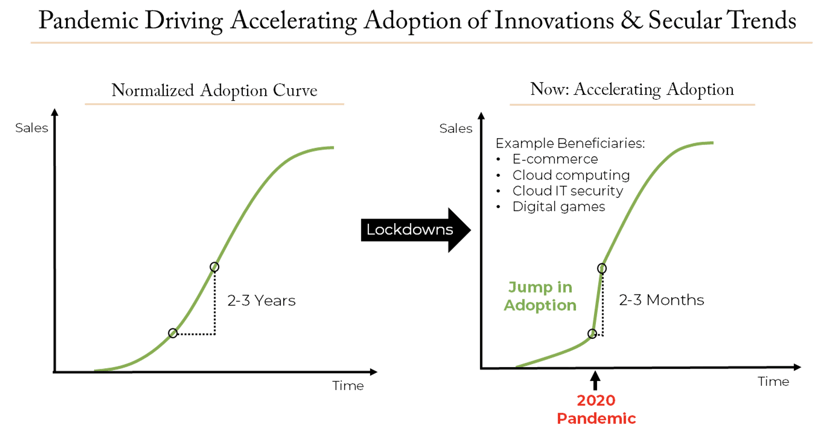

In part one of our blog series on this topic, we explored how the pandemic lockdown has accelerated the adoption of innovative digital products and services and compressed 2-3 years of adoption into 2-3 months for certain offerings, as illustrated below. This has been especially true for innovations in e-commerce, cloud computing, cloud-based IT security, and digital games, among others.

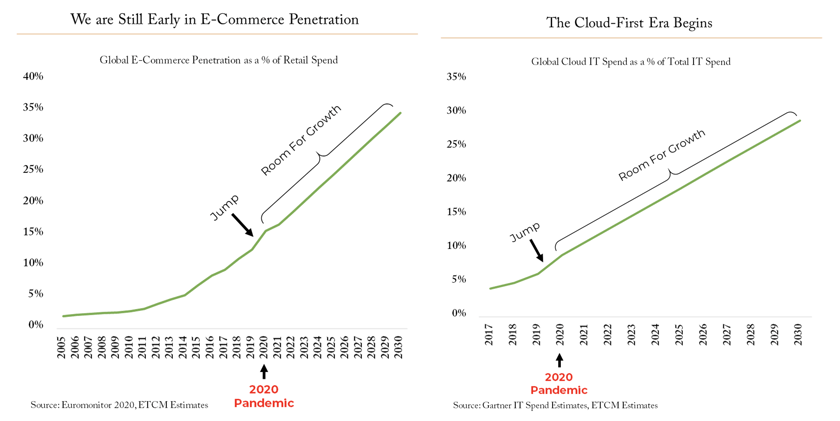

Just because we jumped up the S-curve of adoption doesn’t mean there isn’t more room for growth. We still see a long runway of growth for global adoption of the key innovations represented in our portfolio. Two examples of important evolutionary shifts—ones that have been playing out over the past decade but were accelerated by the pandemic—are e-commerce and cloud computing. Both show that there still remains considerable room for future growth in both key markets, as we illustrate below (note: projections based on ETCM estimates).

The below chart on the left shows e-commerce as a percentage of global total retail sales, starting in the mid-2000s with low single-digit share. Over the next decade, e-commerce expanded to slightly over 10% of total retail sales, and then in a period of a few months during the pandemic e-commerce penetration exploded, growing to well over 15% of total retail sales.

- The first key takeaway is that e-commerce saw 5 years-worth of share gains in a matter of months. We believe this acceleration supports the strong stock appreciation for e-commerce businesses during this period, performance which we believe was earned through accelerated adoption and durable changes in consumer behavior.

- The second takeaway is that despite the ramp in e-commerce adoption this year, there remains a long runway for e-commerce penetration and room for growth to the future. Long term, we believe e-commerce will become the majority of retail sales as consumers value its convenience, increased selection, and lower prices, when compared to traditional retail channels.

The above chart on the right shows the percentage of global IT spending in the cloud over time. The cloud has gone from humble beginnings, accounting for significantly less than 5% of total IT spending in the mid-2010s, to around 10% of overall IT spending in 2020. We believe that cloud spend, like e-commerce, can become a much greater percentage of spending over the long term, suggesting ample room for growth from today’s levels.

Additionally, we believe investors are beginning to appreciate the specialness of the software-as-a-service (SaaS) business model—with a recurring and highly visible revenue stream, an ability to push innovation to customers and stay ahead of their needs (which means customer retention is higher and LTV greater). Additionally, we believe the COVID-19 pandemic and the increasingly distributed workforce has, in effect, anointed SaaS as the de facto standard for the majority of enterprise applications as employees need to be able to access applications from anywhere. In short, the cloud-first era has begun. CIOs now have a cloud-first orientation and that has an important, and often underappreciated, impact on each SaaS company’s margin structure, with increased leverage potential. Coupled with a lasting reduction in travel expense for enterprise sales reps, the margin profile for software companies now has been structurally improved.

Note: If identifying emerging innovators is of interest to you, please listen to the replay of our recent conference call that took place on November 17, 2020 to hear President, CIO and Portfolio Manager Thomas Ricketts, CFA discuss this concept in greater depth. Click graphic below to access the replay.