Navigating a Bifurcating Economy: Leaning Into the Digital Economy, Which is Healthy

September 25, 2020

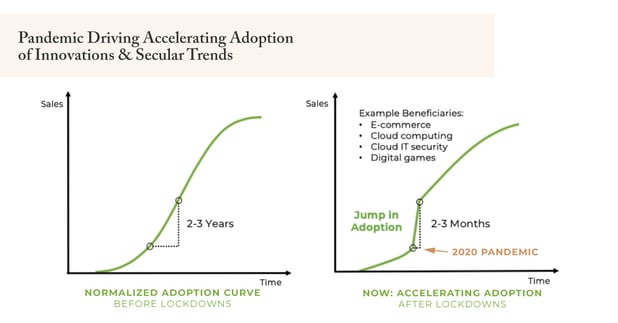

While the economy is on a road to recovery, we believe there is a seismic shift taking place as a result of the pandemic. We believe the pandemic is creating a “bifurcated economy,” widening the gap between the physical-based economy and the digital economy (see illustration below). In the physical economy (think retailers and small, local businesses), the environment is a near depression, with many businesses at risk of shrinking or going out...

Biotech is Just Getting Started as a Growth Industry

September 02, 2020

After 35 years of development, the biotechnology industry has finally refined many of today’s biotech tools to work effectively and safely for patients. In our opinion, the biotech industry is finally seeing multiple new technologies enter what we call the “zone of readiness,” where the underlying technologies are both technically and economically feasible. In short, they are ready to be applied to a growing number of diseases, both rare and...

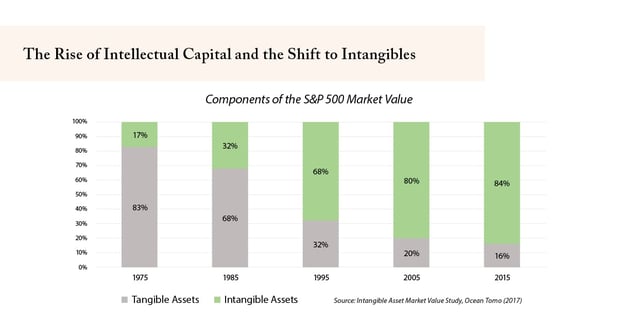

The Rise of Intellectual Capital and the Shift to Intangibles

August 27, 2020

We live in the Age of Innovation. This era is built increasingly on intellectual capital as the value of ideas and concepts displaces the value of land (as seen in the age of agriculture) or even capital (in the industrial age). Others call our current era the Digital Age, but the result is the same: a growing array of innovations across all industries that increases the pace of change and the evolution of technologies, products and services,...

Leading Innovators are Less Risky than Blue-Chippers

August 14, 2020

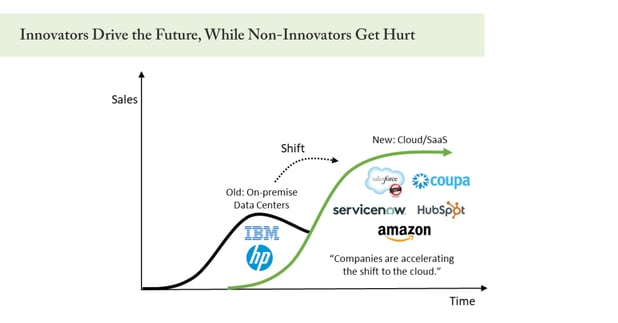

In the Age of Innovation, we need to shift our thinking about where risk lies. Increasingly, the leading innovators are less risky as businesses (and investments) than non-innovators. Traditionally, it was the defensive so-called “stable blue chips” that offered lower risk and solid returns. However, with the pervasive rise of digitization and related technology-enabled business models, industry after industry is undergoing massive change. Many...

![[Vlog] Our Innovation-Focused Research Process](https://insights.evolutionarytree.com/hs-fs/hubfs/Blog%20and%20Social%20Images/2020.06-Blog-14-LinkedIn.png?width=618&name=2020.06-Blog-14-LinkedIn.png)

[Vlog] Our Innovation-Focused Research Process

June 24, 2020

In this eight-minute video segment, taken from a recent presentation for the CFA Society of Columbus, Evolutionary Tree President and Portfolio Manager Thomas Ricketts, CFA walks us through the firm’s differentiated innovation-focused investment process. Topics covered include: How our investment process revolves around a concept we describe as the Innovation Flywheel Identifying innovative companies positioned to benefit from secular trends Our...

How Innovation-Focused Strategies May Provide Both Offense and Defense

June 19, 2020

If you missed our recent press release, we are proud to have been awarded one of PSN’s Top Guns within the large cap growth manager universe for 1Q20. The Russell 1000 Growth Index fell -14.10% during the worst quarter for stocks since 1987. In comparison, our strategy was only down -5.22% (gross of fees), outperforming the Index by 8.88ppts. See important information below on gross and net performance.*

![[Vlog] Why is an Evolutionary Lens So Important for Investors?](https://insights.evolutionarytree.com/hs-fs/hubfs/Blog%20and%20Social%20Images/Everything%20Evolves.png?width=618&name=Everything%20Evolves.png)

[Vlog] Why is an Evolutionary Lens So Important for Investors?

June 11, 2020

In an economy increasingly impacted by innovation, technological change, and evolutionary shifts, industries are facing more periods of dis-equilibrium or disruption relative to periods of equilibrium or stability than in the past. And, in the process more and more industries are being transformed. Interested in viewing this article as a video presentation (8 min)? Click here. Importance of Evolutionary Economics and Technical Change to...

Press Release

June 11, 2020

Evolutionary Tree Flagship Strategy Wins PSN Top Guns Award - Former Portfolio Manager from Sands Capital Ranks #2 Amongst Peers During Q1 2020 - Alexandria, VA – (June 11, 2020) – Evolutionary Tree Capital Management is pleased to announce the Beagle Leading Innovators strategy has been awarded a PSN Top Guns distinction by Informa Financial Intelligence’s PSN manager database for performance during the volatile first quarter of 2020. The...

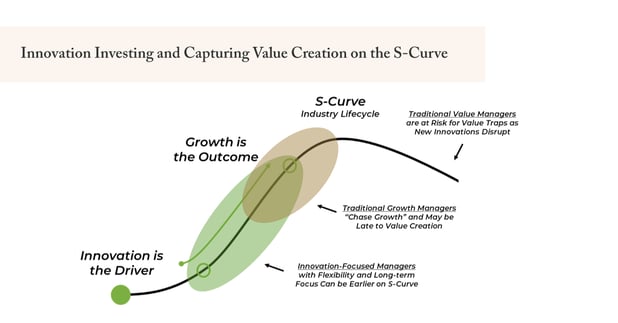

Innovation Investing and Capturing Value Creation on the S-Curve

June 03, 2020

Over my 25-year investment career investing in sustainable growth companies, experience has taught me that the core driver—the root cause—of value creation across the economy is innovation. While most investors acknowledge the importance of innovation in a general sense, it is, in my opinion, more profound than most appreciate for a few key reasons: Innovation is what creates new market-leading products, services, and business models, which are...

Navigating the Bear Market of 2020

May 15, 2020

While the recent market selloff and underlying factors affecting the economy have been unique, history reminds us that certain principles are worth keeping in mind during any bear market. Below is an excerpt of the letter we sent to our clients and partners on March 20, 2020, within days of the first quarter market bottom. This excerpt includes only two of the eight viewpoints intended to help our clients navigate an economy in turmoil. The full...