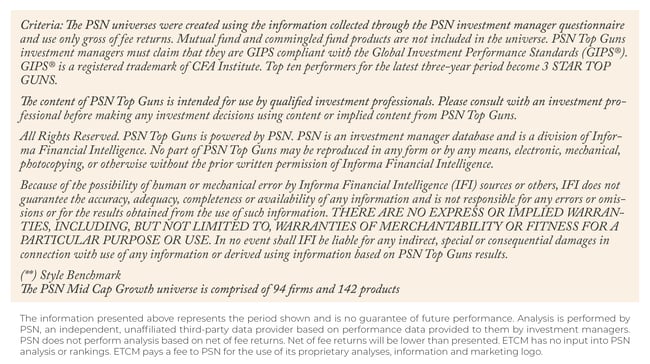

We are pleased to announce that our innovation-focused smid-cap growth portfolio, Darwin Emerging Innovators, delivered a top-ten performance relative to the PSN Mid Cap Growth Universe over the trailing three-year period. *See important information below about gross and net performance.

Evolutionary Tree’s Darwin Emerging Innovators Portfolio ranked #7 out of 142 strategies in PSN’s Mid Cap Growth category. Despite a severe bear market, particularly for innovation and growth-oriented equities, Darwin remains in the top 10 for its trailing 3-year track record (Darwin was launched in October 2019). Our investment approach and team are focused on identifying emerging and mid-stage innovators that meet our 8 criteria earlier in their growth cycles. We strive to identify leading innovators regardless of size, and the Darwin portfolio holds some of our best ideas within the smid-cap universe.

Darwin’s focus on quality innovators differentiates it from competing innovation and growth strategies.

We are not just focused on investing in innovation; rather, we’re focused on finding quality innovators that have leadership positions, competitive advantages, and strong balance sheets that enable them to fund and sustain their growth.

With the significant pullback in Darwin’s performance this year, we believe this strategy is attractively valued. In our view, the Darwin Small/Mid-Cap Innovation and Growth Strategy offers not only access to quality innovative businesses, but also good value relative to the strength of the underlying business fundamentals across the portfolio.