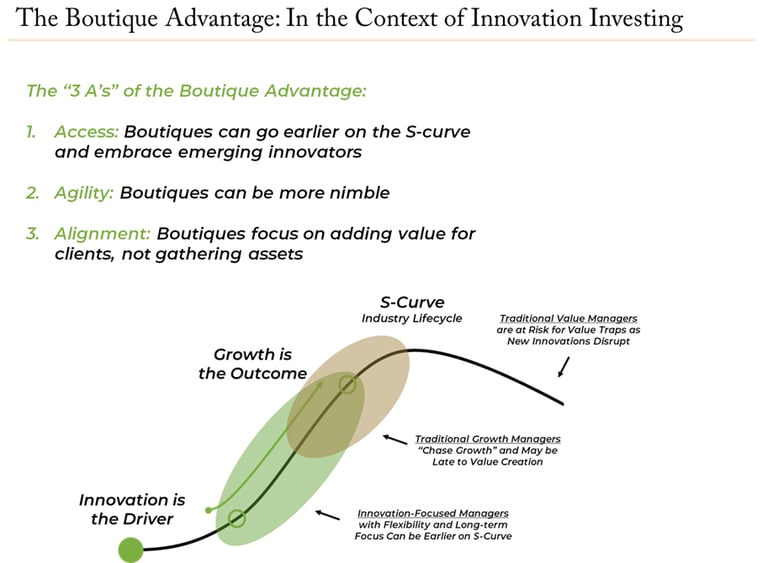

When investment managers are focused on investing in leading or emerging innovators, we believe boutique specialists have even greater competitive advantage today than ever. We call these advantages the “3 A’s” of boutique specialists: 1) Access, 2) Agility, and 3) Alignment. Let’s briefly touch on each advantage.

advantage #1: access.

Boutiques, given their size, can go earlier on the S-curve (see chart below) and embrace emerging innovative businesses in their portfolios closer to when these types of businesses are starting to go mainstream. Larger asset managers, by contrast, may wait until growth has played out for a while and the market cap is large enough to allow a strategy with greater assets under management to own it. Boutiques, by contrast, can access these emerging innovators earlier in the value creation process. That’s a big advantage for boutiques and their clients over larger asset managers.

advantage #2: AGIlity.

We alluded to this earlier when we described the distance between the research analysts and the portfolio managers. The greater the distance, the greater the probability of delays or missed opportunities in the process. Nimbleness is inversely related to investment team size. We believe the ideal investment team size is smaller, cohesive, and focused on one investment philosophy, which enables nimbleness. And, with innovation rapidly invading every industry, being nimble in avoiding companies being negatively impacted, while embracing those innovators driving change, is becoming paramount. Agility is required in an accelerated economy, and boutiques uniquely offer this capability.

advantage #3: alignment.

Boutiques focus on adding value for clients, not gathering assets, and this makes a big difference over time. Thoughtful boutique firms with a long-term and client-focused mindset know that if they add value for clients their businesses will naturally grow. Put clients first. That orientation means that boutiques are often better aligned with their clients than larger firms. But there’s more. Alignment—defined as using an approach that is optimal for clients—in an innovation-driven economy increasingly requires a firm to access emerging innovators and stay agile. In the Age of Innovation, alignment is built on top of access and agility. All three of these advantages work together for the benefit of clients.

What is the bottom-line for investors?

Innovation-focused boutiques are better positioned to add value in the context of innovation investing due to better access to emerging innovative businesses, agility in decision-making, and optimal alignment with clients. Evolutionary Tree is proud to offer these advantages to the benefit of clients.