One of the great things about investing in innovative businesses is that the ability to innovate—to develop new technologies, products, services, and business models—doesn’t stop just because of macro or geopolitical issues. Every year, thousands of new innovations are introduced across every industry and sector of the economy. It is our job to find the most important innovations and the leading innovators developing them. Importantly, every couple of decades, a new technology is introduced that creates a new wave of innovations. Known as “general purpose technologies” by economists, they represent a major new enabling technology that has wide application across many use cases, has big impact and value creation across the economy, and ultimately affects all industries.

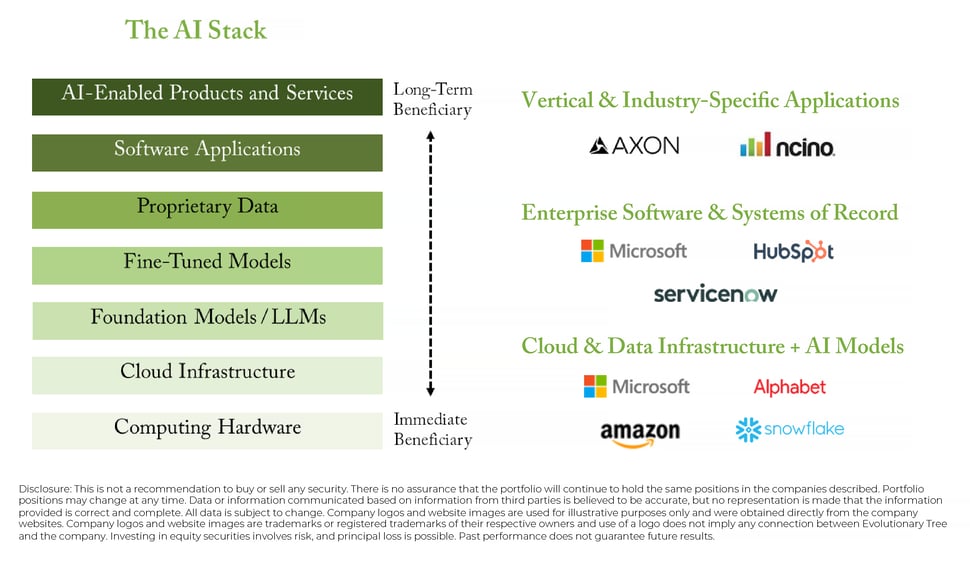

Artificial intelligence, or AI, represents just such a wave, and is going mainstream now. Why? We believe—after decades of behind-the-scenes development—that AI has passed key thresholds for technical and economic feasibility and will drive growth in AI-related services, software, and data businesses.

We believe that artificial intelligence has moved beyond the hype phase and has real utility and implications that are pretty far-reaching—of a magnitude in importance similar to that of the invention of the computer or the Internet. What are the implications of AI for investors? While there are many, here are three implications that we are focused on as investors:

- AI is going to add a major new growth engine for the entire technology sector, and, by association, for growth stocks.

- We believe that AI has the potential to dramatically enhance existing software suites and platforms as leading tech companies add AI functionality to improve productivity, apply data, and generate new content.

- AI is likely to accelerate existing evolutionary shifts within technology, such as the shift to cloud computing and the adoption of modern data platforms. Why? Companies cannot fully utilize AI without accessing and pooling a critical input, namely, data.

The takeaway? We believe AI is real, going mainstream, and likely to benefit a number of our portfolio holdings over time.