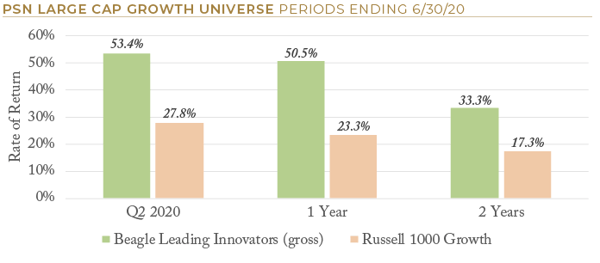

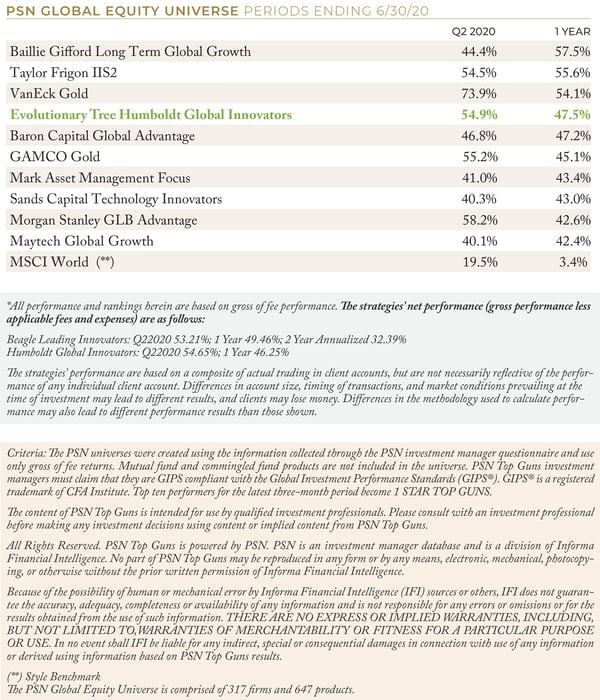

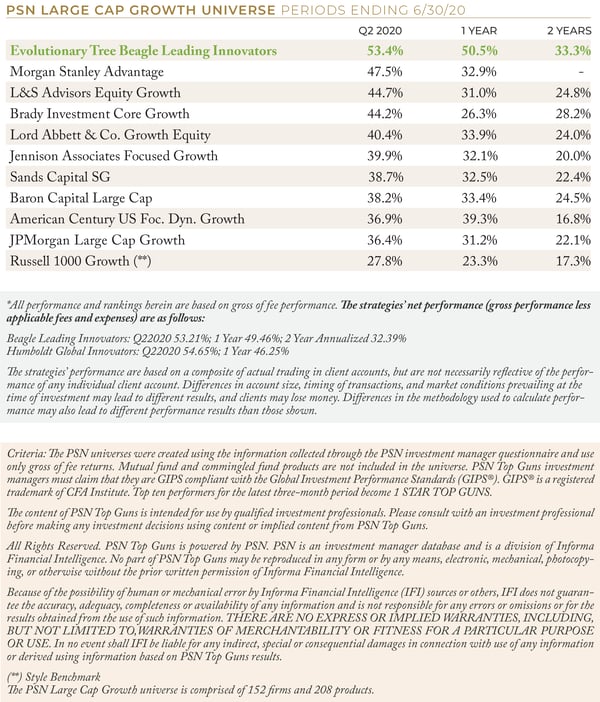

We are truly honored to receive not just one, but several awards for our two flagship innovation-focused portfolios: Beagle Leading Innovators and Humboldt Global Innovators. The awards are a result of our investment team's dedication to identifying and understanding attractive investment opportunities being created by innovations driving structural change across the global economy. See important information below on gross and net performance.*

The awards for the Beagle Leading Innovators portfolio include:

- #1 ranked strategy in the large cap growth universe based on Q2 2020 performance

- #1 ranked strategy in the large cap growth universe based on one-year performance

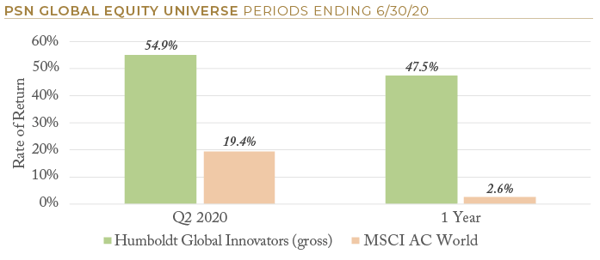

On the global equity front, the success of our Humboldt Global Innovators strategy validates the strength of our global research capability, which we believe every equity manager must possess in this fast-changing world economy. We are able to maximize our team’s resources by focusing on clusters of innovation in select countries rather than analyzing all industries in every corner of the world.

The award for the Humboldt Global Innovators portfolio includes:

- #4 ranked strategy in the global equity universe of 647 products based on one-year performance

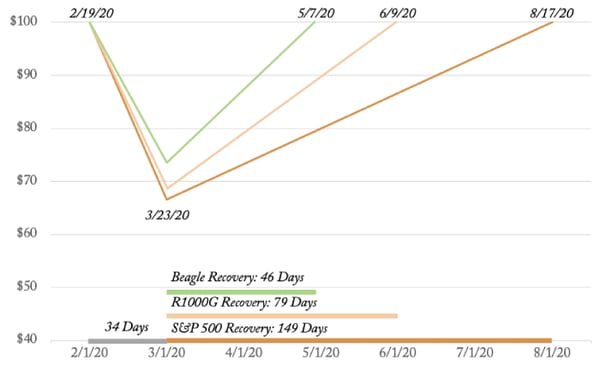

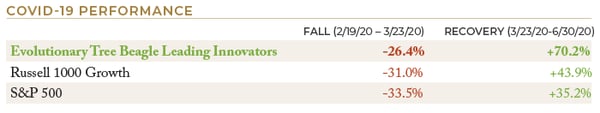

Receiving these awards during such a strong quarter for equities is especially rewarding for us considering it validated our belief that investing in innovative companies can, at times, add value in both up and down markets.

Indeed, this past June, we reflected on outperforming during the tumultuous first quarter, authoring a blog titled How Innovation-Focused Strategies May Provide Both Offense and Defense which provided some thoughts on how innovative businesses outperformed the broad market during the first quarter’s selloff. During the second quarter’s recovery, investors quickly re-embraced leading innovators after the period of economic stress, and our Beagle portfolios recovered much faster than both the Russell 1000 Growth and S&P 500 indices, as illustrated below:

![[Watch Webinar] Innovation Investing: Navigating Accelerating Change in an Evolving Economy (recorded May 5, 2020)](https://no-cache.hubspot.com/cta/default/4802837/a2aaf374-0acb-427d-b82c-f90a60543de2.png)