Identifying Next-Generation Leaders

March 20, 2025

Our firm is increasingly being recognized for our differentiated approach that enables identifying next-generation innovative businesses earlier in their lifecycles—and, at times, embracing these emerging leaders well ahead of traditional growth managers. We developed our eight investment criteria (see graphic below) to provide a disciplined framework for our team to identify and analyze next-generation leaders that can add value over time. The...

Macro 2.0: An Updated Approach to Global Investing Focused on Innovation Clusters

November 21, 2024

Every investor increasingly must navigate a world of structural headwinds, which requires new strategies to succeed. In the old approach to global equity investing, one could generally rely on a few engines of growth, like the rise of emerging markets (especially China), reasonably steady growth in global GDP, and positive demographic trends such as an emerging middle class. In a post-COVID and post-Ukraine invasion world, much has changed from...

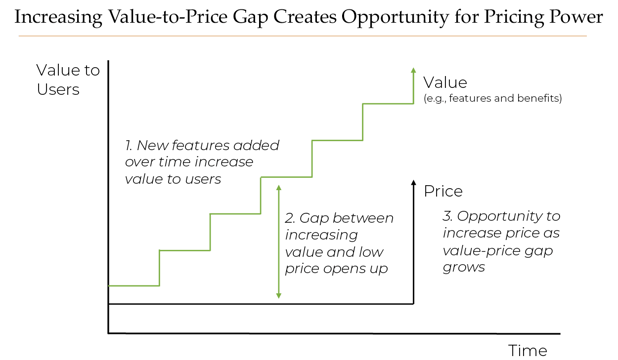

Innovators Are Flexing Pricing Power

May 16, 2024

We believe we are entering a period in which leading companies, with mission critical products and services, can finally flex pricing power. There are multiple reasons for this newfound power. First, we believe the shift from the Easy Money era to rational money is making a number of industries less competitive (as startups die off), allowing the industry leaders to emerge stronger and, in some cases, with improved pricing power. Second,...

Leading Platform Companies Are Thriving in Market Focused on Cost Efficiencies

December 13, 2023

A new secular trend is emerging in the current economic environment: Companies that have built leading platforms—defined as technology-based offerings that can be extended into adjacent areas and new applications—are thriving in an economy that is so focused on cost efficiencies. This is driven by users increasingly consolidating their spend on fewer platform offerings that are unified across multiple applications and moving away from point...

The Pivot to “Efficient Growth” is Driving a Profit Push for Quality Innovators

June 29, 2023

We believe an important shift is happening across the growth stock and technology sector landscape, one that is causing investors to re-evaluate and re-embrace the stocks of highly innovative companies, more broadly. The shift? Quality innovative businesses are now pivoting from a “growth-at-all-costs” approach toward one that emphasizes “efficient growth,” an approach that balances strong top-line growth with a focus on also expanding margins...

An Anti-Hype Investor Explains Why AI is Real and Going Mainstream

May 17, 2023

Every couple of decades, a game-changing technology emerges that triggers a wave of innovations. Known as “general purpose technologies” by economists, they represent a major new enabling technology that has wide application across many use cases, deliver profound impact, generate substantial value across the economy, and ultimately affect all industries. Artificial intelligence, known as AI, is one such technology. We sat down with Tom...

Finding Pockets of Growth in a Struggling Economy: Quality Innovation Can Power Through a “Slowcession”

April 27, 2023

In the current slow-growth environment – both in the U.S. and globally -- there is the potential for an economic recession. Inflation and higher interest rates are pressuring consumers and businesses alike. Despite the risk of a recession, recent indicators suggest the underlying economy, at least in the U.S., is perhaps healthier than most acknowledge: Unemployment remains very low by historic standards (below 4%) and both corporate and...

Books That Inspire Us: 100 Baggers

February 02, 2023

In our blog series, Books That Inspire Us, we share our favorite book titles, why we like them, what we learned from them, and how they inspire the work we do here at Evolutionary Tree Capital Management. In this blog post, Evolutionary Tree Senior Research Analyst Jonathon Ansley, CFA, reviews 100 Baggers: Stocks that Return 100-to-1 and How to Find Them. In this book, author Christopher Mayer studies the historical patterns and key...

Evolutionary Tree Featured as Citywire’s Boutique of the Month

January 18, 2023

We are excited to share that Evolutionary Tree’s story and unique approach to innovation investing were featured in Citywire, a provider of news and analysis on investment managers to advisors and institutional investors around the world. If you haven’t read the article, you can find it in Citywire’s November 2022 issue, where Evolutionary Tree is showcased as the “Boutique of the Month.”

Gratitude for My Mentor: 5 Points of Wisdom

December 20, 2022

The holidays are a great time to remember that there is so much to be grateful for, most especially for key people who influenced and supported us. For me, one of the most influential people in my life was my late mentor, Frank Sands Sr. Mr. Sands, or Frank as I knew him, was one of the greatest investors of our time and I had the great fortune to work closely with him for over 20 years, assisting him in building his firm, Sands Capital, from...