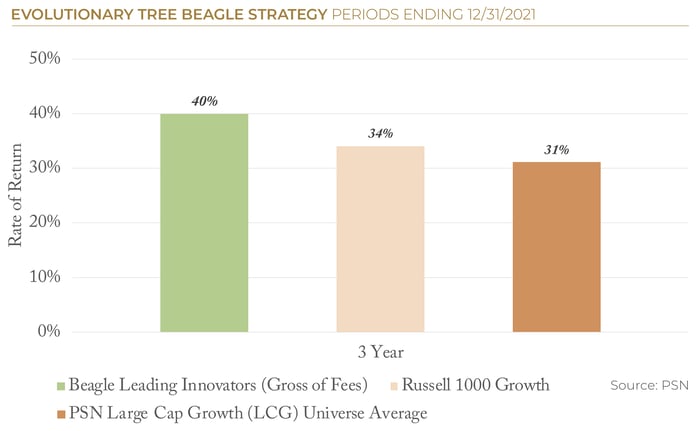

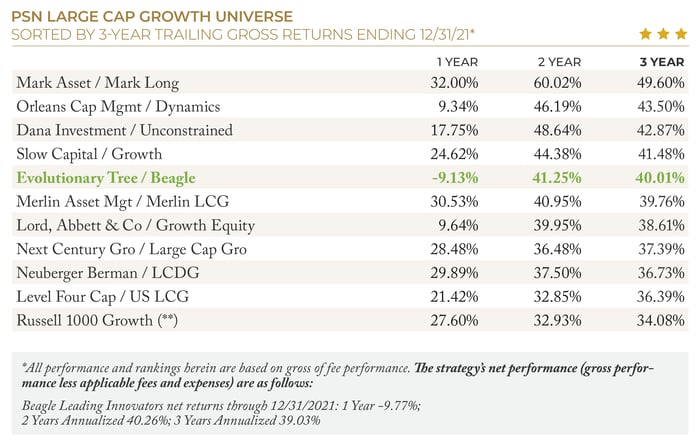

We are pleased to announce that our flagship innovation-focused portfolio, Beagle Leading Innovators, delivered top quartile performance relative to the PSN Large Cap Growth Universe since its inception over four years ago. *See important information below about gross and net performance.

Focusing on important innovations and the quality innovators can add value for clients. As long-term investors, our time horizon is measured in years, and we counsel evaluating our investment strategies over rolling 3- and 5-year periods (Beagle will hit its 5-year track record in February of next year), which will capture our ability to add value for clients over various economic and market environments. We believe quality innovators are best able to drive value creation when you stick with them over many years—including through inevitable periods of underperformance and market or economic turmoil that will occur—as their innovations gain adoption over time.

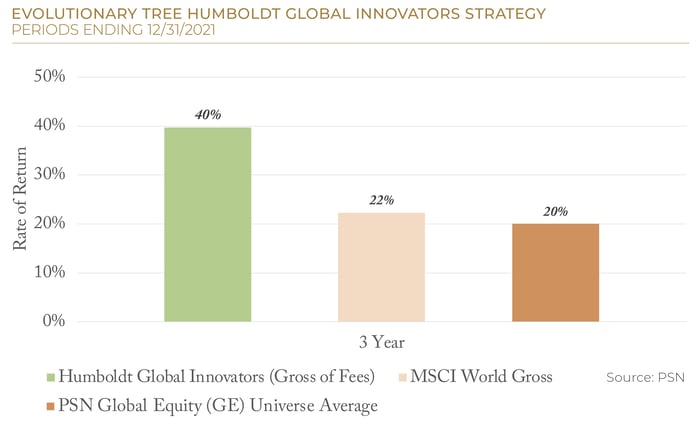

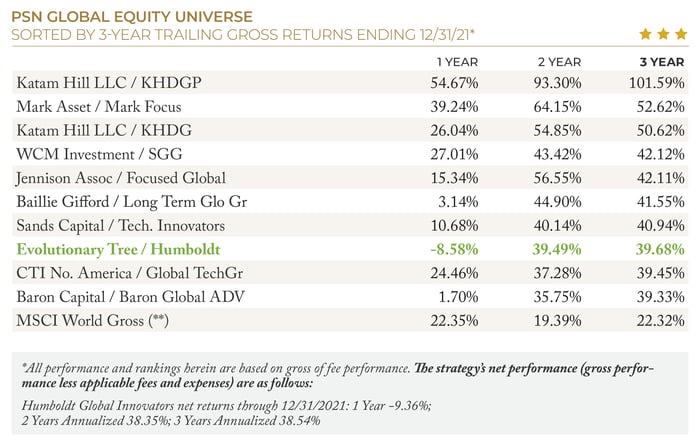

Evolutionary Tree’s Global Equity Strategy Delivers Top Quartile Performance

The objective of the Humboldt Global Innovators strategy is to provide clients with concentrated portfolios of leading and next-generation innovators benefiting from durable secular trends/evolutionary shifts using a long-term oriented and unconstrained approach tailored for the innovation-based economy. Our specialization and targeted approach generally lead us to businesses that reside within innovation clusters around the globe, which results in a high degree of active share and the potential to add value over the long term.

We believe our Humboldt Global Innovators strategy has achieved its objective since its inception. Over the past three years, Humboldt has bested the median return of the PSN Global Equity peer universe by nearly 20 percentage points.

To learn about the investment approach and thinking behind these strong results, read our thought piece: The Power of Innovation to Drive Sustainable Growth and Returns.