Evolutionary Tree Wins Multiple 1st Place PSN Top Guns Awards

March 17, 2021

We are proud to report that our three innovation-focused portfolios, Beagle Leading Innovators, Humboldt Global Innovators and Darwin Emerging Innovators, continue to deliver considerable value on both a relative and absolute basis for our clients. All three strategies won PSN 2 Star (meaning trailing one-year) Top Guns awards for the period ending December 31, 2020, including multiple first place rankings. While the awards were for the one-year...

Innovation Is Not Going to Stop

February 24, 2021

In a recent conference call featuring Evolutionary Tree President, CIO and Portfolio Manager Thomas Ricketts, CFA and Havener Capital Partners Founder and CEO Stacy Havener, Mr. Ricketts was asked about the prolonged outperformance of innovative growth stocks and whether he believed it was sustainable. Read his response below. “Every investor is trying to navigate an evolving economy. What does that mean? It means every industry is structurally...

Will Innovation Still Offer Growth and Investment Opportunity in the Future? Part 2

February 17, 2021

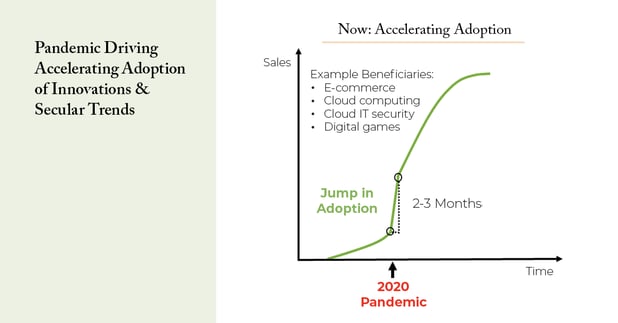

In part one of our blog series on this topic, we explored how the pandemic lockdown has accelerated the adoption of innovative digital products and services and compressed 2-3 years of adoption into 2-3 months for certain offerings, as illustrated below. This has been especially true for innovations in e-commerce, cloud computing, cloud-based IT security, and digital games, among others. Just because we jumped up the S-curve of adoption doesn’t...

Will Innovation Still Offer Growth and Investment Opportunity in the Future? Part 1

February 10, 2021

We know that investors are curious about our views on where we go from here after such a strong year in 2020. There is no doubt that COVID lockdowns accelerated the adoption of many innovations represented in the portfolio. We continue to see the same accelerating trends that we shared in our recent client letter discussing the “Great Digital Acceleration.” The following text is an excerpt from our client letter and is a great reminder of how we...

Top 3 Blogs of 2020

January 06, 2021

Have you noticed how the recession of 2020 actually accelerated the future in terms of advancing certain secular growth trends? Cloud computing, e-commerce and video streaming all provided solutions and cost-saving efficiencies throughout the year, and investments in many companies tied to these trends performed well. Our thought leadership pieces related to innovation were among the most popular pieces we published in 2020. Below, we invite you...

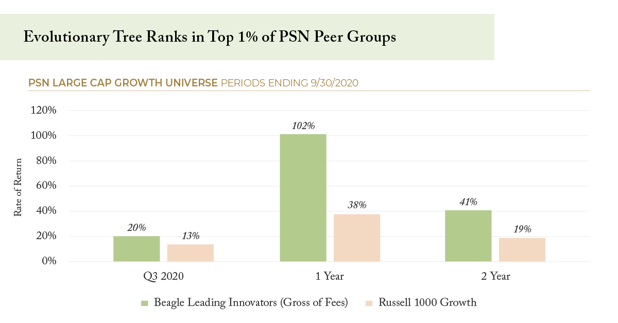

Evolutionary Tree Ranks in Top 1% of PSN Peer Groups

December 17, 2020

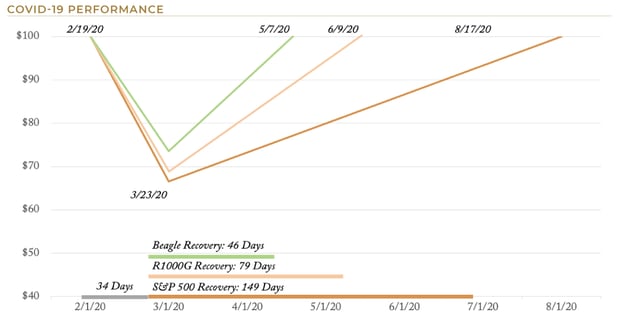

Editor's Note: The post below was originally published December 17, 2020, but has been updated to make it more comprehensive. We are proud to report that our two flagship innovation-focused portfolios, Beagle Leading Innovators and Humboldt Global Innovators, continue to deliver considerable value on both a relative and absolute basis for our clients. Just five months shy of reaching its three-year track record, we believe the Beagle Leading...

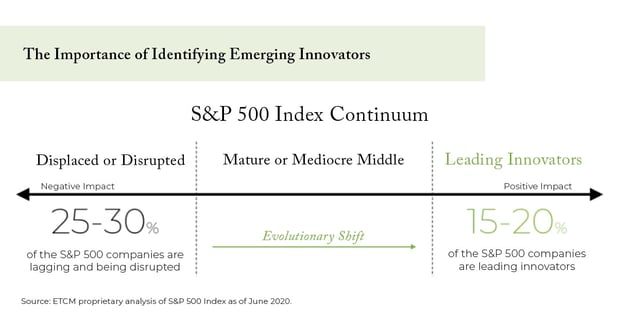

The Importance of Identifying Emerging Innovators

November 11, 2020

Whether it’s video streaming supplanting cable TV or e-commerce taking share from brick-and-mortar stores, most investors realize innovation is rapidly creating winners and losers across today’s economy. However, navigating this environment and keeping up with the pace of innovation can be extremely challenging. This issue of determining who the leading innovators are, as well as avoiding the companies being disrupted, is as critical as ever. We...

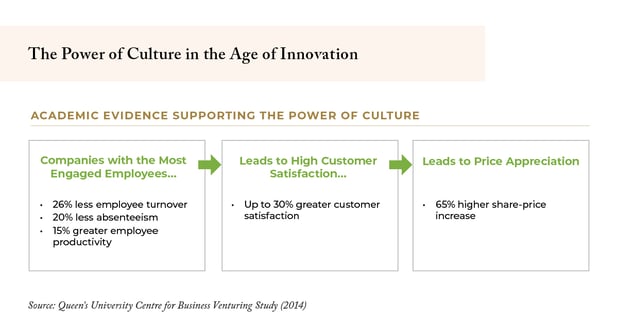

The Power of Culture in the Age of Innovation

October 29, 2020

We all know “great companies” when we interact with them as consumers. They feel different. They almost seem like they have some special power or special sauce that leads to great experiences, strong execution, and high customer satisfaction. At Evolutionary Tree, we believe that this specialness comes from companies having built a unique and effective culture. Why should investors care about culture?

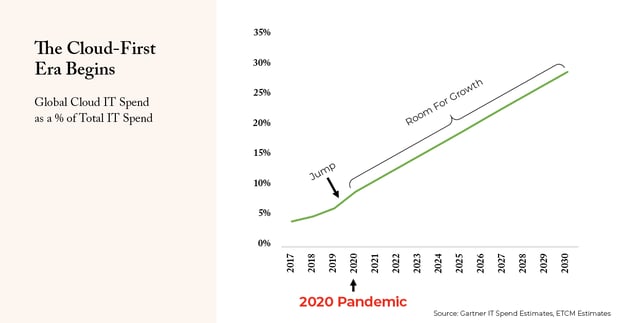

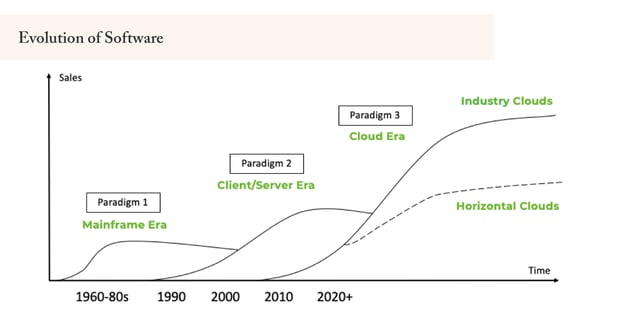

We’re Still in the Early Innings of the Shift to Cloud Computing and SaaS

October 09, 2020

At Evolutionary Tree a key part of our investment process is identifying what we believe are the most important secular trends, or as we call them, evolutionary shifts, happening across the economy. Companies benefiting from multi-year secular trends have a higher probability of sustaining growth over time and may grow at an above-average rate for longer than short-term focused investors might expect. Our investment team systematically tracks...

Evolutionary Tree Strategies Win PSN Top Guns Awards for Q2 2020

September 30, 2020

We are truly honored to receive not just one, but several awards for our two flagship innovation-focused portfolios: Beagle Leading Innovators and Humboldt Global Innovators. The awards are a result of our investment team's dedication to identifying and understanding attractive investment opportunities being created by innovations driving structural change across the global economy. See important information below on gross and net performance.*