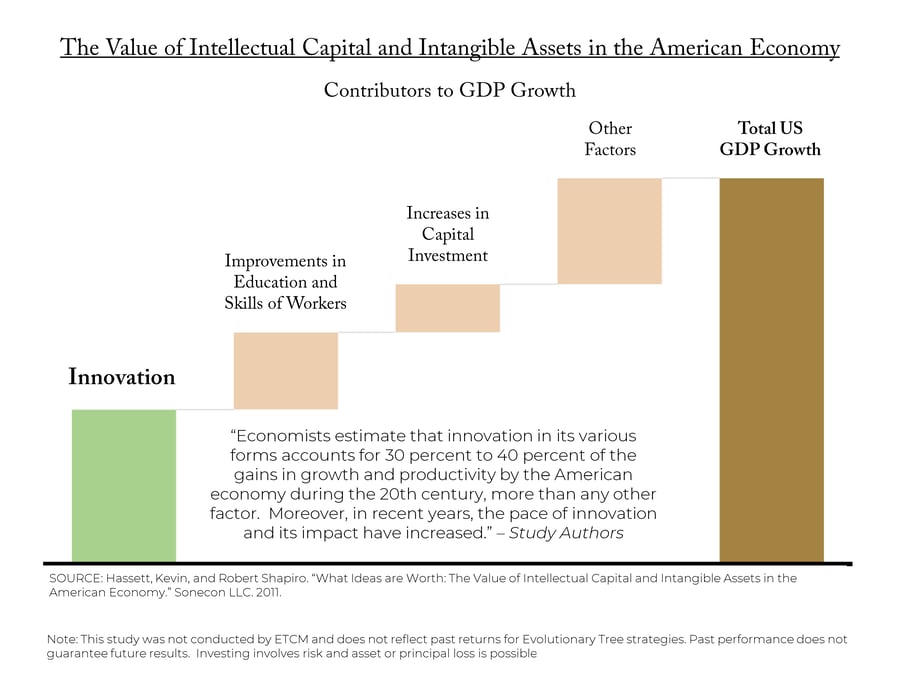

- In the 20th century innovation was the single greatest contributor to U.S. GDP growth.

- At Evolutionary Tree, we believe innovation will play an even greater role in driving economic growth during the 21st century.

- In the short term, macroeconomic headwinds (i.e., inflation, Fed rate hikes, recession) have caused some investors to take their eye off the most important value/wealth creator — innovation — and many quality innovators have been “thrown out with the bathwater.”

- Long-term investors such as us believe innovation remains a powerful force in the economy. It is important in every industry and not going away. In our view, leading innovators remain well positioned to take market share from the non-innovators.

- While most investors seem hyper-focused on the near-term macro environment, we believe investors will eventually re-focus on fundamentals (i.e., businesses creating innovative new products and services and sustaining growth). Evolutionary Tree remains focused on the fundamentals, which continue to be healthy for leading innovators.