Evolutionary Tree Capital Management

Recent Posts

Investing in Makers, Not Fakers

September 13, 2021

Investing in innovation is becoming increasingly important to investors—and the industry is catching on. Having launched our first innovation strategy in 2018, Beagle Leading Innovators, Evolutionary Tree is a recognized and respected manager in this important new investing category. Thomas Ricketts, the firm’s CIO and Portfolio Manager, recently spoke about Evolutionary Tree’s process of identifying true innovators—what he refers to as the...

Monitoring the Evolving Pulse of Innovation in Health Care

September 08, 2021

When asked recently how he feels about investing in health care, Evolutionary Tree CIO and Portfolio Manager Thomas Ricketts described the sector as an area of new knowledge, insight and innovations that may be underappreciated by the market. With scientific breakthroughs and patents continuing their upward trend, he and the Evolutionary Tree team are using rigorous research to identify the companies they believe are developing life-changing...

The Kick-Start Effect: The Real Story Behind How Innovators are Faring in a Re-Opening Economy

August 25, 2021

There is growing evidence that many important secular trends which accelerated during COVID have a life in a post-vaccine world. Let’s start with the narrative many market participants were pushing during the recent growth stock pullback, namely that any company which benefited from COVID (e.g., work from home beneficiaries) would necessarily be hurt when the economy re-opened and employees started going back to work. In this narrative—which we...

Meet the Team – Dan Ayre

August 19, 2021

Here at Evolutionary Tree Capital Management, innovation-focused investing is what we do. We also believe the best partnerships are built upon strong relationships between people. This is why we have penned a “Meet the Team” blog series which is designed to help you to get to know us better. Here is a quick and fun Q&A to get to know Dan Ayre better.

The Power of Evolution to Create Long-Term Opportunity

July 16, 2021

Most investors know that the economy is experiencing accelerating change and intuitively understand that this change can create both opportunity and risk. But how does this change play out, and what drives this process? Most importantly for investors is the question: How can I harness this change for long-term value creation? We have developed a unique model around our evolutionary lens approach that tracks the progression of change to its root...

Why Allocate to Innovation?

July 01, 2021

As a featured presenter during Boutique Week™, a virtual event hosted by Havener Capital in May that included candid conversations with boutique investment managers, Evolutionary Tree CIO and Portfolio Manager Thomas Ricketts shared why he believes innovation investing may emerge as the third investment style, alongside growth and value. By identifying innovations on the boundary of progress, or what Mr. Ricketts refers to as the innovation...

Evolutionary Tree Celebrates 3-Year Track Record for Its #1-Ranked Growth and Innovation Strategy

June 17, 2021

We are very proud to report that our flagship innovation-focused portfolio, Beagle Leading Innovators, recently hit its three-year anniversary as of 3/31/21 and is the top-performing strategy in the PSN Large Cap Growth Universe over the trailing three-year period.

Navigating Change: Finding Investable Innovation

June 04, 2021

In a fast-moving, 21st century economy, innovation permeates our lives. In the past year alone, we’ve found and developed multiple vaccines for a novel virus that threated society. That’s innovation. In response to that virus, we’ve found news ways to conduct school and work from our living rooms. That’s innovation. We’ve also found new ways to shop and entertain ourselves. That’s innovation. In an ever-changing world, those examples are just...

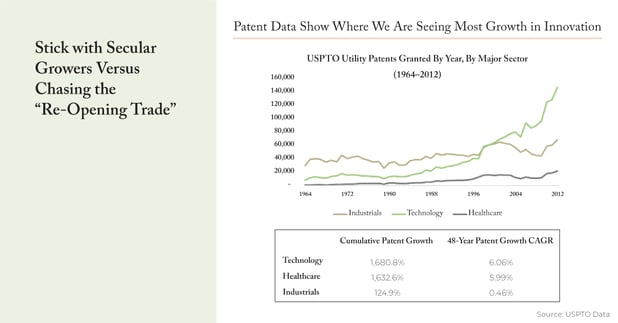

Stick with Secular Growers Versus Chasing the "Re-Opening Trade"

May 06, 2021

While investors are focused on the topic du jour of the “re-opening trade,” we remain focused on longer-term opportunities represented in the portfolio, which are multi-year in nature and driven by the adoption of innovations and secular trends. These are the types of opportunities that will not only benefit from a strengthening economy but can also grow for years beyond that.

Meet the Team - Jonathon Ansley

April 15, 2021

Here at Evolutionary Tree Capital Management, innovation-focused investing is what we do. We also believe the best partnerships are built upon strong relationships between people. This is why we have penned a “Meet the Team” blog series which is designed to help you to get to know us better. Here is a quick and fun Q&A to get to know Jonathon Ansley better.