Evolutionary Tree Investment Team

Recent Posts

Identifying Next-Generation Leaders

March 20, 2025

Our firm is increasingly being recognized for our differentiated approach that enables identifying next-generation innovative businesses earlier in their lifecycles—and, at times, embracing these emerging leaders well ahead of traditional growth managers. We developed our eight investment criteria (see graphic below) to provide a disciplined framework for our team to identify and analyze next-generation leaders that can add value over time. The...

Macro 2.0: An Updated Approach to Global Investing Focused on Innovation Clusters

November 21, 2024

Every investor increasingly must navigate a world of structural headwinds, which requires new strategies to succeed. In the old approach to global equity investing, one could generally rely on a few engines of growth, like the rise of emerging markets (especially China), reasonably steady growth in global GDP, and positive demographic trends such as an emerging middle class. In a post-COVID and post-Ukraine invasion world, much has changed from...

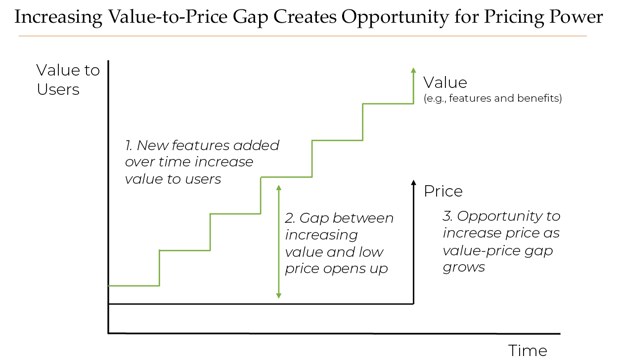

Innovators Are Flexing Pricing Power

May 16, 2024

We believe we are entering a period in which leading companies, with mission critical products and services, can finally flex pricing power. There are multiple reasons for this newfound power. First, we believe the shift from the Easy Money era to rational money is making a number of industries less competitive (as startups die off), allowing the industry leaders to emerge stronger and, in some cases, with improved pricing power. Second,...

Leading Platform Companies Are Thriving in Market Focused on Cost Efficiencies

December 13, 2023

A new secular trend is emerging in the current economic environment: Companies that have built leading platforms—defined as technology-based offerings that can be extended into adjacent areas and new applications—are thriving in an economy that is so focused on cost efficiencies. This is driven by users increasingly consolidating their spend on fewer platform offerings that are unified across multiple applications and moving away from point...

The Pivot to “Efficient Growth” is Driving a Profit Push for Quality Innovators

June 29, 2023

We believe an important shift is happening across the growth stock and technology sector landscape, one that is causing investors to re-evaluate and re-embrace the stocks of highly innovative companies, more broadly. The shift? Quality innovative businesses are now pivoting from a “growth-at-all-costs” approach toward one that emphasizes “efficient growth,” an approach that balances strong top-line growth with a focus on also expanding margins...

Books That Inspire Us: 100 Baggers

February 02, 2023

In our blog series, Books That Inspire Us, we share our favorite book titles, why we like them, what we learned from them, and how they inspire the work we do here at Evolutionary Tree Capital Management. In this blog post, Evolutionary Tree Senior Research Analyst Jonathon Ansley, CFA, reviews 100 Baggers: Stocks that Return 100-to-1 and How to Find Them. In this book, author Christopher Mayer studies the historical patterns and key...

Quality Innovators: Growing Rapidly and On Sale

February 25, 2022

We know it has been a volatile period in the markets over the past six and twelve months, particularly for growth and innovation-focused strategies. Given this backdrop, we provide an expanded blog post to discuss the drivers of the recent volatility and the reasons why we remain confident in our innovation-focused strategy. Despite the recent pullback in growth and innovation stocks, we believe the underlying portfolios are actually in great...

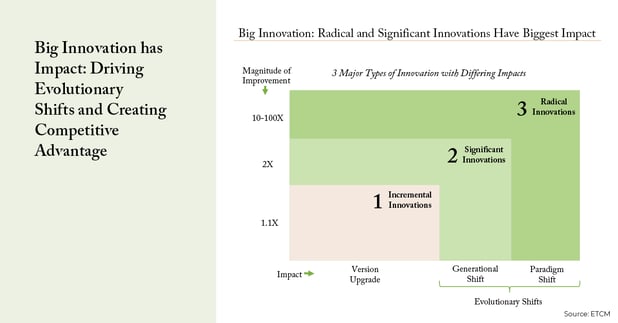

Big Innovation Has Impact: Driving Evolutionary Shifts and Creating Competitive Advantage

November 12, 2021

In last week’s blog post, The Power of Innovation to Drive Sustainable Growth and Returns, we shared evidence from various academic and consultant-driven studies supporting the notion that innovation drives sustainable growth and long-term returns. This week, we continue the conversation and provide examples of portfolio holdings we feel provide further evidence that big innovations can have a big impact on returns.

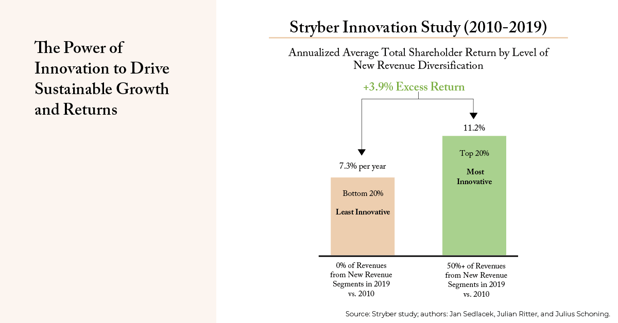

The Power of Innovation to Drive Sustainable Growth and Returns

November 05, 2021

At Evolutionary Tree Capital Management, we believe investors are wise to harness innovation to power their portfolios. Why? Simply put, innovation is what sustains growth for companies and drives stock returns over the long term. In the first of a two-part blog post highlighting the impact of big innovation, we share evidence from various academic and consultant-driven studies that support this theory and profile examples of companies with...

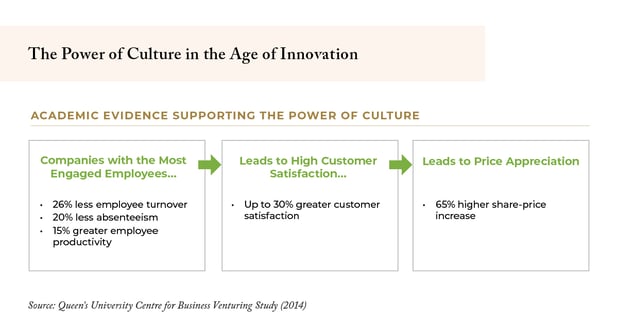

The Power of Culture in the Age of Innovation

October 29, 2020

We all know “great companies” when we interact with them as consumers. They feel different. They almost seem like they have some special power or special sauce that leads to great experiences, strong execution, and high customer satisfaction. At Evolutionary Tree, we believe that this specialness comes from companies having built a unique and effective culture. Why should investors care about culture?