Why Boutiques Have an Advantage in the Age of Innovation

March 22, 2022

We are often asked the question: How do you describe the advantage that investment boutiques have over larger asset managers, and how does innovation investing play to these advantages? Let’s briefly define boutiques first and contrast them with larger firms.

Evolutionary Tree’s Innovation-Focused Strategies Rank in the Top Quartile of Their PSN Peer Universes

March 10, 2022

We are pleased to announce that our flagship innovation-focused portfolio, Beagle Leading Innovators, delivered top quartile performance relative to the PSN Large Cap Growth Universe since its inception over four years ago. *See important information below about gross and net performance.

Quality Innovators: Growing Rapidly and On Sale

February 25, 2022

We know it has been a volatile period in the markets over the past six and twelve months, particularly for growth and innovation-focused strategies. Given this backdrop, we provide an expanded blog post to discuss the drivers of the recent volatility and the reasons why we remain confident in our innovation-focused strategy. Despite the recent pullback in growth and innovation stocks, we believe the underlying portfolios are actually in great...

Evolutionary Tree’s Flagship Innovation-Focused Strategy Again Achieves Top Ranking Within PSN’s Large-Cap Growth Universe

December 14, 2021

For the third consecutive period, our innovation-focused portfolio, Beagle Leading Innovators, ranked #1 in the PSN Large Cap Growth Universe over the three-year period ending 9/30/2021. *See important information below about gross and net performance.

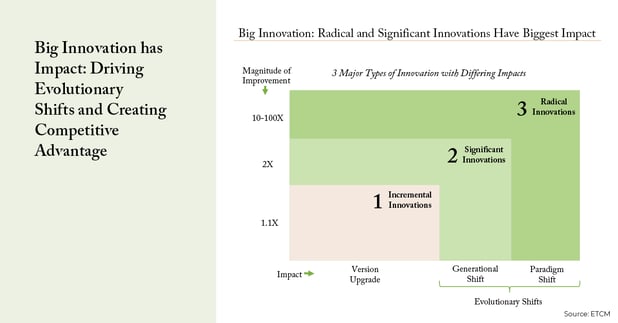

Big Innovation Has Impact: Driving Evolutionary Shifts and Creating Competitive Advantage

November 12, 2021

In last week’s blog post, The Power of Innovation to Drive Sustainable Growth and Returns, we shared evidence from various academic and consultant-driven studies supporting the notion that innovation drives sustainable growth and long-term returns. This week, we continue the conversation and provide examples of portfolio holdings we feel provide further evidence that big innovations can have a big impact on returns.

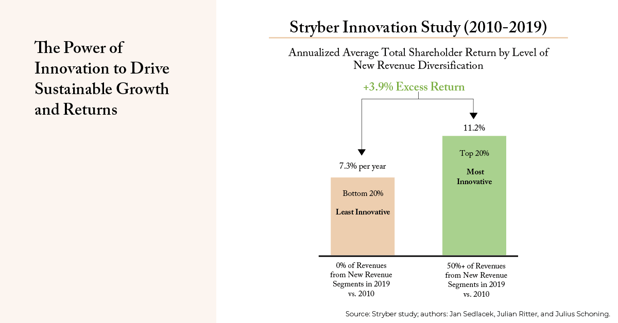

The Power of Innovation to Drive Sustainable Growth and Returns

November 05, 2021

At Evolutionary Tree Capital Management, we believe investors are wise to harness innovation to power their portfolios. Why? Simply put, innovation is what sustains growth for companies and drives stock returns over the long term. In the first of a two-part blog post highlighting the impact of big innovation, we share evidence from various academic and consultant-driven studies that support this theory and profile examples of companies with...

Interview with Tom Ricketts Featured on Financial Advisor Online Magazine Website

October 29, 2021

Investors want to know… How can they harness the power of innovation to compound their wealth? Bill Hortz, founder of the Institute for Innovation Development and a featured columnist for the online edition of Financial Advisor Magazine, tapped Evolutionary Tree Capital Management CIO—and innovation-investing thought leader—Tom Ricketts, for the answer.

Innovation as The Third Style of Investing

October 14, 2021

Does the rise of innovation investing warrant a new investment style? Evolutionary Tree President and CIO Thomas Ricketts believes it does. In a recent “Behind the Markets” podcast hosted by Jeremy Schwartz, Mr. Ricketts offered his perspective on how investors seeking to fully participate in the rise of innovation are finding it necessary to look beyond traditional growth investing. A few of the key points Mr. Ricketts made in favor of...

Evolutionary Tree’s Flagship Innovation-Focused Strategy Ranks #1 Within PSN’s Large-Cap Growth Universe

September 29, 2021

We are very proud to report that our flagship innovation-focused portfolio, Beagle Leading Innovators, is the top-performing strategy in the PSN Large Cap Growth Universe over the trailing three-year period.

Investing in Makers, Not Fakers

September 13, 2021

Investing in innovation is becoming increasingly important to investors—and the industry is catching on. Having launched our first innovation strategy in 2018, Beagle Leading Innovators, Evolutionary Tree is a recognized and respected manager in this important new investing category. Thomas Ricketts, the firm’s CIO and Portfolio Manager, recently spoke about Evolutionary Tree’s process of identifying true innovators—what he refers to as the...